Gold price plummets as traders cash in on hot US PPI

- Gold declines over 1% as US PPI rises unexpectedly, countering a weak jobs report and complicating disinflation narrative.

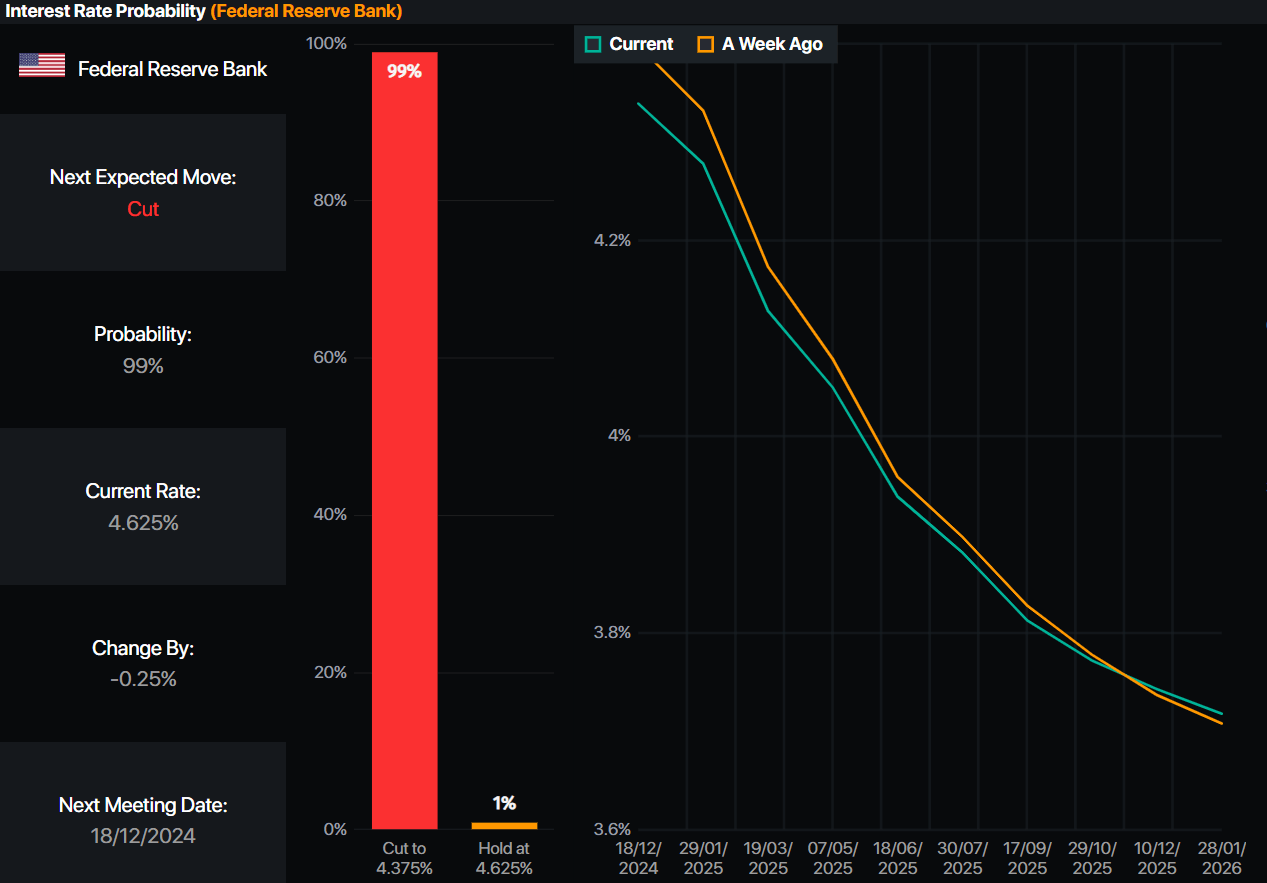

- Investors anticipate a potential Fed rate cut with high expectations of a 25 bps reduction next week.

- US Treasury yields see a slight increase, adding pressure to Gold prices as market prepares for upcoming Fed decision.

Gold prices snapped a four-day streak of gains on Thursday, tumbling more than 1% as investors digested mixed economic data from the United States. A softer than expected jobs report, but higher prices on the producer’s side, kept traders from pushing Bullion prices higher. The XAU/USD trades at $2,684.

The Producer Price Index (PPI) exceeded forecasts, hinting that the disinflation process might be stalling. Along with that, the US Bureau of Labor Statistics revealed the labor market is cooling as the number of Americans filing for unemployment benefits was above estimates.

