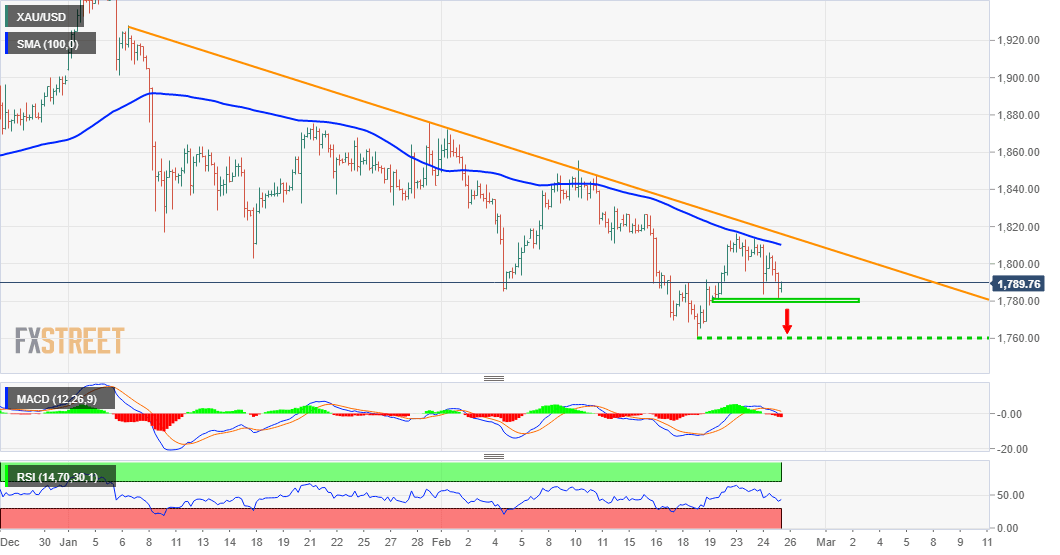

Gold Price Analysis: XAU/USD remains depressed, bears await a break below weekly lows

- A strong rally in the US bond yields prompted some fresh selling around gold on Thursday.

- Some follow-through weakness below the $1780 area will set the stage for further losses.

- A sustained move beyond a descending trend-line resistance will negate any bearish bias.

Gold failed to capitalize on the previous day's goodish bounce and witnessed some fresh selling on Thursday. The precious metal maintained its offered tone through the mid-European session and was last seen hovering near the lower end of its daily trading range, just above the $1785 level.

A fresh leg up in the US Treasury bond yields was seen as one of the key factors driving flows away from the non-yielding metal. That said, the heavily offered tone surrounding the US dollar extended some support to the dollar-denominated commodity and helped limit deeper losses, at least for now.

From a technical perspective, bearish traders are likely to wait for some follow-through selling below weekly lows support near the $1780 region before positioning for any further decline. The XAU/USD might then accelerate the slide towards YTD lows, around the $1760 area touched last Friday.

A subsequent slide will be seen as a fresh trigger for bearish traders and turn the precious metal vulnerable to prolong its recent downward trajectory. The next relevant target on the downside is pegged near the $1725-24 horizontal zone before the metal eventually drops to the $1700 neighbourhood.

On the flip side, any meaningful recovery attempt is more likely to confront immediate resistance near the $1800 mark. This is closely followed by a resistance marked by an eight-week-old descending trend-line, around the $1810-11 region and weekly swing highs, near the $1815-16 supply zone.

A sustained move beyond will negate any near-term bearish bias and prompt some near-term short-covering move. The XAU/USD might then aim to surpass the $1825 intermediate hurdle and climb further to test the $1845 strong resistance en-route monthly swing lows, around the $1855 region.

XAU/USD 4-hourly chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.