Gold Price Forecast: XAU/USD slides beneath $1,800 on DXY rebound ahead of Fed Minutes

- Gold price extends pullback from 61.8% Fibonacci retracement level as US dollar pares recent losses ahead of FOMC Minutes.

- Risk-off mood, downbeat China data also weigh on the XAU/USD prices.

- Second-tier US data, headlines surrounding the Fed, Inflation and recession will be important as well.

Gold price (XAU/USD) refreshes intraday low near $1,795 as a firmer US dollar weighed on the key asset during Monday’s Asian session. That said, the sour sentiment and catalysts from China join the market’s cautious mood ahead of this week’s Federal Open Market Committee (FOMC) meeting minutes to propel the greenback of late.

US Dollar Index (DXY) licks it wound around 105.75 as a risk-aversion wave underpins the greenback’s haven demand. Also keeping the greenback firmer is the Fed policymakers’ resistance to praising the recently softer inflation, as well as economic fears emanating from China and Europe.

Recently, China’s Retail Sales eased to 2.7% YoY in July versus 5.0% expected and 3.1% prior whereas Industrial Production (IP) edged lower to 3.8% during the stated month, from 3.9% prior and 4.6% market forecasts. During the previous week, China’s inflation numbers also eased for July, which in turn pushed the People’s Bank of China (PBOC) to cut the one-year medium-term lending facility (MLF) rates by 10 basis points (bps). China’s status as the world’s biggest user of commodities makes XAU/USD prices prone to news surrounding the dragon nation.

The economic fears are also present in Europe amid a steep decline in Russia’s energy exports to the old continent after the bloc sanctioned Moscow for its invasion of Ukraine.

During the weekend, news that many US lawmakers are visiting Taiwan after House Speaker Nancy Pelosi’s visit seemed to have raised fears of the US-China tension, which in turn weighed on the gold prices.

On the contrary, the news suggests that a probable meeting between US President Joe Biden and his Chinese counterpart Xi Jinping, as signaled by the Wall Street Journal (WSJ), could favor the risk-on mood. Also positive for the mood were headlines suggesting improved coronavirus conditions in China's financial hub Shanghai.

Elsewhere, softer prints of the US Consumer Price Index (CPI) and the Producers Price Index (PPI) managed to ease the market’s inflation fears. Even so, Richmond Federal Reserve (Fed) Bank President Thomas Barkin said on Friday that he wants to raise interest rates further to bring inflation under control. "I'd like to see a period of sustained inflation under control, and until we do that I think we are just going to have to move rates into restrictive territory," Barkin told CNBC, per Reuters.

While portraying the mood, the US 10-year Treasury yields remain pressured at around 2.83 after posting weekly losses by the end of Friday. Further, S&P 500 Futures print 0.25% intraday losses while Japan’s Nikkei 225 rises 2.65% on a day by the press time. It’s worth noting that Wall Street rallied on Friday.

Having tracked the risk catalysts earlier, gold traders may wait for Wednesday’s Fed Minutes for clearer directions. However, today’s NY Empire State Manufacturing Index for August, expected 8.5 versus 1.1 prior, may offer immediate directions.

Technical analysis

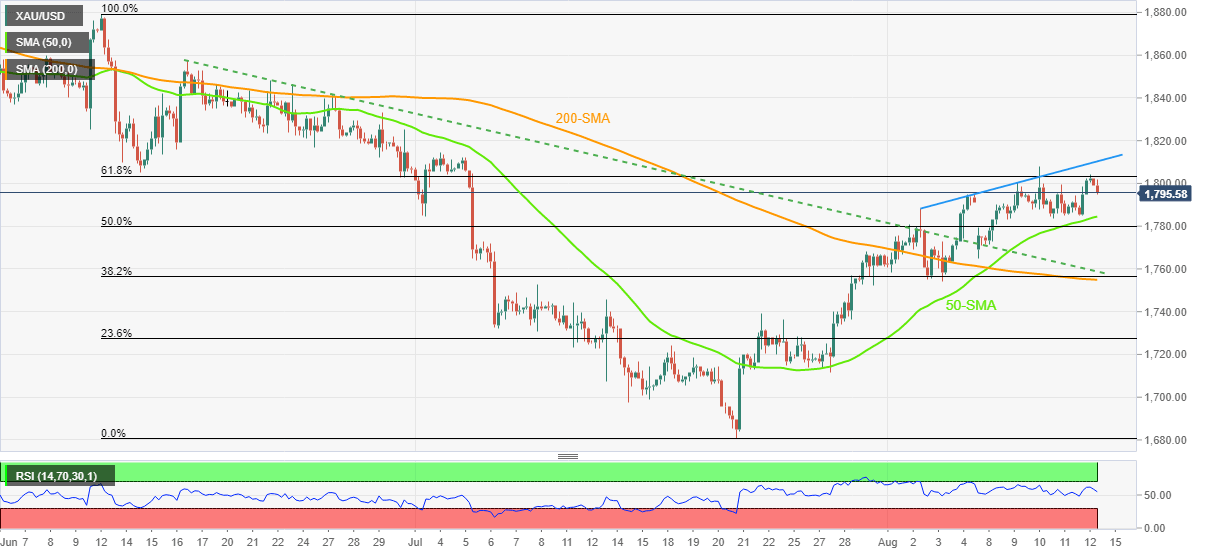

Gold price prints the biggest daily loss in over a week as it reverses from the 61.8% Fibonacci retracement of the June-July downturn. That said, the RSI (14) retreat also favors the XAU/USD’s latest weakness.

The pullback moves, however, need validation from the 50-SMA level surrounding $1,784 before directing gold sellers towards the previous resistance line from June 16, close to $1,760 by the press time.

It should be noted, however, that a convergence of the 200-SMA and 38.2% Fibonacci retracement level, near $1,754, appears a tough nut to crack for the metal sellers afterward.

Alternatively, an upside clearance of the 61.8% golden ratio, close to $1,805, might not be above to propel the XAU/USD prices as a fortnight-old resistance line near $1,811 acts as an extra filter to the north.

Gold: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.