- Gold Price remains bearish at five-month low, lacks momentum of late.

- Sustained trading below $1,900 upside hurdle, China woes underpin bearish bias about XAU/USD.

- August PMIs, US Durable Goods Orders and Jackson Hole Symposium will be in the spotlight for clear directions.

- Central bankers’ hesitance to welcome policy pivot can drag Gold Price further towards the south.

Gold Price (XAU/USD) remains on the back foot at the lowest level in five months as market players seek solace in the US Dollar amid uncertainty ahead of this week’s top-tier data/events. Also exerting downside pressure on the XAU/USD could be the pessimism surrounding one of the world’s biggest commodity users, namely China.

Although China announced a slew of measures to restore investor confidence, the Gold Price fails to pick up bids as concerns about the dragon nation’s economic health remain dicey. Also, looming geopolitical woes and trade war fears join the People’s Bank of China’s (PBoC) no change in five-year Loan Prime Rates (LPRs), despite cutting the one-year LPRs by 10 basis points (bps), exert downside pressure on the Gold Price. Furthermore, upbeat US Treasury bond yields and cautious mood keeps the XAU/USD sellers hopeful.

However, the indecision about the Fed Chair Jerome Powell’s monetary policy bias and the market’s wait for this week’s August month Purchasing Managers Indexes (PMIs), US Durable Goods Orders and the top-tier central bankers’ speeches at the annual Jackson Hole Symposium event puts a floor under the Gold Price.

Also read: Gold Price Forecast: XAU/USD eyes a firm rebound to 200 DMA again

Gold Price: Key levels to watch

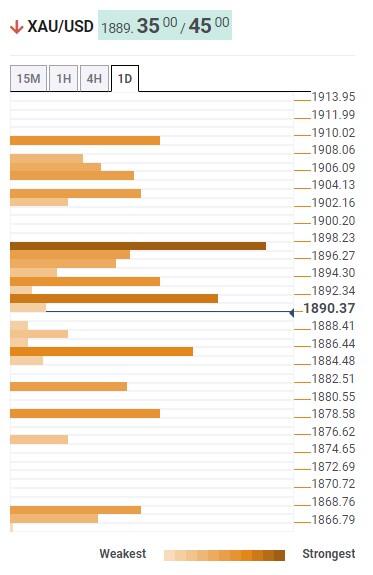

As per our Technical Confluence indicator, the Gold Price stays well beneath the $1,898 resistance confluence comprising Fibonacci 38.2% in one week, 100-SMA on one-hour and the previous daily high.

Adding strength to the downside bias is the XAU/USD’s sustained trading below $1,892 immediate hurdle including the Fibonacci 61.8% on one-day and the middle band of the Bollinger on the hourly play.

It’s worth noting that the convergence of the 10-DMA and Pivot Point one-week R1, close to $1,910, acts as the final defense of the Gold bears, a break of which could convince the buyers to return to the table.

Alternatively, the previous weekly low and Pivot Point one-day S1 puts a floor under the Gold Price near $1,885.

Following that, the $1,878 becomes a crucial support as it comprises the lower band of the Bollinger on the daily chart, as well as the Pivot Point one-week S1.

In a case where the Gold Price remains bearish past $1,878, the $1,865 support confluence, encompassing Pivot Point one-month S2, will be in the spotlight.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.