Mexican Peso drops on risk-aversion, Retail Sales eyed

- Mexican Peso erases previous gains on global geopolitical developments and dovish comments from Banxico’s Governor.

- Victoria Rodríguez Ceja’s dovish stance on continued rate cuts reflects efforts to manage inflation amidst economic challenges.

- Geopolitical risks remain heightened as military actions in Ukraine influence USD/MXN’s volatility.

The Mexican Peso erased some of Tuesday's gains versus the Greenback as geopolitical risks continued to drive the financial markets amid a possible escalation of the Russia-Ukraine conflict. Additionally, Bank of Mexico (Banxico) Governor Rodriguez's dovish remarks alongside the ongoing economic slowdown in Mexico hurt the prospects of the emerging market currency. At the time of writing, the USD/MXN trades at 20.30, up by 1%.

Bank of Mexico Governor Victoria Rodríguez Ceja indicated that the central bank plans to continue reducing its benchmark interest rate, citing progress in lowering inflation. Besides this, traders are eyeing the release of Mexican Retail Sales data for September on Thursday, followed by the release of the Gross Domestic Product (GDP) and mid-month inflation figures on Friday.

Meanwhile, some analysts hint that the Mexican economy will not grow within the 2% to 3% range in 2025 as expected by the Finance Ministry. Gabriela Siller of Banco Base said, “It is extremely difficult to achieve GDP growth […] especially in the first year of administration and with cuts in public spending.”

In geopolitics, rising tensions underpinned the USD/MXN as Ukraine fired long-range, British-made missiles into Russian territory. This followed the launch of US-made missiles into Russia on Tuesday.

Aside from this, Federal Reserve (Fed) speakers crossed the wires. First, Governor Lisa Cook said that if the labor market and inflation evolve as expected, it would be appropriate to continue lowering the policy rate toward neutral. She added that if progress on inflation stalls or slows, that would be a scenario for pausing.

Lately, noted hawk Governor Michelle Bowman said the Fed should pursue a cautious approach on monetary policy and added that neutral policy may be closer than most policymakers think.

Ahead this week, the US economic docket will feature the release of Initial Jobless Claims, housing data, and more Fed speakers on Thursday.

Daily digest market movers: Mexican Peso retraces on strong US Dollar

- The USD/MXN soars sharply, boosted by a strong US Dollar. The US Dollar Index (DXY) is up 0.54% at 106.72.

- Mexican Retail Sales for September are expected at 0.1% MoM, unchanged from the previous reading. On a yearly basis, sales are foreseen plunging from -0.8% to -1.2%.

- On Thursday, US Initial Jobless Claims are expected to rise from 217K to 220K for the week ending November 16.

- US Existing Home Sales are projected to rise from 3.854 million to 3.93 million.

- Market participants trimmed estimates for a 25 bps cut by the Fed, with odds falling from 62% to 59%. The odds of keeping rates unchanged are up at 41%, as depicted by the CME FedWatch Tool.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 23 bps of Fed easing by the end of 2024.

- Last week, Moody’s changed Mexico’s credit outlook to negative, mentioning constitutional reforms that could negatively impact Mexico’s economic and fiscal strength.

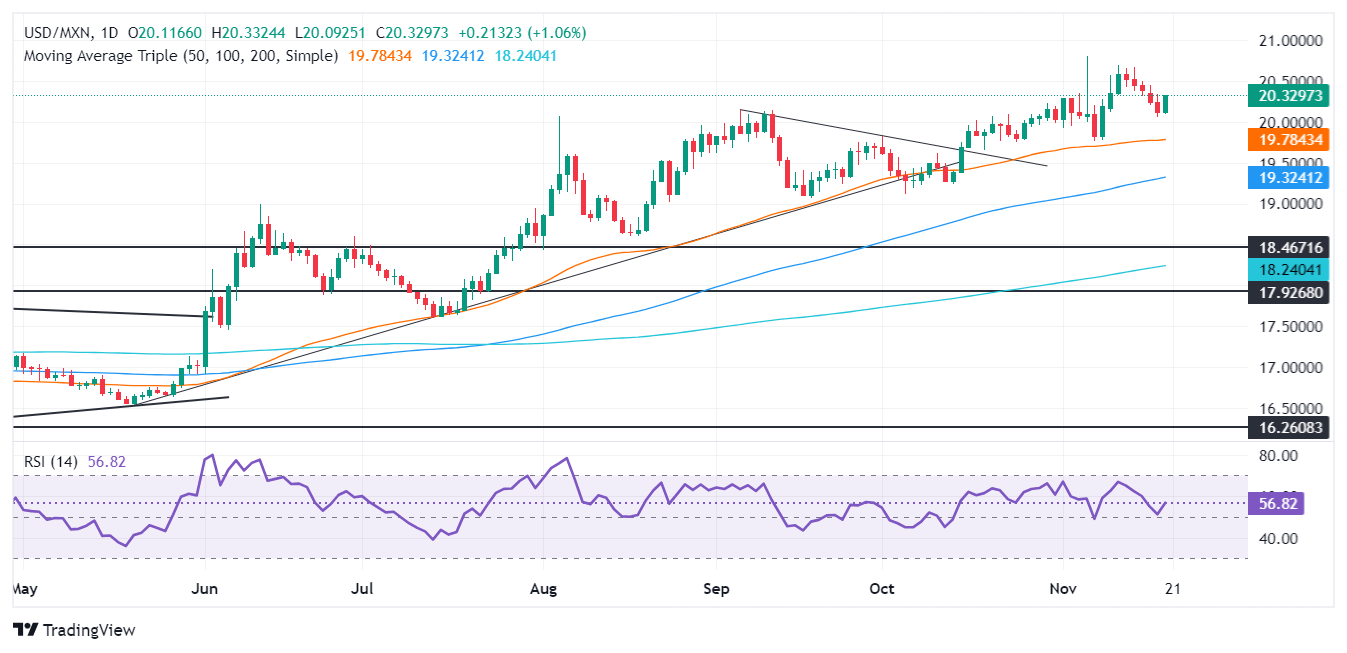

USD/MXN technical outlook: Mexican Peso slumps as USD/MXN climbs past 20.30

The USD/MXN uptrend remains intact with buyers stepping in near 20.07, the day’s low, lifting the pair toward the 20.30 mark. A daily close nearby the daily highs would form a “bullish Harami” candlestick pattern and pave the way for further upside.

The next resistance would be the 20.50 figure, followed by the November 12 peak at 20.69. Once those levels are removed, the next resistance would be the year-to-date (YTD) high of 20.80.

On the flip side, the USD/MXN first support would be the 20.00 figure. A breach of the latter will expose the 50-day Simple Moving Average (SMA) and the November 7 low around 19.75, followed by the 19.50 mark.

Oscillators like the Relative Strength Index (RSI) remain bullish though short-term, suggesting some consolidation before buyers gather steam.

Economic Indicator

Retail Sales (MoM)

The Retail Sales released by INEGI measures the total receipts of retail stores. Monthly percent changues reflect the rate of changes of such sales. Changes in retail sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive or bullish for the Mexican peso, while a low reading is seen as negative or bearish.

Read more.Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.