Bullion prices dropped on speculation that traders booked profits ahead of the Federal Reserve’s (Fed) monetary policy decision next week.

There’s growing certainty that the Fed will lower borrowing costs by 25 basis points at the December 17-18 meeting. The swaps market shows odds of 98% that the fed funds rate will be cut to the 4.25%-4.50% range.

Source: Prime Market Terminal

A timid jump in the US 10-year Treasury bond yield of one-and-a-half basis points to 4.289% weighed on the golden metal.

Earlier the European Central Bank (ECB) lowered interest rates for a third straight meeting, hinted that further easing is coming as inflation edges down toward the 2% goal.

Ahead this week, the US economic docket remains absent with traders bracing for next week’s Fed meeting.

Daily digest market movers: Gold price is heavy as US real yields climb

- Gold prices advanced as US real yields rose two basis points to 1.996%.

- The US Dollar Index remains firm at 106.75, up 13%.

- The PPI for November showed that headline inflation on the producer side rose by 3% YoY, up from 2.4% in October and above forecasts of 2.6%, while core PPI increased by 3.4% YoY, exceeding projections of 3.2% and rising from 3.1%.

- US Initial Jobless Claims for the week ending December 7 jumped to a two-month high of 242K, exceeding estimates of 220K.

- This data added to Wednesday’s CPI figures, cementing the case for another rate cut by the Fed. However, for 2025, the US yield curve suggests that speculators estimate 100 basis points of easing toward the end of the year.

- Data from the Chicago Board of Trade, via the December Fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

- Analysts at Goldman Sachs noted that China’s central bank “may even increase Gold demand during periods of local currency weakness to boost confidence in their currency.”

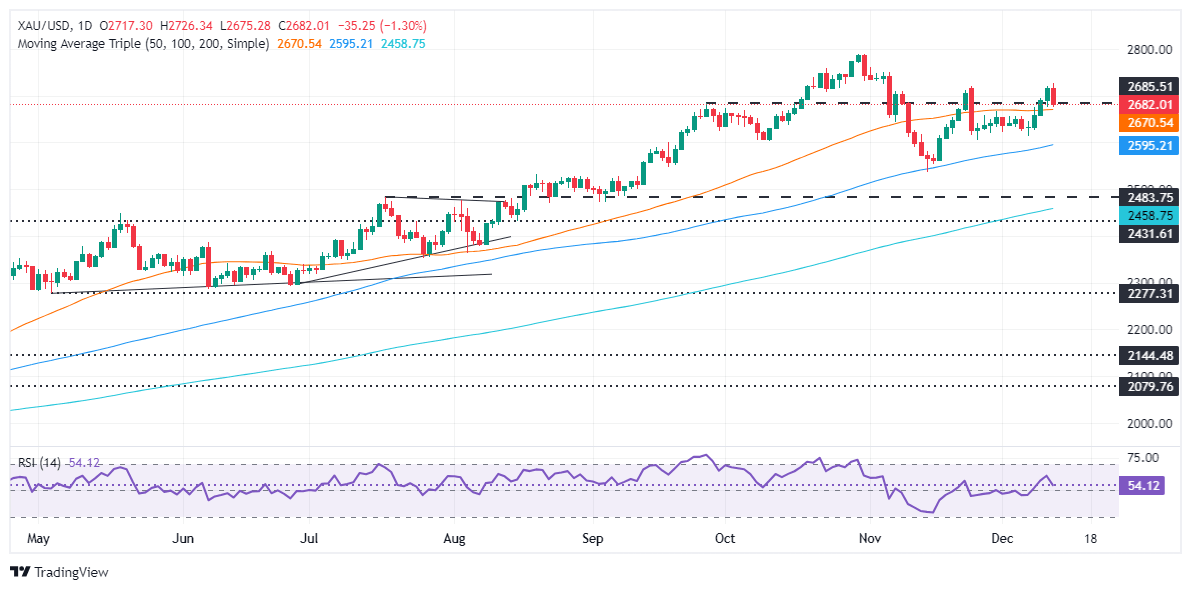

Technical outlook: Gold price resumes its bullish trend, eyes $2,721

Gold price rally pauses as the non-yielding metal retraces to the 50-day Simple Moving Average (SMA) at around $2,670. Despite this, momentum remains bullish as portrayed by the Relative Strength Index (RSI). Over the short term though, sellers are in charge.

If XAU/USD slides beneath the 50-day SMA, look for a drop toward $2,650, ahead of the $2,600 mark. On the other hand, if buyers conquer the $2,700 resistance level, the next supply zone tested would be the November 25 peak of $2,721, before challenging the record high of $2,790.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.