Gold price retreats amid falling US yields, buoyant US Dollar

- Gold prices fall despite stronger US Dollar amid economic slowdown signs.

- US ISM Manufacturing PMI remains in contraction; employment sub-component improvement offers market some relief.

- Despite a drop in 10-year Treasury yields to 3.84%, Gold only briefly recovers after dipping to $2,473.

Gold prices fell during the North American session as traders returned to their desks following the Labor Day holiday. Data from the United States (US) hinted that business activity contracted, though traders bought the Greenback. The XAU/USD trades at $2,490, down 0.34%.

Earlier, the Institute for Supply Management (ISM) revealed the August Manufacturing PMI, remained below the 50-line contraction/expansion level, an indication of an economic slowdown. Despite this, an Employment sub-component of the report improved slightly.

This is a relief for Federal Reserve (Fed) officials, who have remained worried about labor market weakness. Fed Chair Jerome Powell said in a speech in Jackson Hole that employment risks are tilted to the upside.

Bullion prices ignored the fall in US Treasury bond yields yet recovered some ground after hitting a low of $2,473. The US 10-year Treasury note yields 3.84%, dropping eight basis points after the ISM’s report.

According to the CME FedWatch Tool, markets are pricing in a 65% chance of the Fed cutting its rate by 25 bps at the upcoming September meeting. This will be a headwind for the Greenback and a tailwind for the non-yielding metal, which is expected to rise moderately, as 35% of the traders had positioned for a 50 bps cut.

"If the US jobs report is significantly weaker, speculation about a US recession and faster rate cuts will resurface, further supporting Gold," analysts at Commerzbank noted.

The US economic docket will be busy this week with the release of JOLTS job openings, the ADP National Employment Change, and the Nonfarm Payrolls (NFP) figures.

Daily digest market movers: Gold price traders await busy US economic calendar

- ISM Manufacturing PMI for August improved from 46.8 to 47.2, below estimates of 47.5.

- July’s JOLTS job openings are expected at 8.10 million, down from 8.184 million in June.

- Private hiring, revealed by the ADP National Employment Change report, is foreseen increasing from 122K in July to 150K in August.

- August’s NFP figures are expected to rise from 114K to 163K, while the Unemployment Rate could dip, according to the consensus, from 4.3% to 4.2%.

- December 2024 Chicago Board of Trade (CBOT) fed funds future rates contract hints that investors are eyeing 98 basis points of Fed easing this year.

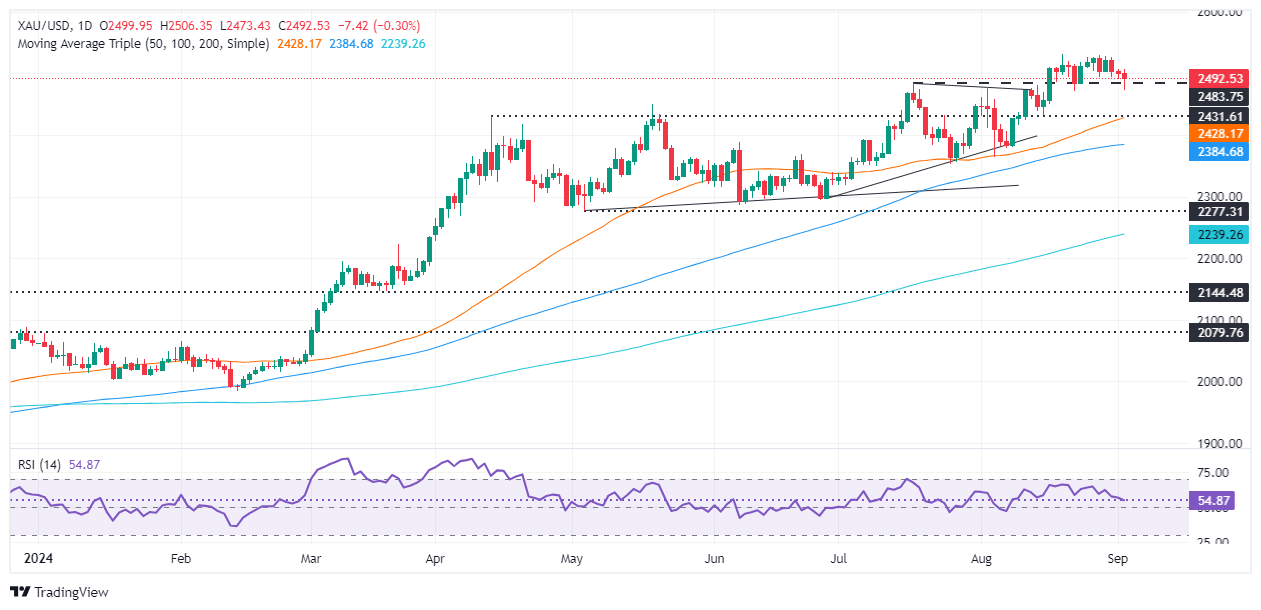

Technical outlook: Gold price set to dive further below $2,500

Gold price is upwardly biased, even though momentum shifted in sellers’ favor and opened the door for a drop to $2,470. The Relative Strength Index (RSI) hints that buyers are in charge, but in the near term the yellow metal could weaken.

In that event, if XAU/USD drops below $2,500, the next support would be the August 22 low at $2,470. Once surpassed, the next stop would be the confluence of the August 15 swing low and the 50-day Simple Moving Average (SMA) near the $2,427-$2,431 area.

Conversely, if XAU/USD stays above $2,500, the next resistance would be the all-time high, and the following resistance would be the $2,550 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.