Mexican Peso plunges on US hard-landing concerns

- Mexican Peso recovers from yearly low, trades at 19.49, still down over 1.70%.

- Safe-haven demand for Yen and Franc amid turmoil impacts emerging market currencies.

- Wall Street indices' losses heighten financial market stress, affecting USD/MXN volatility.

- Upcoming Mexico data: Auto Exports (Tuesday), Inflation, Banxico decision (Thursday).

The Mexican Peso trims some of its earlier losses held during the Asian session on Monday, with the emerging market currency depreciating almost 6% to a yearly low of 20.22. The USD/MXN is trading back below the 20.00 figure, but still the Peso is down over 1%, exchanging hands at 19.49.

Market sentiment remains sour across the globe, triggering a flight to safe-haven assets like the Japanese Yen and the Swiss Franc in the FX space. Against emerging market currencies, flows outside the latter bolstered the Greenback, which posted substantial gains against the Mexican Peso.

Meanwhile, Wall Street’s post losses between 2% to 3% among its largest indices indicate stress in the financial markets. Hence, USD/MXN traders must be aware of the market mood, which could spark volatility in the exotic pair.

Mexico’s economic docket will be light at the beginning of the week but gains traction on Tuesday and Thursday. Auto Exports for July will be issued on Tuesday, followed by inflation data and the Bank of Mexico (Banxico) monetary policy decision on Thursday.

Across the border, the US docket revealed that contrary to a weaker-than-expected manufacturing activity report, the services segment exceeded estimates, according to Institute for Supply Management (ISM) data.

Other data revealed by S&P Global showed that business activity dipped by a tenth yet remains expanding.

Daily digest market mover: Mexican Peso slumps on market mood, US recession fears

- Sour sentiment will likely continue to drive the financial markets. Fears are broadening after Asia stock indices plummeted sharply as fears that the Federal Reserve is behind the curve could trigger a recession.

- This, along with the Bank of Japan (BoJ) laying the ground for higher interest rates as it battles inflation and a reduction of its balance sheet, drained the liquidity of the financial markets, sparking the global stock market sell-off.

- Mexico’s Auto Exports for July are forecasted to remain at 3.3% YoY and Auto Production at 3.8% YoY.

- July’s inflation is expected to remain unchanged at 0.38% MoM and 4.98% YoY. Core inflation is estimated to hit 4.13% annually.

- The US ISM Services PMI expanded by 51.4 in July, above estimates of 51 and up from June’s 48.8 contraction.

- S&P Global Services’ PMI dipped from 55.3 to 55.0, below forecasts for a 56.0 jump.

- The CME FedWatch Tool shows the odds of a 50-basis-point interest rate cut by the Fed at the September meeting at 86.5%, up from 74% last Friday.

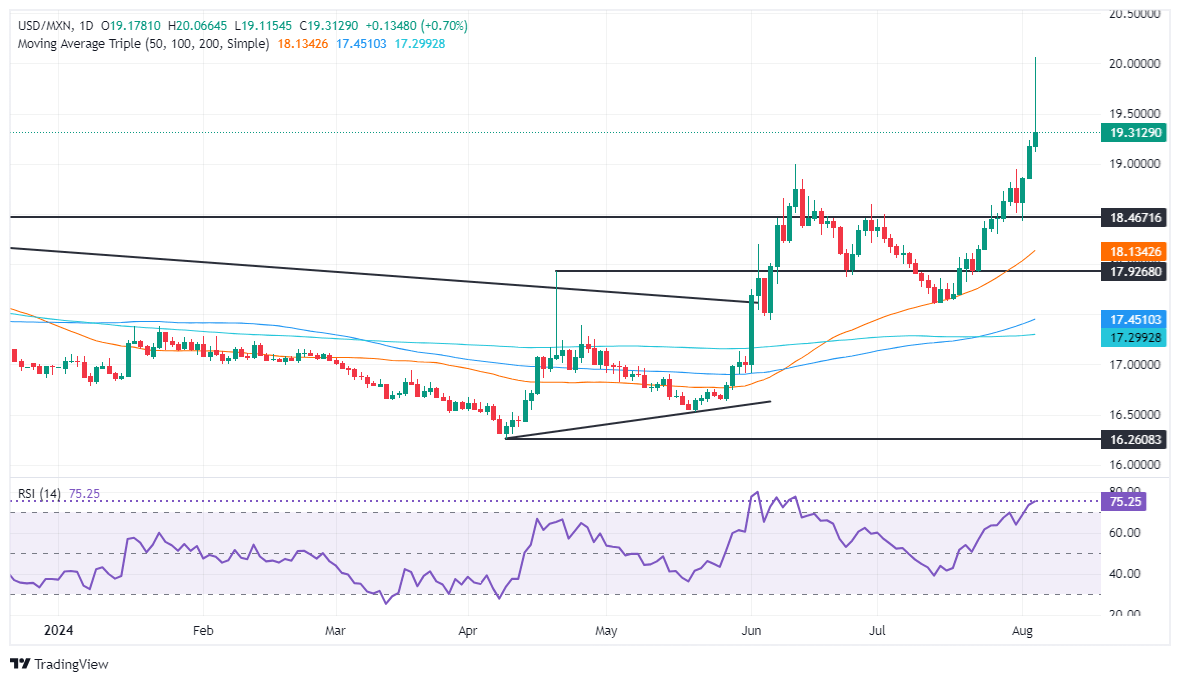

Technical analysis: Mexican Peso depreciates sharply as USD/MXN rises above 19.30

The USD/MXN is trimming some of its gains, following a spike that lifted the pair to a new 22-month high, to levels last seen in October 2022. But it’s still headed for further gains.

The Relative Strength Index (RSI) suggests that buyers are in charge after turning overbought, as seen by the USD/MXN dip from highs toward the current exchange rate. However, once the RSI dives below 70, buyers could re-enter and lift the pair higher.

If USD/MXN achieves a daily close above the August 2 high of 19.22, that will expose the 19.50 psychological figure. A further upside is seen above that level, at 20.00, followed by the current year-to-date (YTD) peak at 19.22.

Conversely, if the pair drops below 19.22, the USD/MXN will be poised to challenge the 19.00 psychological figure. Once cleared, the next support would be the 50-day Simple Moving Average (SMA) at 18.12. In further weakness, the exotic pair could challenge the 17.50 mark.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.