Mexican Peso recovers as US recession risks dissipate

- The Mexican Peso halts its march lower after strong economic data from the US, its largest trading partner.

- China data tempers slowdown fears and also supports emerging market FX, including the MXN.

- USD/MXN stalls, forms a Shooting Star candlestick pattern and reverses.

The Mexican Peso (MXN) trades higher in its most heavily-traded pairs on Friday after bottoming out of its three-day down slope on Thursday.

A blend of not-as-bad-as-expected China growth data and strong US Retail Sales and Jobless Claims released on Thursday are helping bulls turn the Peso tanker slowly around. The Chinese data lifts market sentiment, providing a gentle backdraught to stern for MXN, whilst the strong US data supports the Peso because of the importance of the US market for Mexican exports.

That said, Peso-negative factors are likely to continue to provide a headwind. These include threats from former president Donald Trump to slam up to 300% tariffs on Mexican car imports, the widespread view that Mexico is facing an economic slowdown – given credence by a recent International Monetary Fund (IMF) report – political risk from constitutional reforms the market doesn’t like, and persistent concerns around the budget deficit.

Mexican Peso recovers after US, China data

The Mexican Peso found support on Thursday and managed to end its string of losing days after strong data out of the US painted an improved economic outlook for its most significant trading partner.

US Retail Sales and Retail Sales ex Autos both showed a higher-than-expected rise in September, and were above the increases seen in August. Retail Sales rose 0.4% and sales ex autos by 0.5%, beating estimates of 0.3% and 0.1%, respectively, and previous readings of 0.1% and 0.2% (revised up).

Initial Jobless Claims also indicated a resilient labor market with 241K out-of-work Americans claiming benefits in the week ending October 11. This was below the 260K expected and 260K (revised up) in the previous week. Given the Federal Reserve’s concerns about the fragility of the US labor market, the data had a disproportionately positive impact on the outlook for the economy as well as the future path of monetary policy, two key elements driving currencies.

“The main catalyst for the day's market moves was another batch of upbeat US data, which dampened any immediate fears about a potential recession,” said Jim Ried, Global Head of Macro Research at Deutsche Bank. “It feels a far cry from the recession fears of the summer, and also from the 260bps of Fed cuts priced in by the end of 2025 shortly before the September FOMC,” added Reid.

China data lessens concerns over slowdown

The Mexican Peso might have gained further support on Friday morning after the release of China Gross Domestic Product (GDP) growth, Retail Sales and Industrial Production data, which came out overall on the positive side, and helped to boost global market sentiment, which, in turn, tends to be positive for the Peso.

Chinese GDP increased by a higher-than-expected 4.6% YoY in Q3, which whilst below Q2’s 4.7% was not as bad as the 4.5% growth forecast by economists.

On a QoQ basis, GDP grew 0.9% in Q3, which though below the 1.0% forecast was, nevertheless, above the 0.7% expansion seen in Q2.

China Retail Sales surged 3.2% YoY in September, from 2.1% in the previous month and trouncing expectations of 2.5%. It was a similar story with Industrial Production, which rose 5.2% YoY in September, beating both previous (4.5%) and expected readings (4.6%).

