Gold Price News and Forecast: Sellers look to retain control as XAU/USD fails to reclaim $1,800

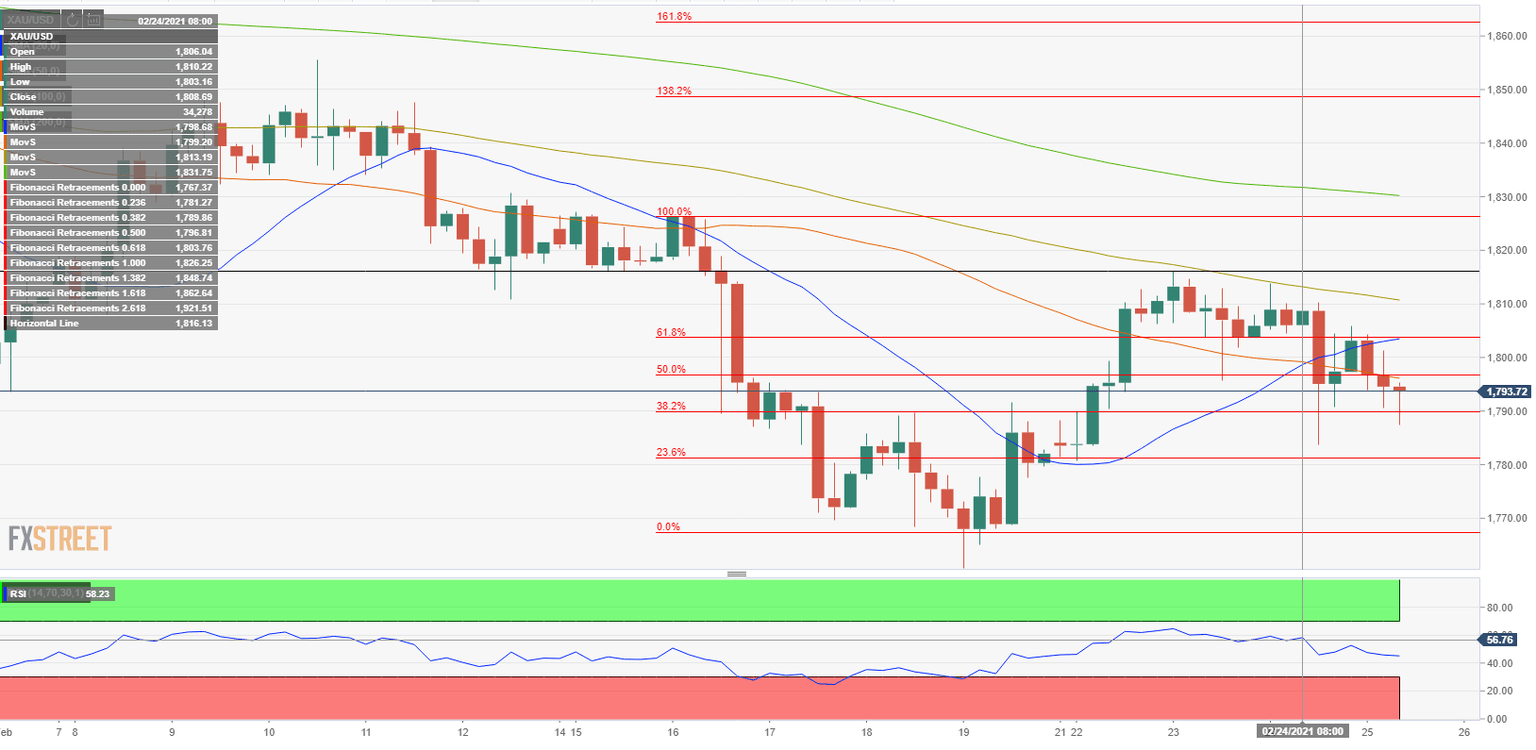

Gold Price Analysis: XAU/USD remains depressed, bears await a break below weekly lows

Gold failed to capitalize on the previous day's goodish bounce and witnessed some fresh selling on Thursday. The precious metal maintained its offered tone through the mid-European session and was last seen hovering near the lower end of its daily trading range, just above the $1785 level.

A fresh leg up in the US Treasury bond yields was seen as one of the key factors driving flows away from the non-yielding metal. That said, the heavily offered tone surrounding the US dollar extended some support to the dollar-denominated commodity and helped limit deeper losses, at least for now. Read more...

