Mexican Peso rallies sharply to a new two-day high against US Dollar

Most recent article: Mexican Peso holds steady amid mixed US Retail Sales, jobs data

- Mexican Peso advances in aftermath of US inflation report, US yields declining becomes headwind for Greenback.

- Banxico Governor's optimistic outlook on inflation trajectory bolsters confidence, targets 3% by 2025.

- Market shrugs off US PPI data, reducing speculation on immediate Federal Reserve rate cuts.

The Mexican Peso finished Wednesday’s session registering gains of 0.68% against the US Dollar as US Treasury bond yields retrace. A risk-on impulse propelled the emerging market currency to a two-day high, as Wall Street finished the session with gains between 0.50% and 2.44%. The USD/MXN exchanges hands at 17.07, down 0.05%.

Mexico’s economic calendar on Monday, featured an interview of the Bank of Mexico (Banxico) Governor Victoria Rodriguez Ceja. She said inflation is expected to resume its downtrend and added that inflation would hit Banxico’s 3% target by 2025.

In the US the release of the Producer Price Index (PPI) was ignored by market participants, which had already dialed back odds for Fed rate cuts.

Daily digest market movers: Mexican Peso regains control amid soft US Dollar demand

- The US Bureau of Labor Statistics revealed December’s PPI, which came below the previous reading of -0.1% at -0.2%. In monthly data, the core PPI stood at -0.1%, suggesting that inflation is cooling down.

- The US Consumer Price Index (CPI) was lower than the previous month, though it exceeded estimates. Excluding volatile items, the so-called core CPI was unchanged, shy of the 4% threshold.

- Market players are expecting the first rate cut by the Federal Reserve at the June monetary policy meeting as they trimmed odds for March and May.

- US 10-year Treasury note yields erase some of yesterday’s gains and are down six basis points to 4.273%, while the US Dollar Index (DXY) dropped toward 104.71, down -0.13%.

- Mexico’s central bank revised their inflation expectations to the upside for the period from Q1 to Q3 of 2024, expecting inflation to converge toward 3.5% in Q4, based on the latest monetary policy statement.

- Chicago Fed President Austan Goolsbee said, “It is totally clear that inflation is coming down,” even though the latest inflation report was high.

- Atlanta Fed President Raphael Bostic said the Fed must be resolute and added that he’s “laser-focused” on inflation. At the same time, Dallas Fed President Lorie Logan noted that there’s no urgency on cutting rates.

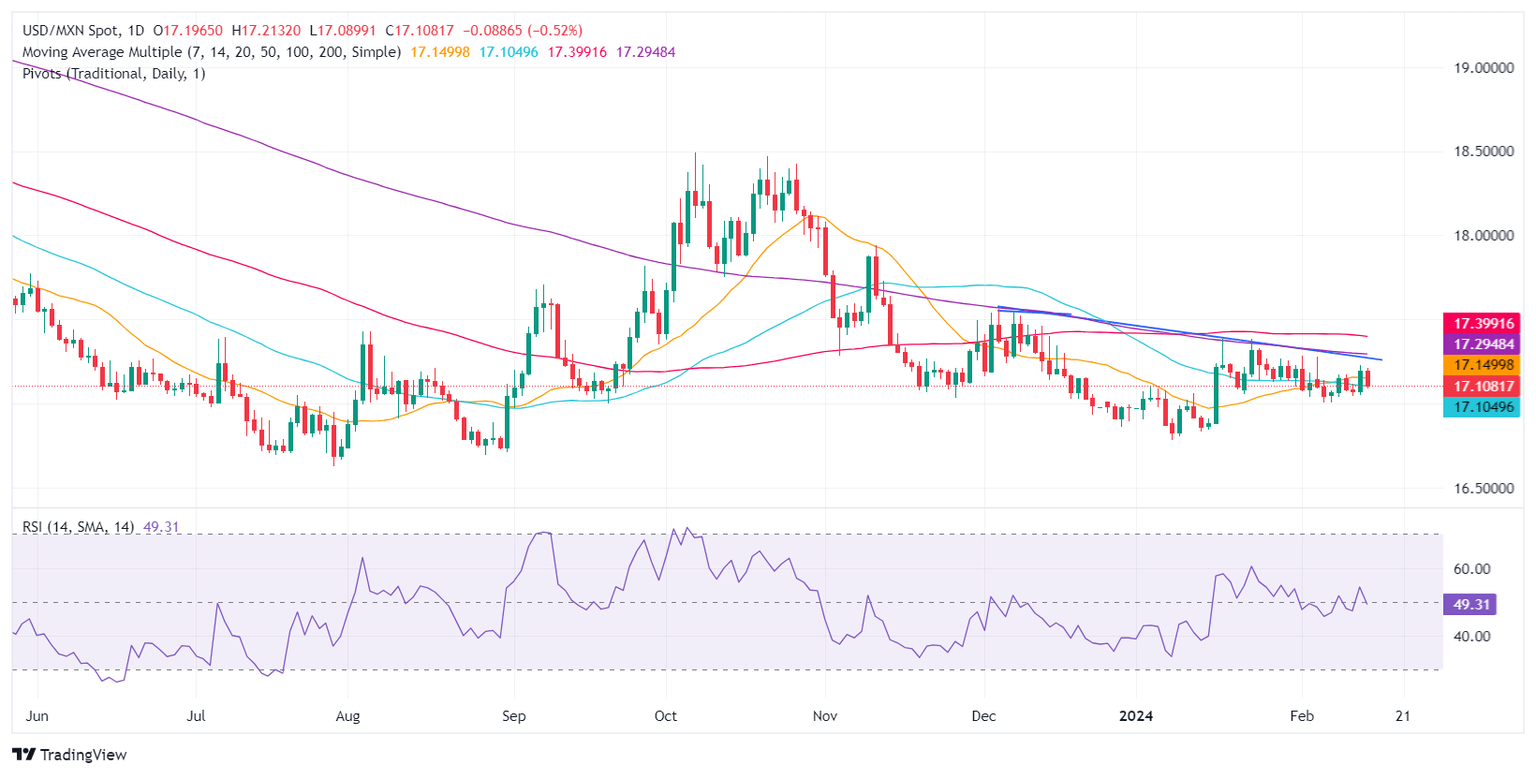

Technical analysis: Mexican Peso climbs as USD/MXN edges back above 17.15

The USD/MXN remains neutrally-biased, but short-term momentum favors sellers. The exotic pair tumbled below the 50-day Simple Moving Average (SMA) at 17.11. The Relative Strength Index (RSI) points downward, having crossed the 50-midline, which could open the door for additional downside. A daily close below that level could pave the way for further losses. The next support would be the 17.00 figure, followed by last year’s low of 16.62.

On the flip side, if buyers reclaim the 50-day SMA, that could pave the way for further upside, with the next resistance seen at the 200-day SMA at 17.29. Once cleared, the next resistance would be the 100-day SMA at 17.40.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.