Gold retreats as lower US yields offset the impact of hawkish Powell speech

- Gold price drops from daily highs as better global risk sentiment diminishes safe-haven demand.

- A dip in US Treasury yields places additional pressure on the US Dollar amidst hawkish Fed remarks.

- Easing Middle East tensions sway Gold market, forthcoming US sanctions on Iran could influence future precious metal prices.

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve (Fed) officials. US Treasury bond yields dropped and undermined the Greenback, capping Gold’s plunge.

XAU/USD trades at $2,375, down 0.34%, after hitting a daily high of $2,395, just shy of surpassing $2,400. Tensions in the Middle East had subsided after Israeli officials commented that they considered striking Iran on Monday but decided to wait, according to Axios. In the meantime, the US will impose new sanctions on Iran in the upcoming days, said Jake Sullivan, the White House National Security Advisor.

Back to economic themes, Fed Chair Jerome Powell said the US economy has performed quite strongly while acknowledging that recent data shows the lack of further progress on inflation.

Daily digest market movers: Gold slides amid falling US yields, soft US Dollar

- Powell added, "The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence,” that inflation is on the path to 2%. He said, “Given the strength of the labor market and progress on inflation so far, it is appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.”

- Recent US economic data indicates a robust economy, highlighted by February's Retail Sales, which outperformed expectations, and steady Industrial Production figures. These positive indicators have helped to mitigate concerns raised by weaker-than-anticipated housing data released on Wednesday.

- In the meantime, the CME FedWatch Tool shows the first rate cut could happen in September, with odds for a quarter percentage point cut standing at 71%.

- Despite decent US economic data, market participants seem to be focused on geopolitical risks. Sources cited by The Jerusalem Post revealed that Israel has reportedly finalized plans for a counter strike against Iran.

- US Dollar Index (DXY), which tracks the buck’s performance against a basket of six other currencies, loses 0.15% to 105.96.

- Gross Domestic Product (GDP) estimates for Q1 2024 show that the US economy is expected to grow 2.9%, up from 2.8% estimated on April 15, according to the Atlanta GDPNow model.

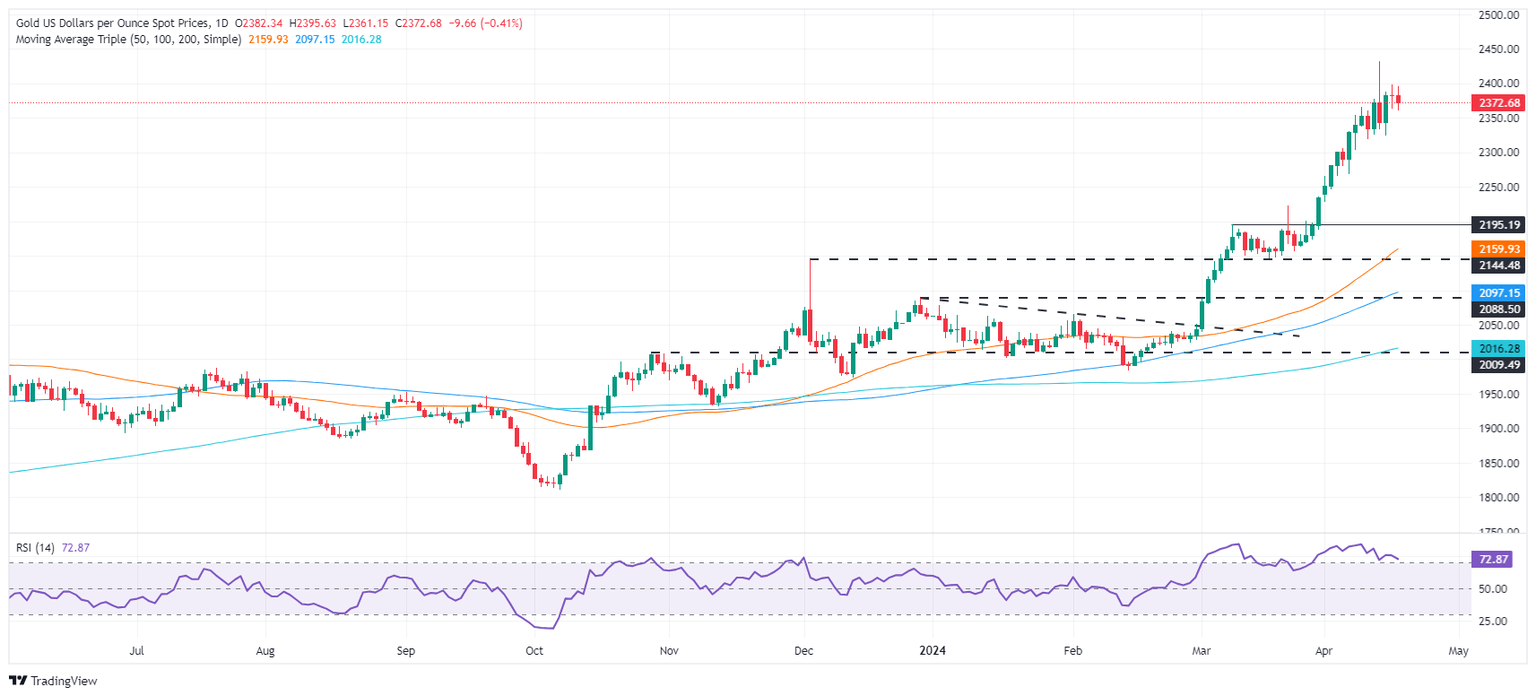

Technical analysis: Gold dives as RSI nearly exits overbought levels

Gold’s daily chart depicts the yellow metal as upwardly biased despite retreating toward the $2,370 region. The formation of a Doji on Tuesday suggests that buyers lack the momentum to extend the precious metal's gains, opening the door for a pullback.

In addition, the Relative Strength Index (RSI has fallen below the 80 level and hasn’t looked back, as it is nearly crossing below the 70 level, suggesting that buying pressure is fading.

That said, XAU/USD is headed for a correction. The first support would be the $2,350 mark, followed by the April 15 daily low of $2,324. Once surpassed, Gold might test $2,300.

On the other hand, if buyers drag prices toward $2,400, a test of the all-time high of $2,431 is on the cards.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.