Gold Price Analysis: Sellers look to retain control as XAU/USD fails to reclaim $1,800

- XAU/USD stays under modest bearish pressure on Wednesday.

- Gold struggles to reclaim $1,800 despite USD weakness.

- $1,780 could be seen as the next target on the downside.

The XAU/USD pair dropped to a two-day low of $1,783 on Wednesday but staged a rebound and managed to close the day above $1,800. However, the pair remains on the back foot despite the broad-based selling pressure surrounding the greenback on Thursday and was last seen losing 0.55% on the day at $1,795.

Gold technical outlook

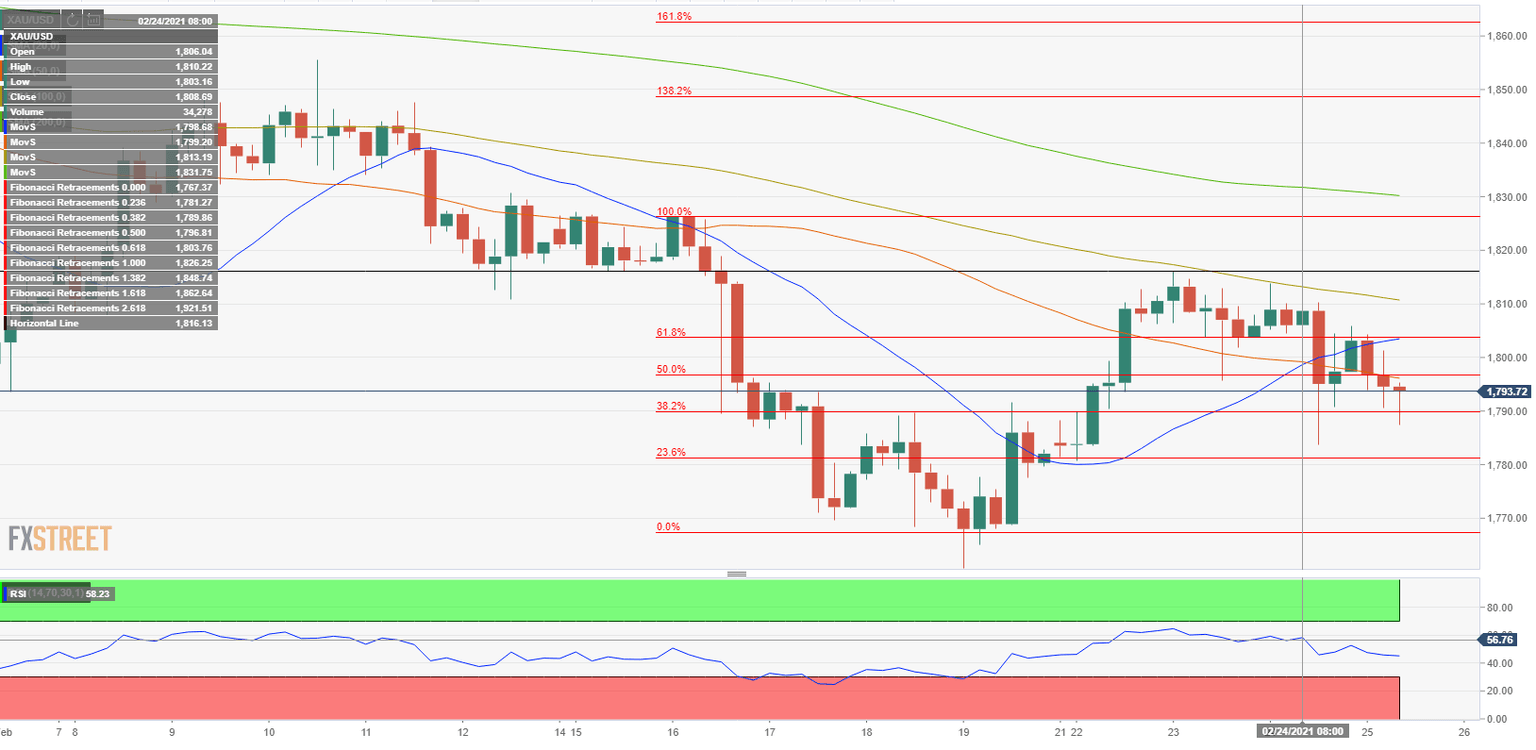

The Relative Strength Index (RSI) indicator on the four-hour chart moves sideways a little below 50 following Wednesday's drop, showing that XAU/USD struggles to determine a direction in the near-term. Meanwhile, the pair continues to trade below the 20 and 50-period SMAs, suggesting that the next move is likely to be lower.

On the downside, the initial support aligns at $1,790, where the Fibonacci 38.2% retracement of the last week's drop is located. With a break below that level, XAU/USD could extend the slide toward the next Fibonacci retracement level at $1,780.

On the upside, $1,800 (psychological level) could be seen as the first resistance ahead of $1,803 (Fibonacci 61.% retracement) and $1,810 (100 SMA).

Gold four-hour chart

Additional levels to watch for

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.