Gold pulls back below $2,750 level on profit taking

- Gold pauses after rallying on the back of safe-haven flows due to the continued conflict in the Middle East.

- The BRICS summit further puts the spotlight on the precious metal as an alternative to the dominance of the US Dollar.

- XAU/USD pulls back from the $2,750 psychological level as traders take profits after the strong rally.

Gold (XAU/USD) pulls back from the territory of the $2,750s on Wednesday after reaching new all-time highs, as traders take profit.

Investor demand for safe havens has been a major driver of Gold's recent rally amid the continued conflict in the Middle East and increased election uncertainty in the US. Former President Donald Trump and Vice President Kamala Harris are running neck-and-neck in opinion polls and the increased chance of a Trump victory is seen as a threat to a stable geopolitical outlook.

A further factor could be the focus on the BRICS trading bloc as the group kicks off its 2024 summit and its members – especially Russia – seek to find an alternative to the dominance of the US Dollar (USD), with a currency backed by Gold touted as a viable alternative.

Limiting gains for the precious metal, however, is the global bond rout as investors see interest rates around the world falling at a slower pace than previously envisioned.

This revision in outlook is the starkest in the US, where the US Federal Reserve (Fed) had previously been expected to be more aggressive in slashing interest rates, but is now on a much gentler downward trajectory. With interest rates and the US Dollar expected to remain relatively elevated, Gold loses some of its luster as a non-interest-paying asset.

Gold backed by safe-haven flows

Gold has pushed ever higher as war wages on in the Middle East. Fighting continues between the Israeli army, Hamas and Hezbollah in Gaza and Lebanon despite efforts at a ceasefire. Investors are turning to safe-haven assets like Gold to lessen risk.

The death of the Hamas leader Yahya Sinwar failed to provide the chink of light for opening negotiations that commentators had hoped. On his eleventh visit to the region, US Secretary of State Anthony Blinken seems no closer to securing a ceasefire despite headlines announcing progress, as was the case on his last visit.

Indeed, according to news just breaking on Sky News, Blinken has had to take cover in a bunker after air-raid sirens went off over Tel Aviv on Wednesday. Eye-witness reports also tell of how the Israeli military has begun attacking the ancient city of Tyre on Lebanon's Mediterranean coast, after issuing a warning to residents to evacuate their homes.

Additionally, more – not less – conflict is expected as the Israelis prepare for an anticipated retaliatory attack on Iran. Their plans appeared to gain greater urgency on Monday after an Iranian drone penetrated Israeli air defense systems and exploded near Israeli Prime Minister Benjamin Netanyahu’s private residence over the weekend.

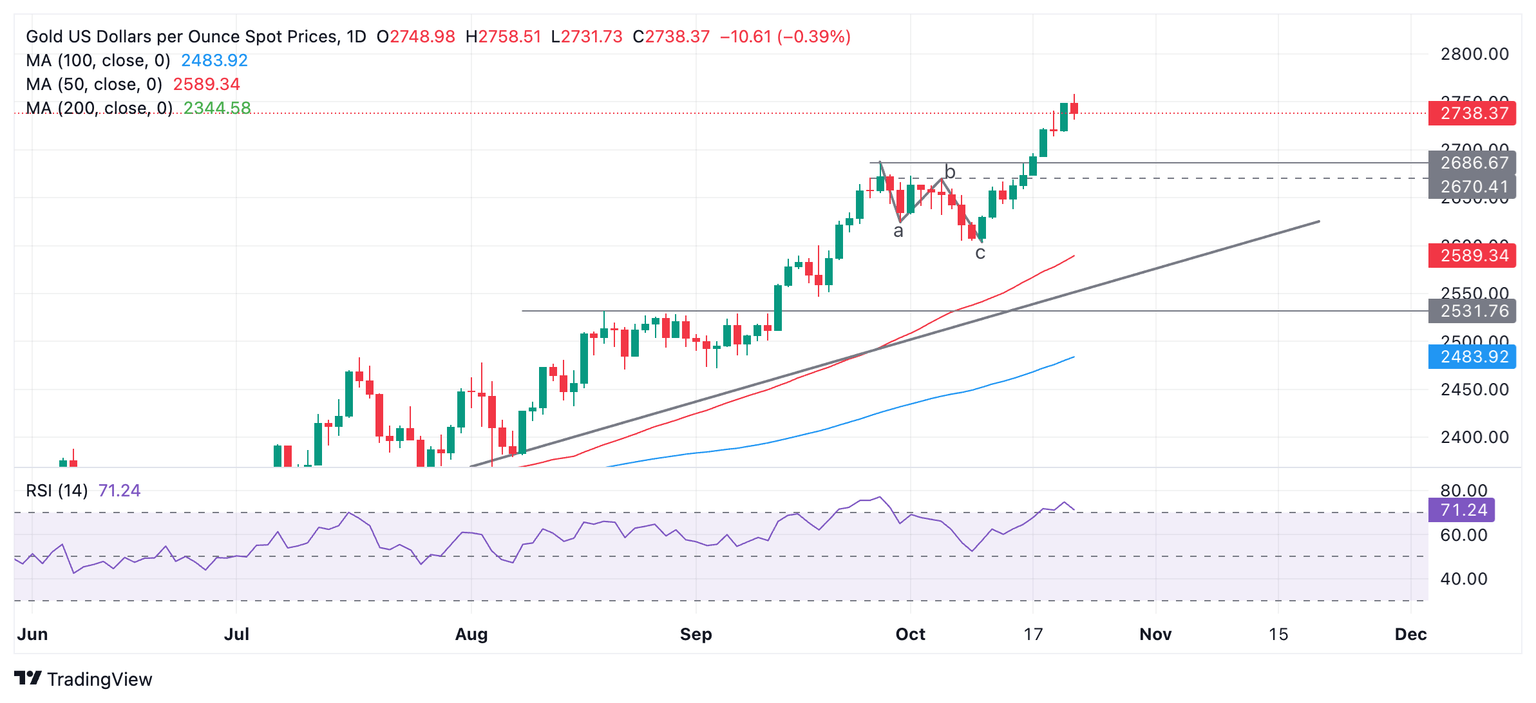

Technical Analysis: Gold pauses after reaching new highs

Gold pauses and pulls back below the $2,750 round-number and psychological barrier.

That said, the yellow metal is in a steady uptrend on all time frames (short, medium and long) which given the technical dictum “the trend is your friend” favors more upside. After having breached the $2,750 target it is now likely to set its sights on the next big-figure level at $3,000.

XAU/USD Daily Chart

The Relative Strength Index (RSI) is overbought, however, advising long-holders not to add to their positions because of the risk of a pullback. Should RSI close back in neutral territory, it will be a sign for long-holders to close their positions and open shorts as a deeper correction might be evolving. Support lies at $2,750, $2,700 (key round-number levels) and $2,685 (September high).

Gold’s overall strong uptrend, however, suggests that any corrections will probably be short-lived, and afterward, the broader bull trend will resume.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.