Mexican Peso rises against USD as poor data increases Fed rate-cut bets

Most recent article: Mexican Peso strengthens for third day as US economic slowdown looms

- The Mexican Peso drifts higher after comments from Banxico Deputy Governor Heath suggesting interest rates should remain elevated.

- EUR/MXN and GBP/MXN trade flatter as European political risk diminishes, supporting the Euro and Pound.

- USD/MXN pushes lower in a step-decline towards 18.00.

The Mexican Peso (MXN) drifts higher in its key pairs on Thursday although it is gaining more strength against the US Dollar (USD) due to a recent run of poor US economic data, than its European counterparts. Comments from the Deputy Governor of the Bank of Mexico, Jonathan Heath, have further provided the Peso with a tailwind.

At the time of writing, one US Dollar (USD) buys 18.12 Mexican Pesos, EUR/MXN trades at 19.57, and GBP/MXN at 23.11.

Mexican Peso receives a boost from a post on X

The Mexican Peso gains overnight after recent comments from Banxico Deputy Governor Jonathan Heath suggested he is not in a rush to vote for interest-rate cuts due to still-high inflation.

Heath said on X that he, “agree[s] with Jerome Powell, more benign inflation data is needed before cutting rates. He(Powell) said it for the Federal Reserve, but the same applies to the case of Mexico”.

His comments differ from those of the Governor of the Banxico, Victoria Rodríguez Ceja, who recently said that progress had been made on disinflation, which “allows us to continue discussing downward adjustments in our rate, and I consider that this is what we will be doing in our next monetary policy meetings.”

Evidence the US economy is cooling

The US Dollar weakened across the board after a slew of data out on Wednesday provided more evidence that the US economy is cooling.

The ISM Services Purchasing Managers Index (PMI) revealed a slowdown in the sector, which economists have been singling out as a major driver of hot inflation. The June reading showed a fall to 48.8 from 53.8 in May, which was well below the consensus estimate of 52.5. It was the “weakest it’s been since May 2020 during the Covid-19 pandemic,” according to Jim Reid, Head of Global Macro Research at Deutsche Bank. Although the Services Prices Paid component remained in expansion territory at 56.3, that was still lower than the 58.1 in May.

US Jobs data was also underwhelming. US Initial Jobless Claims rose 238,000 in the week ending June 29, higher than estimates of 235,000 and the previous week’s 233,000.

This “pushed the 4-week moving average up to 238.5k, which is the highest it’s been since August,” added Deutsche’s Reid. At 1.858 million, Continuing Claims stood at their highest since November 2021. To top it off, the ADP Employment Change metric for June, which measures the number of new private employees on the payroll, showed a rise of 150,000, which was below May’s figure and the 160,000 forecast by economists.

The Minutes of June’s Federal Reserve (Fed) meeting were also released on Wednesday, and these retained the neutral robotic data-dependent rhetoric of the pre-Powell-in-Sintra days. The Fed basically said it wanted to see more progress on inflation, which still stood at 2.7% (before more recent data showed a fall to 2.6%), and weaker economic data in general before pressing a button on interest-rate cuts.

French-bund bond spreads narrow as election risk recedes

The Mexican Peso is trading in a range against the Euro, which continues to recover as risks subside that the far-right French National Rally (RN) party will gain an overall majority in the second round of the French elections on Sunday.

This is reflected in the spread between French and German yields, which narrowed further on Wednesday. “Franco-German 10yr spread (-5.0bps) fell to its tightest level in three weeks, at 67 bps,” according to Deutsche Bank’s Jim Reid, in a sign investors are pricing in less of a risk of an all-out victory for extremist parties at the French election.

Pound in focus on election day

The Pound Sterling (GBP) is also holding its ground against the Mexican Peso on the day of the UK general election. Polls have shown the left-of-center Labour Party consistently in the lead by a wide margin of around 20 points, which translates into them probably winning a large majority of seats.

Although most economists agree that whoever the future government is, it will have little fiscal room for maneuver, there is an argument that greater political stability could support both the economy and the Pound Sterling going forward.