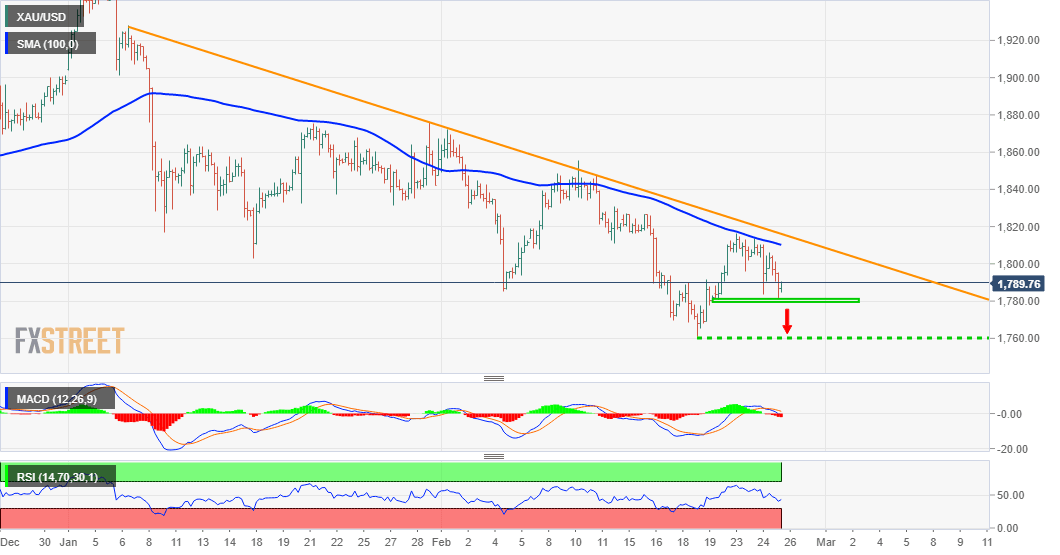

Gold Price Analysis: Sellers look to retain control as XAU/USD fails to reclaim $1,800

The XAU/USD pair dropped to a two-day low of $1,783 on Wednesday but staged a rebound and managed to close the day above $1,800. However, the pair remains on the back foot despite the broad-based selling pressure surrounding the greenback on Thursday and was last seen losing 0.55% on the day at $1,795.

The Relative Strength Index (RSI) indicator on the four-hour chart moves sideways a little below 50 following Wednesday's drop, showing that XAU/USD struggles to determine a direction in the near-term. Meanwhile, the pair continues to trade below the 20 and 50-period SMAs, suggesting that the next move is likely to be lower. Read more...

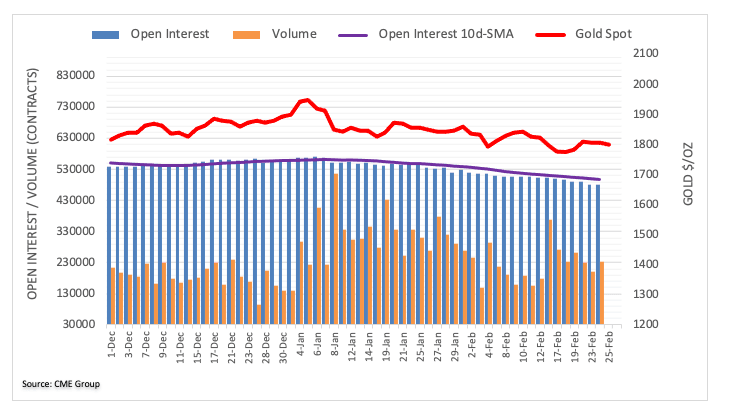

Gold Futures: Further consolidation looks likely

Open interest in gold futures markets rose for the first time after eight consecutive daily pullbacks on Wednesday, this time by just 599 contracts in light of preliminary data from CME Group. In the same line, volume reverses two daily drops and went up by around 34.3K contracts.

Gold prices charted an inconclusive session on Wednesday amidst rising open interest and volume, exposing the continuation of the consolidative mood at least in the very near-term. The resumption of the upside faces the next target of note around $1,850 per ounce, where coincide recent tops and the 200-day SMA. Read more...

Author

FXStreet Team

FXStreet