Gold Price News and Forecast: XAU/USD (mostly) hinges on Trump´s electoral chances

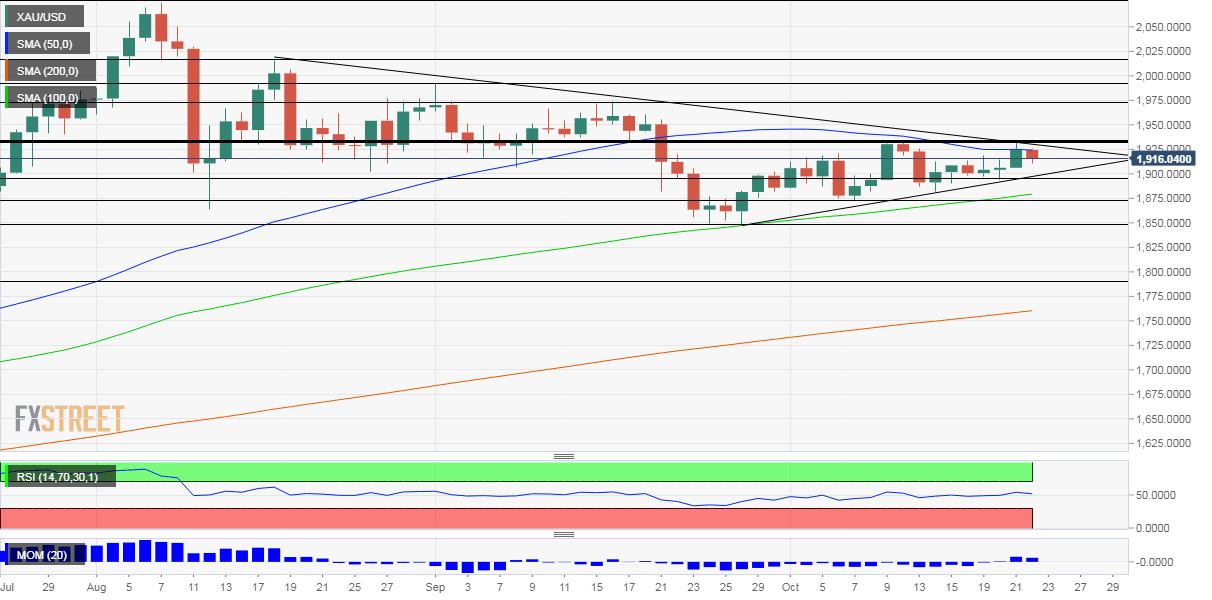

Gold Price Analysis: XAU/USD pressured to break below $1,900

XAU/USD is open to start the week lower by some 0.10% despite a slide in the greenback on Friday by 0.20%. The market is range bound and trendless with election and stimulus uncertainty whipsawing prices from day-to-day.

A second wave of the coronavirus gathering pace is also problematic for investor sentiment, although the recent news of an FDA approval for remdesivir gave a hint of positive news as do the prospects of the Johnson Johnson trials getting back on track.

Gold Weekly Forecast: XAU/USD (mostly) hinges on Trump´s electoral chances

"Putting pen to paper" – such commentary from Washington about a fiscal stimulus deal has been pushing gold prices higher, while pessimism about a deal held it back. With time running out toward Election Day, the next bout of cash to fuel gold prices mostly depends on the outcome.

When President Donald Trump completed his U-turn – from cutting off talks with Democrats to stating he wants a larger deal than them, gold advanced. The same happened when House Speaker Nancy Pelosi expressed optimism about striking an accord.

Author

FXStreet Team

FXStreet