Mexican Peso benefits from softer US Dollar after Services PMI miss

- The Mexican Peso broadly continues strengthening against the US Dollar after worse-than-expected US Services data.

- US Services inflation appears to be slowing, potentially indicating the possibility of an early interest-rate cut from the Fed.

- The long-term trend for the USD/MXN pair is lower, but chart sigils and omens suggest a risk of a recovery.

The Mexican Peso seesaws between tepid losses and gains against the US Dollar on Thursday.

The recent trend for the Peso has been up, with USD/MXN seeing more weakness creep in after the release of lower-than-expected US ISM Services PMI figures, which recalibrated views about the stickiness of US inflation, a key factor for USD pairs.

The release of Bank of Mexico (Banxico) March meeting Minutes at 15:00 GMT is the next key event for the Mexican peso on Thursday. In that meeting the Banxico decided to cut interest rates by 0.25% for the first time since 2021. It is expected to be the start of an easing cycle, according to a note by analysts at BBH. The meeting minutes could be carefully scrutinized, therefore, for clues.

Mexican Peso extends uptrend after US Services data undershoots

The Mexican Peso’s valuation against the US Dollar rose after the release of US ISM Services PMI data on Wednesday. Figures for March showed an unexpected decline to 51.4 from 52.6 previously, when a slight rise to 52.7 had been expected.

Perhaps of more importance, was the acute fall in the ISM Services Prices Paid component, which measures inflation in the sector. It showed a decline to 53.4 in March from 58.6 in February.

-638478213864341723.png&w=1536&q=95)

ISM Services Prices Paid: Monthly

The Prices Paid component is significant for the US Dollar and USD/MXN because Services inflation is considered particularly sticky by economists and the Federal Reserve (Fed) has said it is watching price pressures in the sector carefully as it deliberates whether or not to cut interest rates.

Lower interest rates or their expectation thereof are negative for the US Dollar as they reduce its attractiveness to foreign capital, lowering inflows.

Given the sudden step-decline in Services inflation revealed by the Price Paid metric it suggests a greater possibility the Fed may decide to cut interest rates as soon as June, as had been previously expected.

Recent strong US data and the threat of resurgent inflationary forces had pushed back bets of a June rate cut or even suggested the Fed might wait till 2025.

However, the March Services’ data has increased the probability once again of the Fed cutting in June, raising it back above the 60%-chance level, according to the CME FedWatch tool, a market-based gauge of future policy moves.

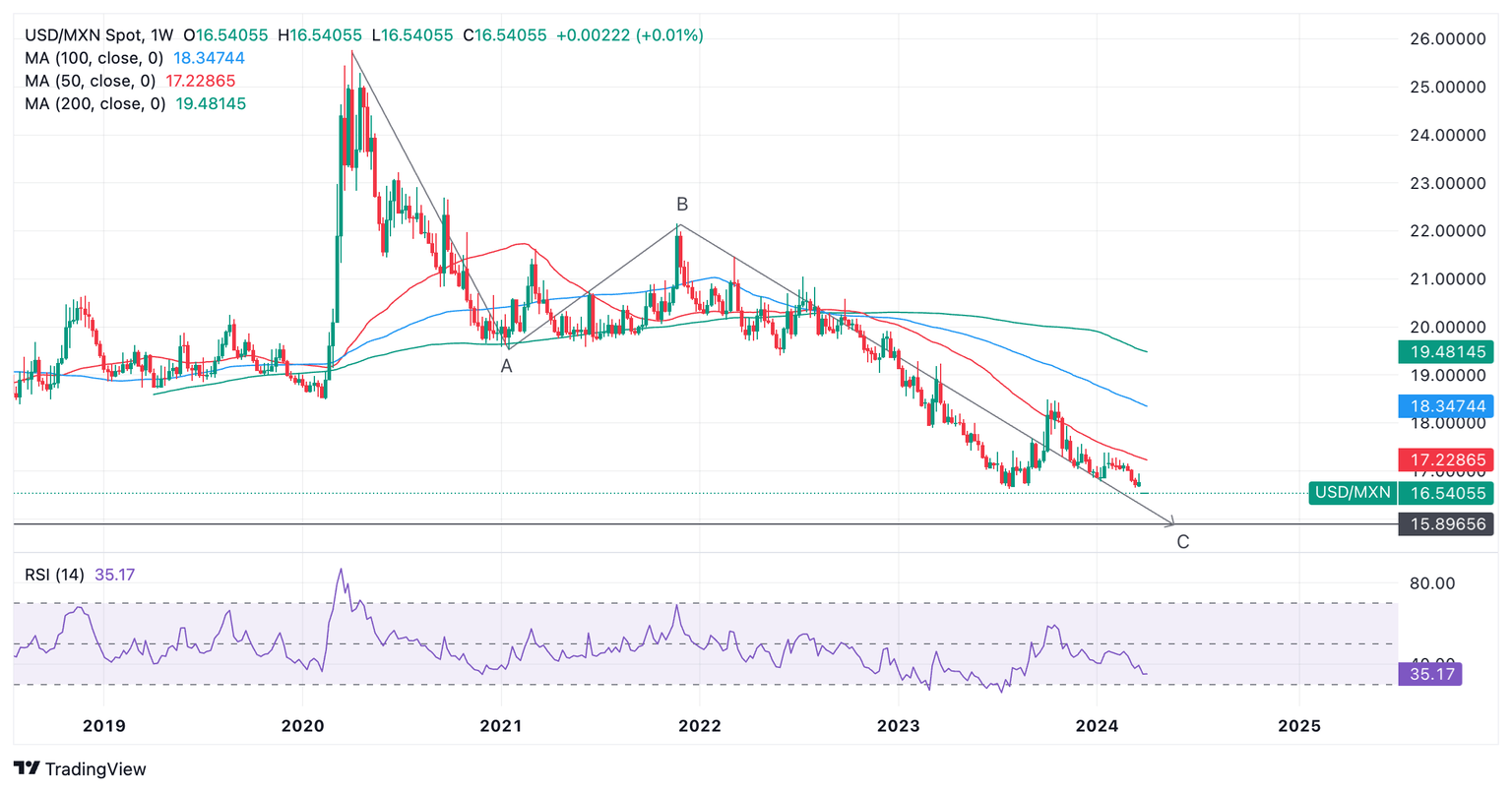

Technical Analysis: USD/MXN in long trend lower

USD/MXN is at the dog-end of a long-term downtrend that started after the pair peaked at 25.76 in April 2020 – we are now in the 16.50s.

The long move down could be characterized as a very large three-wave pattern called a Measured Move. Such patterns are composed of an A, B, and C wave, with wave C extending to a similar length to wave A, or a Fibonacci 0.618 ratio of A.

US Dollar versus Mexican Peso: Weekly Chart

If such a pattern is truly unfolding, price has almost reached the point at which C will equal A, calculated as lying at 15.89.

It has also by now surpassed the conservative target for the end of C at the 0.618 Fibonacci extension of A (at 18.24).

Once the pattern is complete the market usually reverses or undergoes a substantial correction.

The Relative Strength Index (RSI) is converging quite acutely with price, which is a sign the downtrend could be losing momentum. Although in 2024 price has pushed below the level of the 2023 lows, RSI has not followed suit. This non-correlation can be a precursor to a recovery. However, given there has been no reaction from price yet, it merely constitutes supplementary evidence the downtrend may be waning, rather than anything concrete.

An actual turnaround in the price itself would be necessary to support the view a change is on the horizon, and that is still lacking.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.