Hycroft Mining Stock News and Forecast: HYMC soars as AMC and Adam Aron pump the bulls

- Hycroft Mining (HYMC) stock rallies over 80% on Monday in a frenzy of speculation.

- Hycroft Mining (HYMC) was mentioned by Adam Aron from his Oscars limo.

- AMC benefits from its stake in HYMC as it looks to become an investment company.

Wow is the only way to describe some of the moves in the meme stock space on Monday. Where have you been hiding for the last few months? Just when you thought it was safe to go back in the water, boom, shorts get squeezed. It was not a short squeeze just a good old-fashioned momentum play. Now while I do take issue with pushing a stock so far beyond its fundamental valuation I also have a problem with commentators putting down momentum trading as some form of lesser investing. but trend following is just the same thing and no one looks down on trend following CTA's or hedge funds in quite the same way as they do retail traders. There is massive speculation, yes and it may not end well for quite a lot but momentum trading has always been a feature of markets. Even Warren Buffet has been buying Occidental Petroleum despite it being up 50% this year. Now we cannot compare the two. Occidental is an energy powerhouse and a cash cow. Hycroft Mining is a small gold miner that looked like it may go out of business until AMC stepped in.

Hycroft Mining (HYMC) stock news: It's all about the money money money

Hycroft Mining (HYMC) stock jumped for two main reasons. Firstly it has raised a big pot of cash so it can survive and not struggle to fend off bankruptcy. It was headed this way as it was burning cash and last year had to shed nearly half of its workforce in Nevada. But now it is in a much sounder position. Secondly momentum. HYMC stock has the perfect cheerleader in AMC CEO Adam Aron. Heck, he even took a call from Reuters from his limo on the way to the Oscars on Sunday night. he then followed this up with an appearance on CNBC on Monday to further talk about Hycroft Mining and AMC stock. Now the share raise was dilutive as new shares were issued buy as Hycroft Mining CEO said the company is now on a much sounder financial footing. “Thanks to the significant and timely equity private placement announced March 15, 2022, with Eric Sprott and AMC Entertainment Inc., combined with the ATM equity program completed today, our financial position is significantly strengthened allowing us to reduce our debt and extend repayment to 2027.” HYMC sold nearly 90 million shares to raise $138.6 million on top of the investment from AMC and Eric Sprott. So yes it is dilutive. But already the stock is soaring again in Tuesday premarket by another 30%, up to $3.17 now. With such volume and demand, HYMC should be raising as much cash as possible. It should tap the market again and again. This is the only sensible thing to do if investors want to give you the money. The 89 million hare placing took place at an average price of approximately $1.54. Now HYMC stock is trading at $3.17 so I would be looking to raise more cash straight away. As the saying goes cash is king.

Now for those of you with a fundamental bias, well you are likely not even reading this as HYMC is not a stable proposition. If you are investing in this just know what you are getting into. Similarly, if you are short-term trading this name, be aware it is highly volatile with little underlying valuation to fall back on. So this is a high risk. But if that is what you want jump right in, plenty of others already have!

Hycroft Mining stock forecast

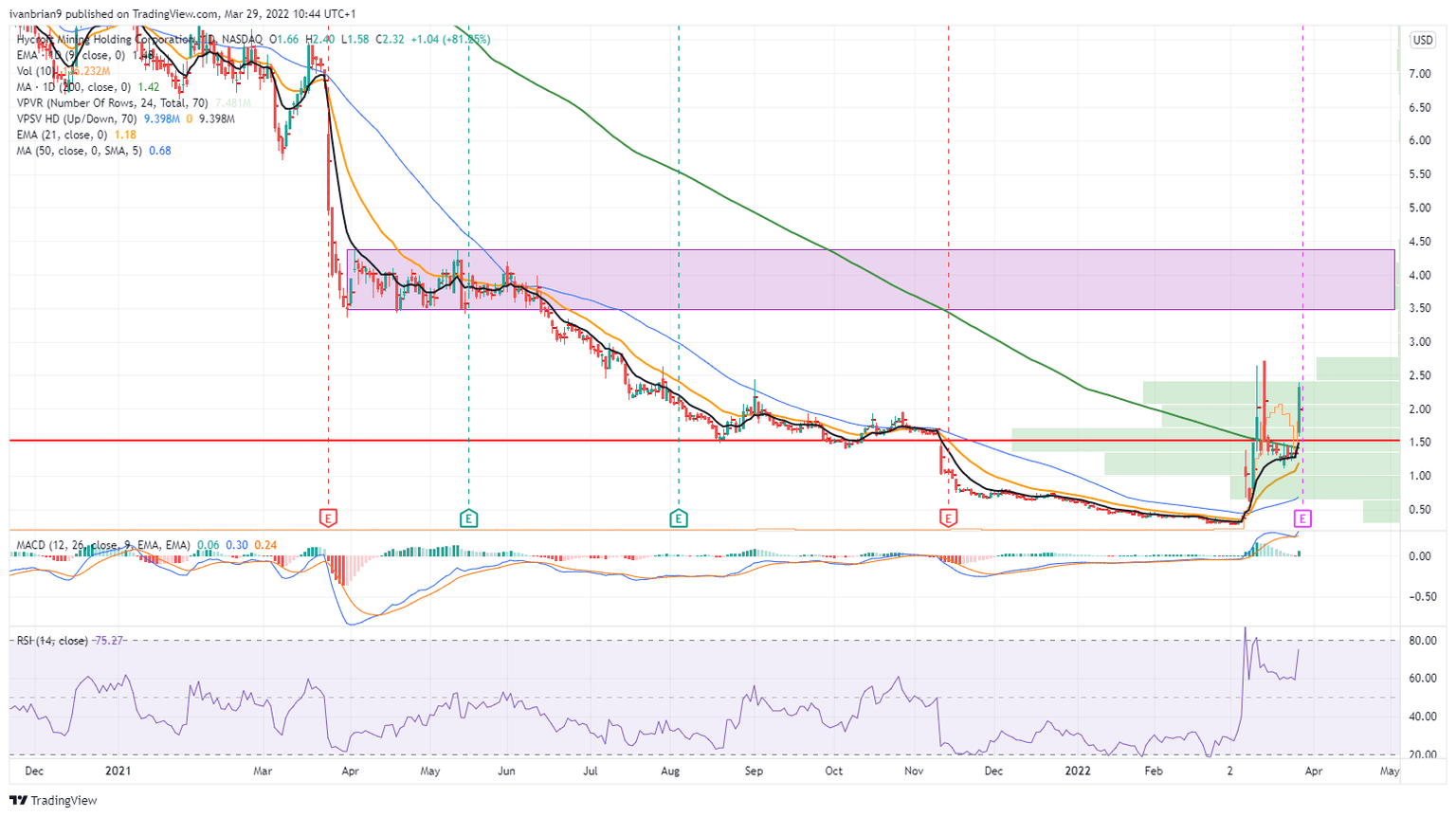

HYMC stock has traded as high as $3.42 in Tuesday's premarket. That brings it back to the consolidation zsone from last April and May so it will provide some resistance.

HYMC stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.