Gold Price Forecast: XAUUSD advances towards $1,800 amid a decline in odds for hefty Fed’s rate hike

- Gold price is aiming to capture the $1,800 hurdle amid sheer optimism in the market.

- Economists at Danske Bank believe that the risk of persistent inflation has not vanished.

- Wednesday’s Retail Sales data is seen higher at 0.9% despite a decline in inflation.

Gold price (XAUUSD) has climbed above the critical resistance of $1,770.00 in the early Tokyo session. The precious metal has become a prized asset for market participants in the past week after the US October inflation report disclosed easing price pressures. The gold prices are set for further rally towards the crucial resistance of $1,800.00 as a decline in the inflationary pressures is promising that the Federal Reserve (Fed) won’t look for hefty rate hikes in its December monetary policy.

Meanwhile, a decline in the US dollar index (DXY) after plummeting US Consumer Confidence has strengthened the gold’s rally. The sentiment data dropped to 54.7 vs. the projections of 59.5. Going forward, the price action in the US bond market will be keenly watched after an extended weekend.

Contrary to the improved risk appetite due to a decline in the US inflation rate, economists at Danske Bank are of the view that price pressures in the US are set to persist. “While markets have reacted very positively to the October CPI print, we continue to see further risks of more persistent inflation and think it is too early to trade a clear Fed pivot.”

Going forward, Wednesday’s Retail Sales data will remain in the spotlight. The monthly data is seen higher at 0.9% vs. the prior release of 0%. An incline in retail demand despite a monthly decline in price pressures indicates solid retail demand by households.

Gold technical analysis

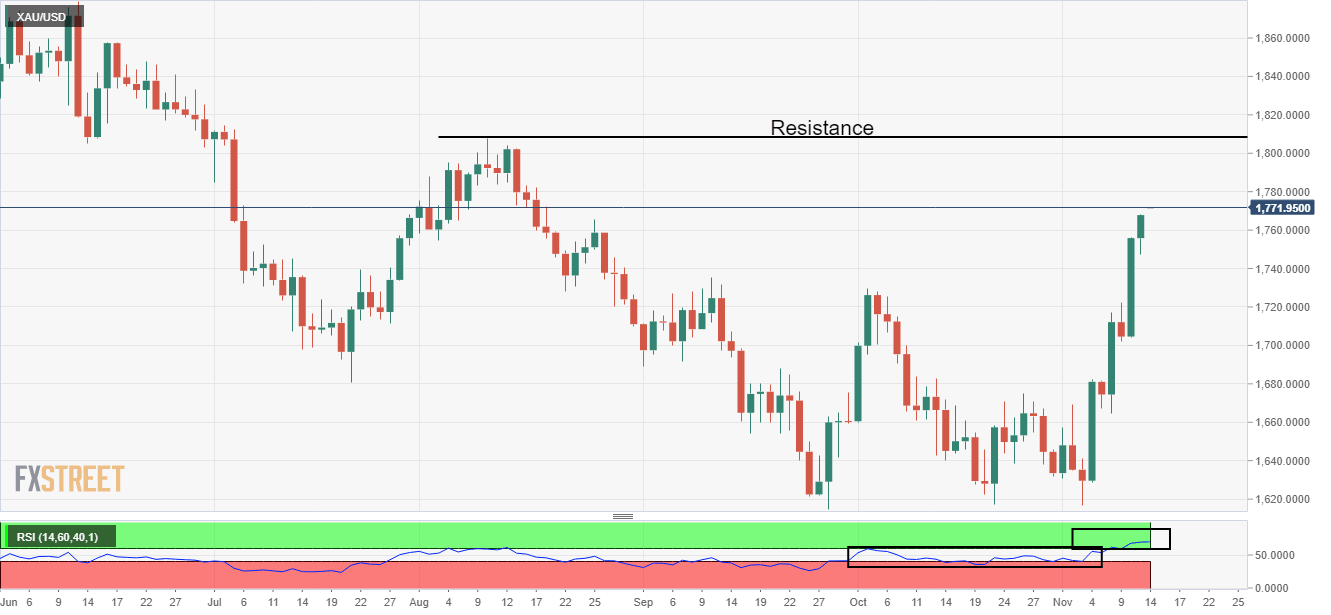

On a daily scale, the gold price is marching towards the horizontal resistance plotted from the August 10 high at $1,807.93. The Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which indicates that the gold bulls are playing the upside momentum.

Gold daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.