Gold Price News and Forecast: XAU/USD trapped between daily and weekly structure

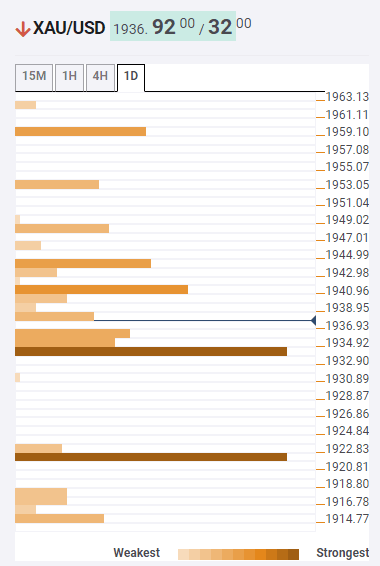

Gold Price Analysis: XAU/USD bulls to have a bumpy road towards $1,964 – Confluence Detector

Gold prices refresh intraday low near $1,938 while extending pullbacks from the six-week top, flashed the previous day, during early Friday. The yellow metal recently eased after US election updates suggest President Donald Trump’s lead in Pennsylvanian voting count. Earlier in Asia, news from Georgia and Arizona marked Joe Biden as the front-runner for the US presidency while keeping his 260+ electoral votes, versus 270 required.

Although fears of a hung decision over the blue wave in America probe the US dollar bears, optimism surrounding further easy money, be it from the central banks or governments, enthuses the global risk sentiment.

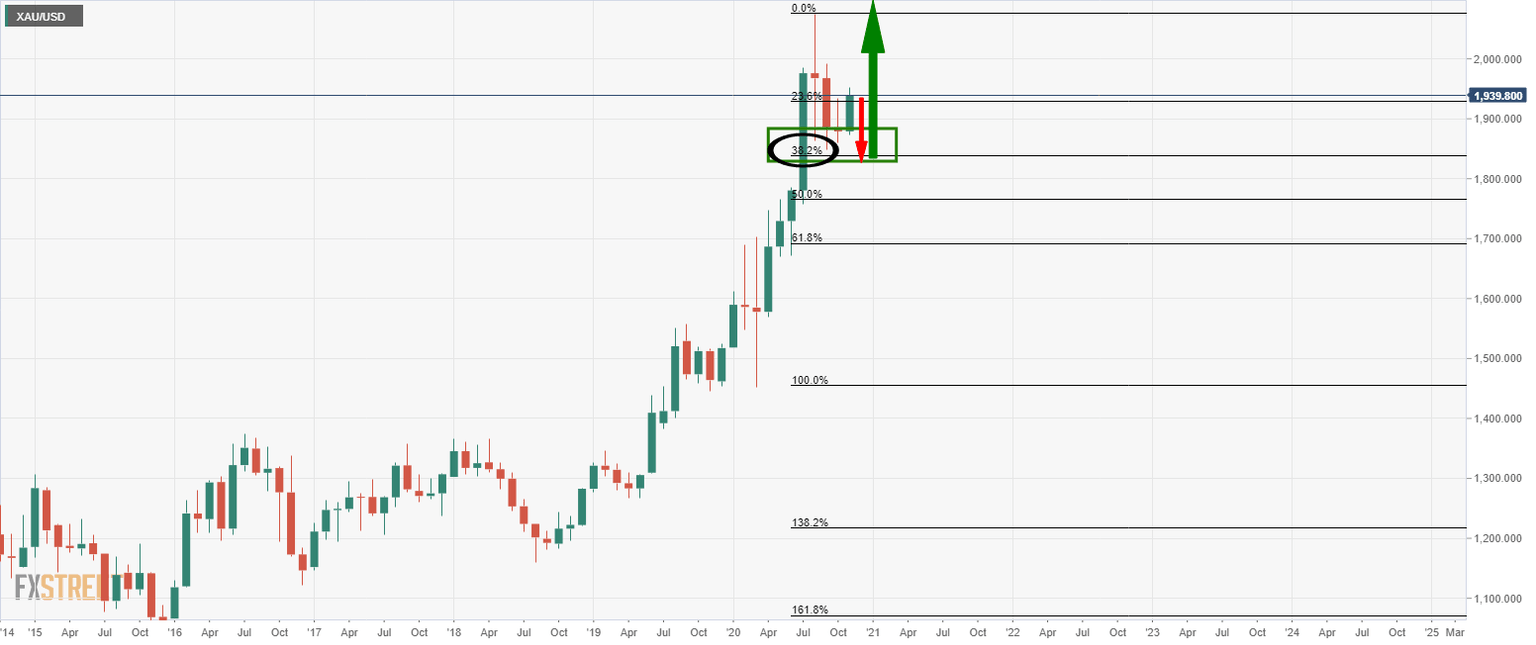

Gold Price Analysis: Trapped between daily and weekly structure

Gold has been capped in its recent advance to the $1,950 level as market volatility slows down and the US election nerves settle into a foregone conclusion of a Democratic Party victory. However, there are still uncertainties left in the race which could equate to further volatility which might be required to help gold break out of its $1,865 and $1,950 range prior and into a newly formed trending market.

While stuck below weekly resistance, the monthly chart's correction may not be finished yet, despite the bullish tendencies on the lower time frames. However, the daily reverse head and shoulders may prove to be the dominating chart pattern in the near term to tip the balance in the bull's favour once again.

Author

FXStreet Team

FXStreet