Gold rallies to new all-time highs after US Jobs data

- Gold rallies to new highs in the $2,770s after the release of US JOLTS jobs data.

- The precious metal was also supported by falling Oil prices which are likely to lead to lower inflation and interest rates.

- XAU/USD trades trades to a new higher high in line with its longer-term bullish trend.

Gold (XAU/USD) rises to a new record high in the $2,770s on Tuesday after the release of lower-than-expected US JOLTS Job Openings data indicated cracks appearing in the US labor market. This makes it more likely the US Federal Reserve (Fed) will slash interest rates to protect growth. Lower interest rates are positive for non-interest paying assets such as Gold.

US JOLTS Job Openings fell to 7.44 million in September from a revised-down 7.861 million in August and below estimates of 7.99 million, according to data from the US Bureau of Labor Statistics (BLS).

Gold rises due to lower Oil prices

Gold had already been on the rise due to falling Oil prices, which declined 6.0% (Brent Crude) on Monday due to the news that Israel only attacked military targets in Iran, leaving its Oil and nuclear installations unaffected.

Cheaper Oil is likely to help maintain lower levels of inflation globally as it reduces fuel and energy costs – a major factor in production, transportation and heating. This, in turn, is likely to accelerate the downward progression of global interest rates, boosting Gold’s attractiveness to investors.

Gold also remains underpinned by safe-haven flows due to the ongoing conflict in the Middle East and the escalation of the war in Ukraine following the news that North Korea has sent troops to Russia.

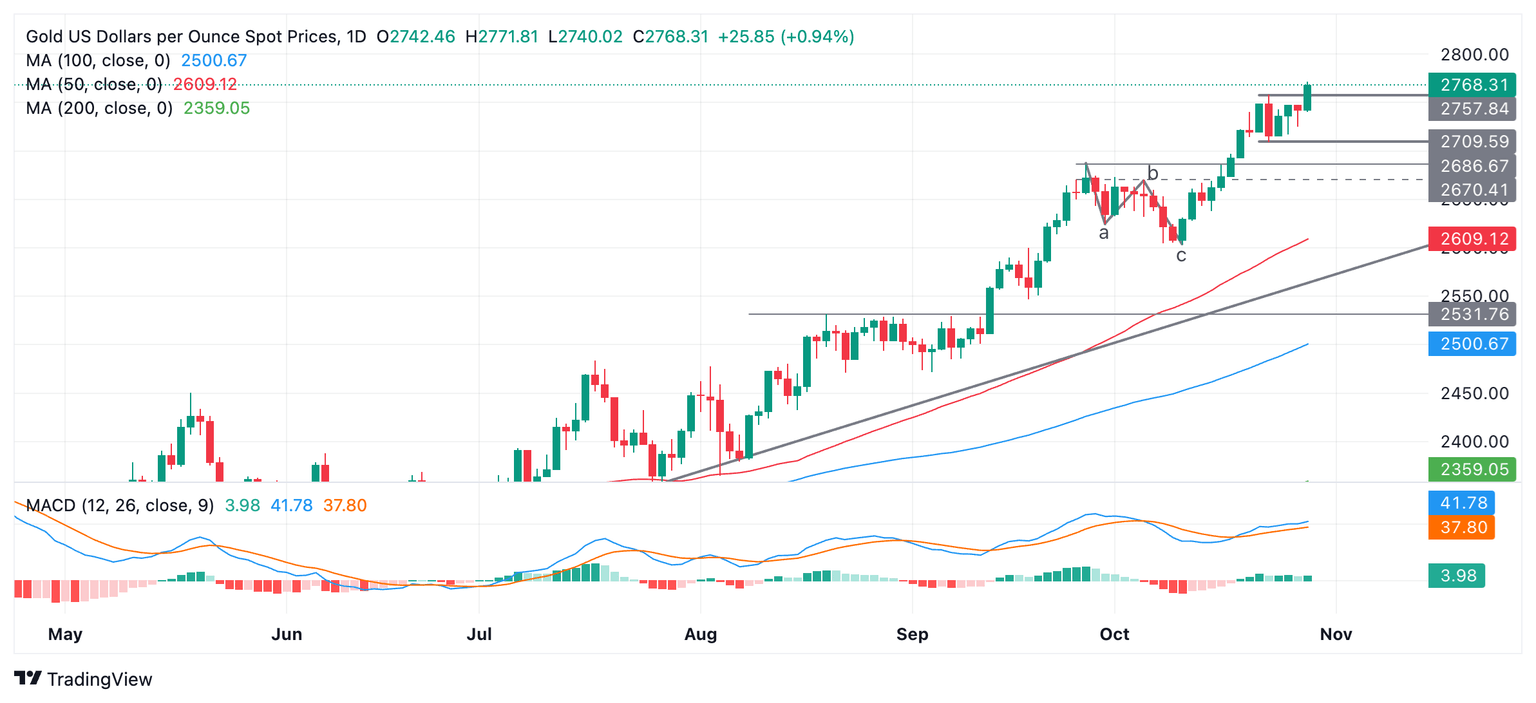

Technical Analysis: Gold tests top of range

Gold breaks out of the top of its mini range, which stretches from a low of $2,708 to the all-time high at $2,758.

Overall, the yellow metal is in a steady uptrend on all time frames (short, medium and long), which, given the technical principle that “the trend is your friend,” tilts the odds in favor of more upside.

XAU/USD Daily Chart

The break above the top of the range confirms a continuation of the bullish trend up to the next big-figure target level, which lies at $3,000 (round number and psychological level).

Economic Indicator

JOLTS Job Openings

JOLTS Job Openings is a survey done by the US Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers and different offices each month.

Read more.Last release: Tue Oct 29, 2024 14:00

Frequency: Monthly

Actual: 7.443M

Consensus: 7.99M

Previous: 8.04M

Source: US Bureau of Labor Statistics

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.