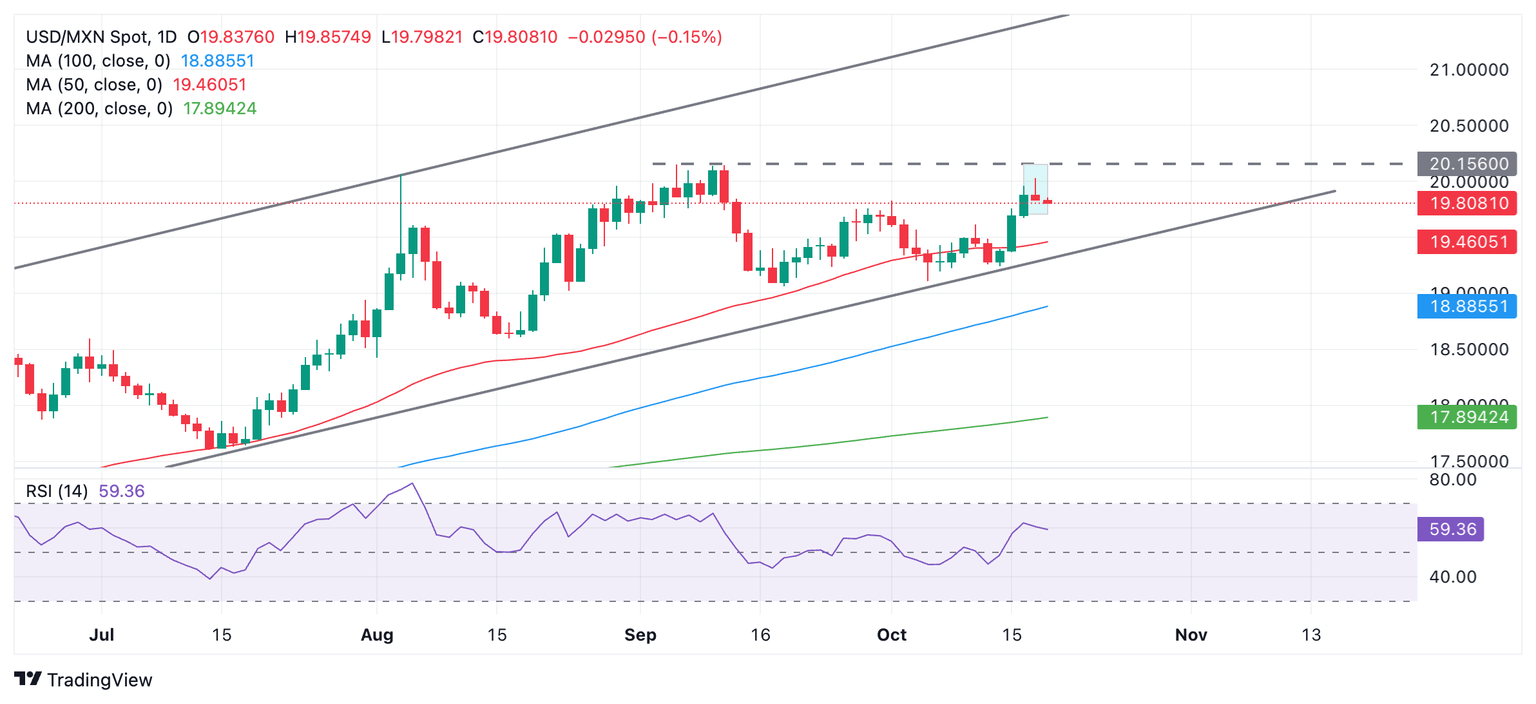

Technical Analysis: USD/MXN recovery stalls and forms Shooting Star candlestick

USD/MXN stalls mid-takeoff, rolling over after three green up days and threatening to correct back. The pair formed on Thursday a slightly ominous, if small, Japanese Shooting Star candlestick – a bearish formation (shaded rectangle on chart). This could indicate a near-term pullback is about to unfold. The pattern requires the next day to be a red down day for confirmation, however, which will not be clarified until the end of Friday (today).

USD/MXN Daily Chart

If there is a pullback, it is likely to be short-lived since USD/MXN is probably in a short-term uptrend, which given the technical analysis principle that “the trend is your friend,” is biased to continue.

The break above the key 19.83 (October 1 high) level unlocked an upside target to between 20.10-20.15 and the vicinity of the September 10 high at 20.13, which remains live.

The Relative Strength Index (RSI) momentum indicator shows that the robust momentum that accompanied the last three up days broadly persists, which also supports a mildly bullish outlook overall.

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Oct 17, 2024 12:30

Frequency: Monthly

Actual: 0.4%

Consensus: 0.3%

Previous: 0.1%

Source: US Census Bureau

Retail Sales data published by the US Census Bureau is a leading indicator that gives important information about consumer spending, which has a significant impact on the GDP. Although strong sales figures are likely to boost the USD, external factors, such as weather conditions, could distort the data and paint a misleading picture. In addition to the headline data, changes in the Retail Sales Control Group could trigger a market reaction as it is used to prepare the estimates of Personal Consumption Expenditures for most goods.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.