Lordstown Motors (RIDE) Stock Price and Forecast: Who negotiates with investors with CEO and CFO gone?

- RIDE stock price falls nearly 20% on Monday.

- Lordstown Motors lost its CEO and CFO on the same day.

- RIDE is supposed to be negotiating with investors for more capital, but who is leading?

Another bad day for SPACs as RIDE rides off into the abyss. Raising money is badly needed for RIDE, and there has never been a better time to raise cash. Interest rates are zero, the Fed is printing money non-stop, and investors are looking for anything higher than a zero interest rate. Lordstown Motors (RIDE) needs extra cash to survive. One would logically expect the CEO and CFO to be the two key decision-makers in leading any negotiation with investors. Now that both are gone, who is actually in charge of the Lordstown plan? Lordstown Motors said on Monday that lead independent director Angela Strand will be taking on the role of the executive chair while RIDE looks for a permanent CEO. Becky Roof will be the interim chief financial officer. This means there are two positions in place, but it is not exactly comforting for investors.

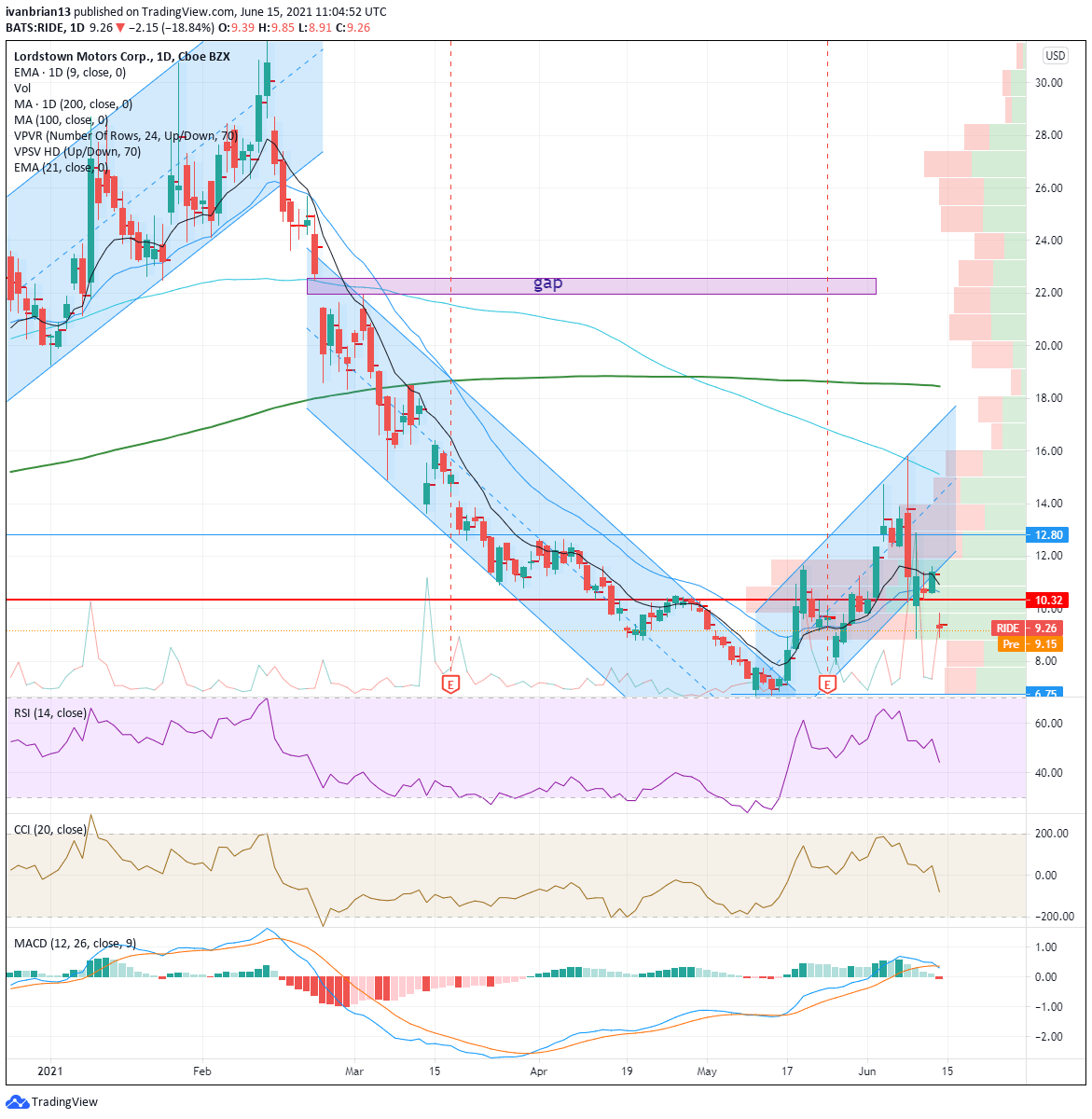

RIDE stock forecast

The results on May 24 were not exceptional and Lordstown said that the anticipated production of its Endurance truck was to be half of the prior expectations. The company also said after the results release that additional capital was needed to meet its business and production plans. The stock tanked and closed nearly 8% lower at $8.95. Bizarrely, RIDE then got caught up in the second or third wave (I have lost count) of meme stock madness, which saw AMC shares take off for the moon. RIDE shares nearly doubled over the next ten trading sessions to $15.80 despite no new news.

Reality hit for the second time on June 8 when Lordstown Motors made a late filing with the SEC, which contained stronger language than that used after the release of the results. The company was forced to admit there was substantial doubt about its ability to survive as a going concern. The shares duly tanked 16% but still remained above the post-results level.

Now the departure of the CEO and CFO has added a further twist and headwind to the stock, which on Monday dropped to $8.91 and a loss of nearly 20%. Again it should be noted this is still above the results release low of $8.95 from May 24.

From the volume profile chart, a break of $8.80 sees volume dry up and a vacuum effect could see an acceleration below the previous $6.75 low. Technically and fundamentally, the stock looks broken, but some positive news on capital raising will probably lead to a surge. Buying out of the money call options could be a good risk-reward as these are relatively cheap now and the author has taken this advice and is long RIDE calls (disclosure). Please use careful risk management as this is a high risk stock. Buying call options limits potential losses and can be a smart choice.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.