Gold price strengthens and climbs amid higher US Treasury yields

- Gold trims some of last week’s losses, posts gains of over 0.50% despite USD strength.

- US Nonfarm Payrolls report shows resilient labor market with 272,000 jobs added.

- Upcoming US inflation data and Fed decisions are likely to impact Gold's future trajectory.

Gold posted solid gains on Monday, rising more than 0.50% as US Treasury yields climbed. Although the yellow metal exchanged hands above last week’s low of $2,277, it is on the defensive amid broad US Dollar strength ahead of the release of crucial US economic data. The XAU/USD trades at $2,311 at the time of writing.

Last week’s US Nonfarm Payrolls for May showed that the labor market remains resilient even though previous reports showed that it was cooling. Nevertheless, 272,000 jobs were created, more than the estimated 185,000. In the same report, the Unemployment Rate rose, while Average Hourly Earnings increased slightly.

Given the backdrop, this week’s inflation report in the US would be crucial. Most analysts estimate inflation to remain at familiar levels, which could reaffirm the Federal Reserve’s (Fed) rhetoric of keeping interest rates “higher for longer.” On the other hand, a reacceleration could prompt Fed officials to adjust their rhetoric, which could pave the way for further losses to the non-yielding metal.

After the US inflation data is released, the Fed will announce its monetary policy decision and update the Summary of Economic Projections (SEP). Any hawkish tilts in the message or the dot plot could trigger volatility among market participants.

In the meantime, the US 10-year Treasury note yield edges up three-and-a-half basis points to 4.47%, a headwind for the yellow metal. Consequently, the DXY, an index of the US Dollar against six other currencies, increased 0.23% to 105.17.

Daily digest market movers: Gold price recovers after strong US jobs report

- News that the People’s Bank of China paused its 18-month bullion buying spree weighed on the precious metal. “Holdings of the precious metal by the PBOC held steady at 72.80 million troy ounces for May,” according to MarketWatch.

- Upcoming US CPI report for May is expected to show headline inflation at 3.4% YoY, while core CPI is foreseen dipping from 3.6% to 3.5% YoY.

- Last week, employment data in the United States spurred speculation that the Fed will keep rates higher for longer.

- Last week’s US data decreased the odds for a Fed rate cut in September, according to the CME FedWatch Tool, from above 50% to 46.7%.

- December’s 2024 fed funds futures contract hints that investors expect 28 basis points of rate cuts by the Fed throughout the year.

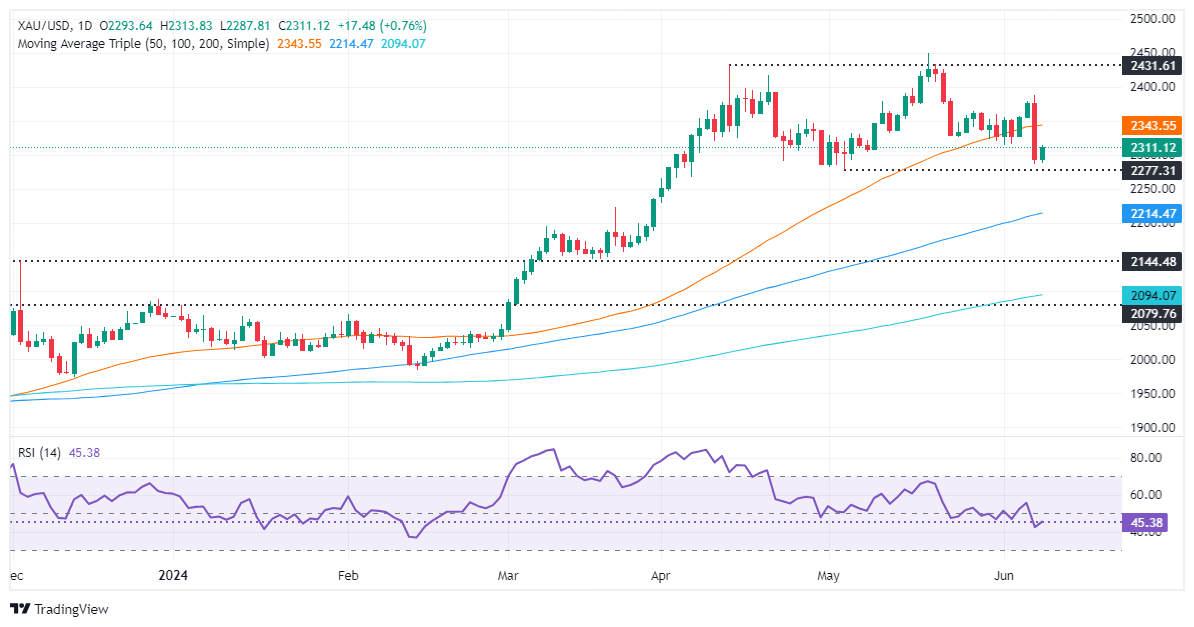

Technical analysis: Gold price climbs, hovers around $2,310

Gold price consolidates above $2,300, even though a Head-and-Shoulders chart pattern emerged. Momentum shifted bearishly as shown by the Relative Strength Index (RSI), which has pierced below the 50-midline, an indication that sellers are in charge.

Therefore, further Gold weakness and sellers could push the spot price below $2,300. Once cleared, the next stop would be the May 3 low of $2,277, followed by the March 21 high of $2,222. Further losses lie beneath with buyers’ next line of defense at around the $2,200 figure.

On the flip side, if Gold buyers lift prices above $2,350, look for a consolidation in the $2,350-$2,380 area.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.