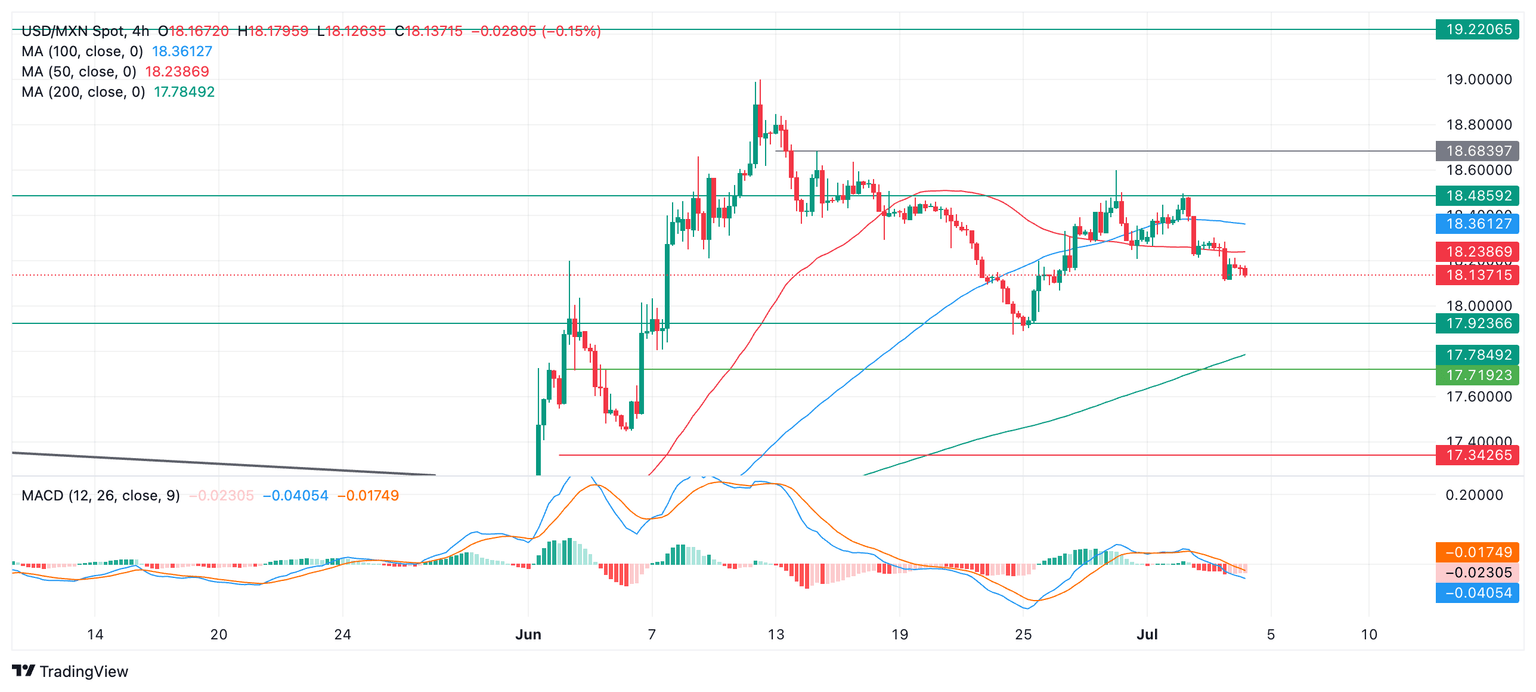

Technical Analysis: USD/MXN looking increasingly range bound

USD/MXN slides lower after peaking at the June 28 swing high at 18.59. It is currently moving down towards the key June 24 low at 17.87. It is possible the pair is entering a sideways trend although it is still a little too early to be sure.

USD/MXN 4-hour Chart

A break below 18.10 would suggest an extension down to probably the vicinity of the June 24 low. At that point price is likely to consolidate. If it begins a leg higher, it could be a sign the pair is entering a sideways trend. Alternatively, a decisive break below 17.87 would likely suggests a new downtrend was in play, with the next target from there at 17.50 (50-day Simple Moving Average).

A rally back above 18.59, however, would suggest a continuation up to 18.68 (June 14 high), followed by 19.00 (June 12 high). A break above 19.00 would provide strong confirmation of a resumption of the short-and-intermediate term uptrends.

The direction of the long-term trend remains in doubt.

Economic Indicator

Continuing Jobless Claims

The Continuing Jobless Claims released by the US Department of Labor measure the number of individuals who are unemployed and are currently receiving unemployment benefits. It is representative of the strength of the labor market. A rise in this indicator has negative implications for consumer spending which discourages economic growth. Generally speaking, a high reading is seen as bearish for the US Dollar (USD), while a low reading is seen as bullish.

Read more.Last release: Wed Jul 03, 2024 12:30

Frequency: Weekly

Actual: 1.858M

Consensus: -

Previous: 1.839M

Source: US Department of Labor

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.