Gold price nears record high on weak US Dollar

- Gold nears all-time high, rises amid volatile US policy statements.

- Trump's WEF comments soften on Chinese tariffs and advocate lower rates, affecting the dollar.

- The US Dollar Index drops 0.62% to 107.44, weakening the Greenback and enhancing gold's hedge appeal.

Gold price extended its weekly gains, poised to challenge the all-time high of $2,790 rather sooner than later. Comments by United States (US) President Donald Trump could be the catalyst that pushes the yellow metal higher, though he surprised traders as he might refrain from imposing duties on Chinese products. The XAU/USD trades at $2,772, up 0.60%.

The market mood shifted slightly negatively even though Trump has eased the trade policy rhetoric against allies and adversaries. US economic data on Friday hinted that manufacturing activity improved in December, according to S&P Global, while Consumer Sentiment deteriorated, reported the University of Michigan (UoM) final survey for January.

However, Trump’s harsh rhetoric is not limited to the trade deficit. At the World Economic Forum (WEF) he added that he would demand lower interest rates.

After his remarks, the Greenback tumbled and remains on the defensive, as seen by the US Dollar Index (DXY), which tracks the American currency's value against a basket of six currencies. It edges down 0.62% to 107.44.

The buck is set to end the week with losses of 1.77% in the first week of US President Donald Trump in office.

Next week, the US economic docket will feature the release of Durable Goods Orders, the Federal Reserve’s (Fed) interest rate decision, Gross Domestic Product (GDP) figures and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold price climbs above $2,770 on solid US data

- Gold price rose ignoring the advance of real yields. Measured by the 10-year Treasury Inflation-Protected Securities (TIPS), yield sits at 2.23%, up by one and a half basis points (bps).

- The US 10-year Treasury bond yield slides two bps during the day at 4.625%.

- US S&P Global Manufacturing PMI for December improved from 49.4 to 50.1, above estimates of 49.6. Meanwhile, the Services PMI dipped from 56.8 to 52.8, missing forecasts of 56.5

- The University of Michigan Consumer Sentiment Final forJanuary expanded by 71.1, below estimates of 73.2 and the preliminary reading of 74.0.

- Existing Home Sales in December rose by 2.2% MoM, from 4.15 million to 4.24 million.

- Market participants are pricing in near-even odds that the Fed will cut rates twice by the end of 2025 with the first reduction occurring in June.

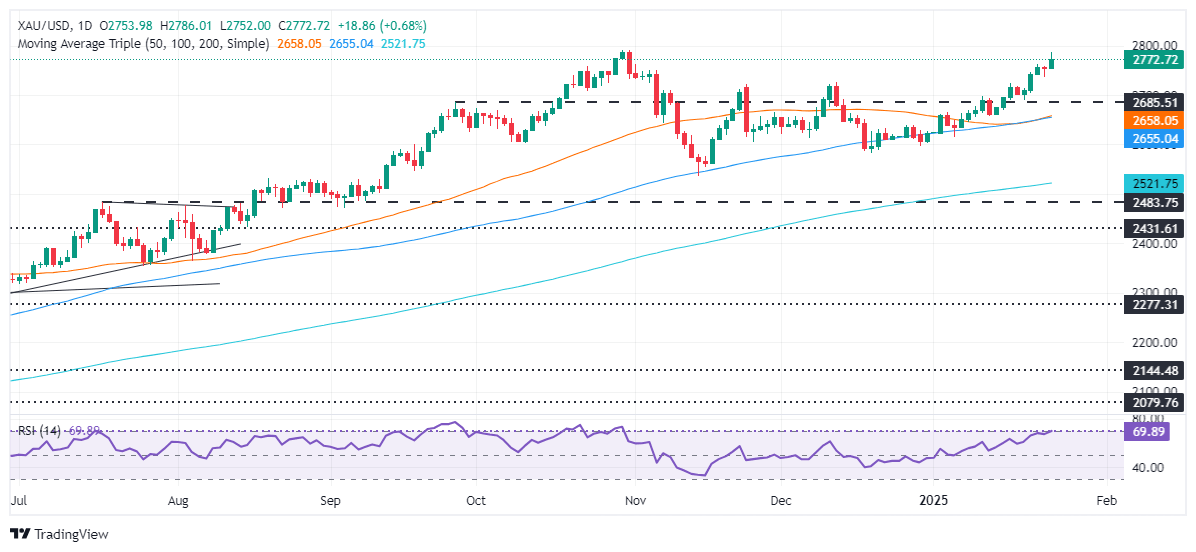

XAU/USD technical outlook: Gold surges above $2,770 as bulls target ATH

Gold price rally is set to extend but traders must clear the record high of $2,790. Despite this, the formation of a bullish candle with a small upper shadow indicates traders are not accepting higher prices. This is further confirmed by the Relative Strength Index (RSI), which has turned overbought.

XAU/USD must surpass the all-time high (ATH) at $2,790 for a bullish continuation. Once cleared, the next resistance would be $2,800, followed by key psychological levels exposed at $2,850 and $2,900.

Conversely, if bears drag Bullion prices below the $2,750 figure, the 50 and 100-day Simple Moving Averages (SMAs) emerge as support levels, each at $2,656 and $2,653. If surpassed, up next lies the 200-day SMA at $2,520.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.