Gold gives up gains after comments from Fed's Barr

- Gold price rises on safe-haven demand after news of the President of Iran’s death increases tensions in the region.

- Comments from Federal Reserve's Michael Barr, however, weigh on the precious metal.

- Gold rises as a general fracturing of the world order drives central banks to stock up on the precious metal.

- A shift in expectations of when the Federal Reserve might cut interest rates further helps non-yielding Gold.

Gold price (XAU/USD) pares its earlier gains to trade in the $2,410s on Monday after comments from Federal Reserve (Fed) Vice Chair for Supervision Michael Barr suggested interest rates would need to remain at their current level for longer to get inflation back to target sustainably.

Barr was quoted as saying the "Fed will need to allow tight policy further time to continue to do its work," during a speech on Monday. The US Dollar rose 0.1% after his words and Gold price fluctuated lower.

Gold had risen to a new all-time high early on Monday due to its safe-haven qualities, as the geopolitical risk barometer rose a notch from increased tensions in the Middle East.

Gold price rises on geopolitics, Fed expectations

Gold price rose to a new all-time high after the news that the President of Iran, Ebrahim Raisi, as well as other high-profile political figures from Iran, died in a helicopter crash in the North of the country over the weekend, according to Reuters. This increased uncertainty in a region already simmering with tensions from the Israel-Hammas conflict.

Russia’s opening up of a second front in the Kharkiv region and the bonding on display between Russian President Putin and Chinese President Xi during Putin’s recent visit to Beijing are further adding to a picture of a fracturing world order, with serious implications for world peace and free trade. All of which is supportive of Gold.

Gold demand from BRICS countries and emerging economy central banks has increased substantially over recent years as a hedge against the threat of Western sanctions, according to the IMF. The trend is only likely to continue in light of recent events on the world stage.

US Federal Reserve more likely to cut interest rates

Gold is also seeing demand as a result of a general lowering of expectations that the Federal Reserve (Fed) will maintain interest rates at their current relatively high level for much longer. This is positive for Gold as it lowers the opportunity cost of holding the non-yielding asset vis-a-vis cash or bonds.

The change in outlook comes on the back of cooler inflation and retail sales data for April released last week. Although members of the Federal Reserve have been evasive about when the Fed might actually move to cut interest rates, the market sees a 65% chance that the fed fund rates will be lower than the current level in September, based on the CME FedWatch tool, which tracks the price of interest-rate futures.

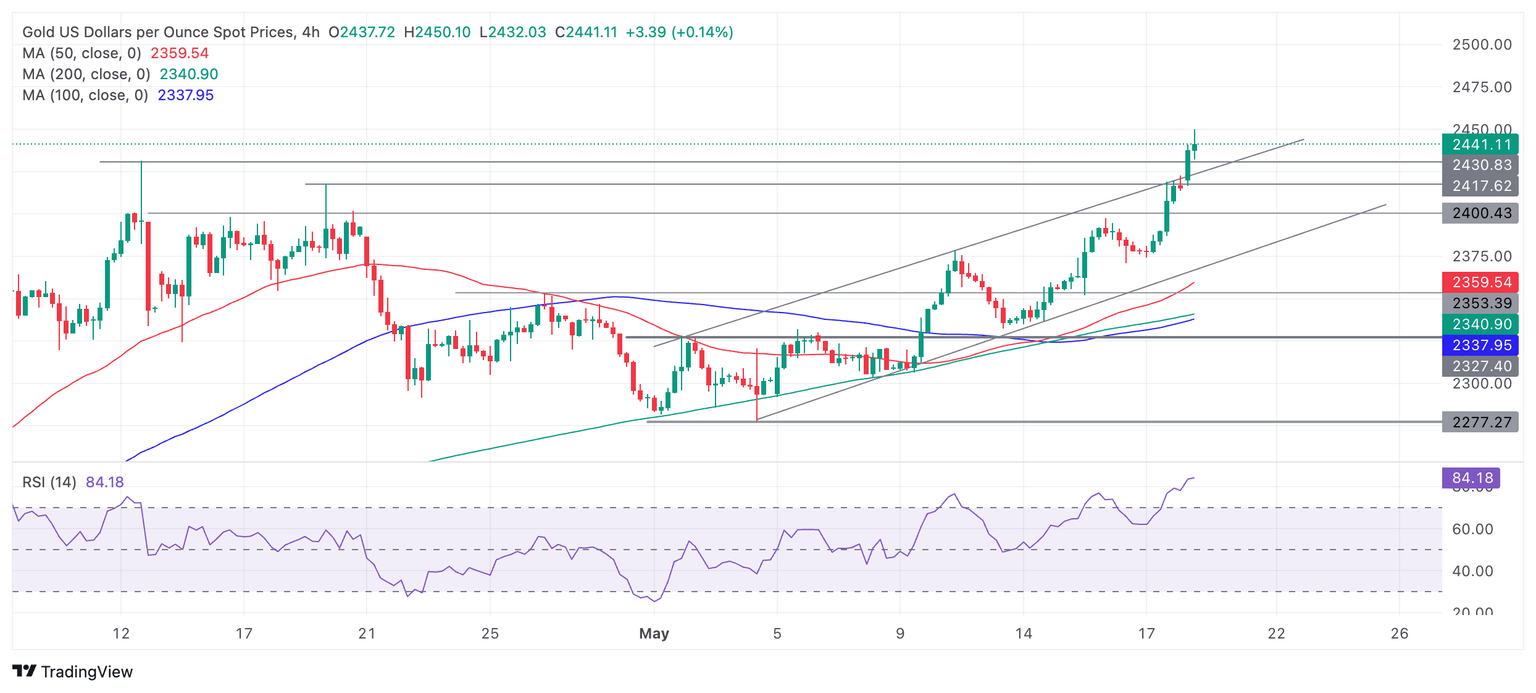

Technical Analysis: Gold price climbs parabolically

Gold price (XAU/USD) rallies to new all-time highs above $2,440 on Monday, breaking out of the rising channel it has been in since May 2.

The precious metal’s short-term trend is bullish, and more upside is expected given the old saying that “the trend is your friend.”

XAU/USD 4-hour Chart

The Relative Strength Index (RSI) is overbought, however, indicating long-holders should not add to their positions. When the RSI falls back into the neutral zone (below 70), it will signal to close long-positions and that Gold price is undergoing a correction. Any such corrections are likely to find support at the upper channel line and former highs at $2,430.

A break above the new $2,450 all-time high would likely continue the rally to the next target at the psychologically significant $2,500 level.

The medium and long-term charts (daily and weekly) are also bullish, adding a supportive backdrop for Gold.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.