Gold Price Forecast: XAU/USD pulls back from two-week high as Fed’s decision looms

- Gold price hit a two-week high at $1937.35 before retreating to $1931.77, down 0.06%.

- US 10-year Treasury bond yield reaches a 16-year high at 4.367%, weighing on gold.

- Investors keenly await the Federal Reserve’s ‘dot plots’ and updated economic projections for rate hike clues.

Gold price retreats after hitting a two-week high at $1937.35 as investors remain on the sidelines ahead of the US Federal Reserve monetary policy decision. US Treasury bond yields are climbing ahead of the Fed’s decision, a headwind for the yellow metal, which was shy of clashing with the 100-DMA. At the time of writing, the XAU/USD is trading at $1931.77, down 0.06%.

Gold retreats as investors await the Federal Reserve’s monetary policy announcement, with rising US Treasury yields adding pressure

Wall Street continues to print losses, while the US 10-year Treasury bond yield touches a 16-year high at 4.367%. Tomorrow, Fed Chair Jerome Powell and his colleagues are expected to keep rates at the current 5.25%-5.50% range and to keep them higher for longer, at least until July 2024, as drawn by the Fed money market futures.

Even though the latest round of data showed that inflation has registered back-to-back upticks, the US central bank is set to skip a rate hike in September. According to the CME FedWatch Tool, odds for the November and December meeting had been lowered, suggesting that traders are not expecting additional rate hikes toward the end of 2023.

Although the Fed’s decision is important, market participants would be focused on the ‘dot plots’ to review the US central bank interest rate path. According to the latest Summary of Economic Projections (SEP), the Fed’s median estimates rates to peak at 5.6%. A confirmation could catch off guard interest rate traders, which expect rates to be capped at 5.50%.

In the meantime, the US Dollar Index (DXY) remains firm at around 105.14, gains 0.06%, underpinned by high US Treasury bond yields. The US 10-year Treasury note yields 4.367%, its highest level in 16 years, a headwind for Gold prices.

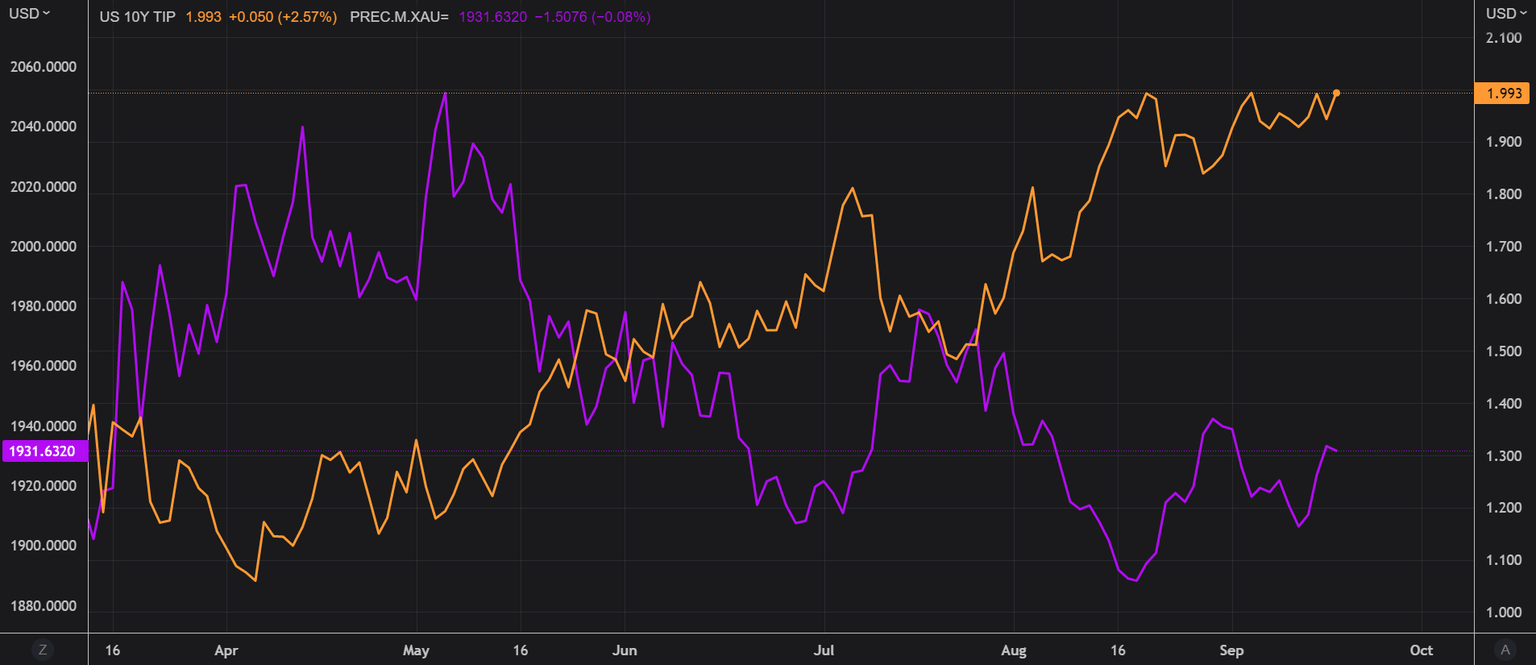

Meanwhile, Gold traders must also be aware of US Real yields, which could be followed using TIPS (Treasury Inflation Protected Securities) as a proxy. When the US 10-year TIPS coupon rises, XAU/USD’s price falls, as shown by the following chart, depicting the inverse correlation between the assets.

Source: Refinitiv

The US economic docket would feature the Fed’s decision on Wednesday, followed by US housing data, unemployment claims, and S&P Global PMIs.

XAU/USD Price Analysis: Technical outlook

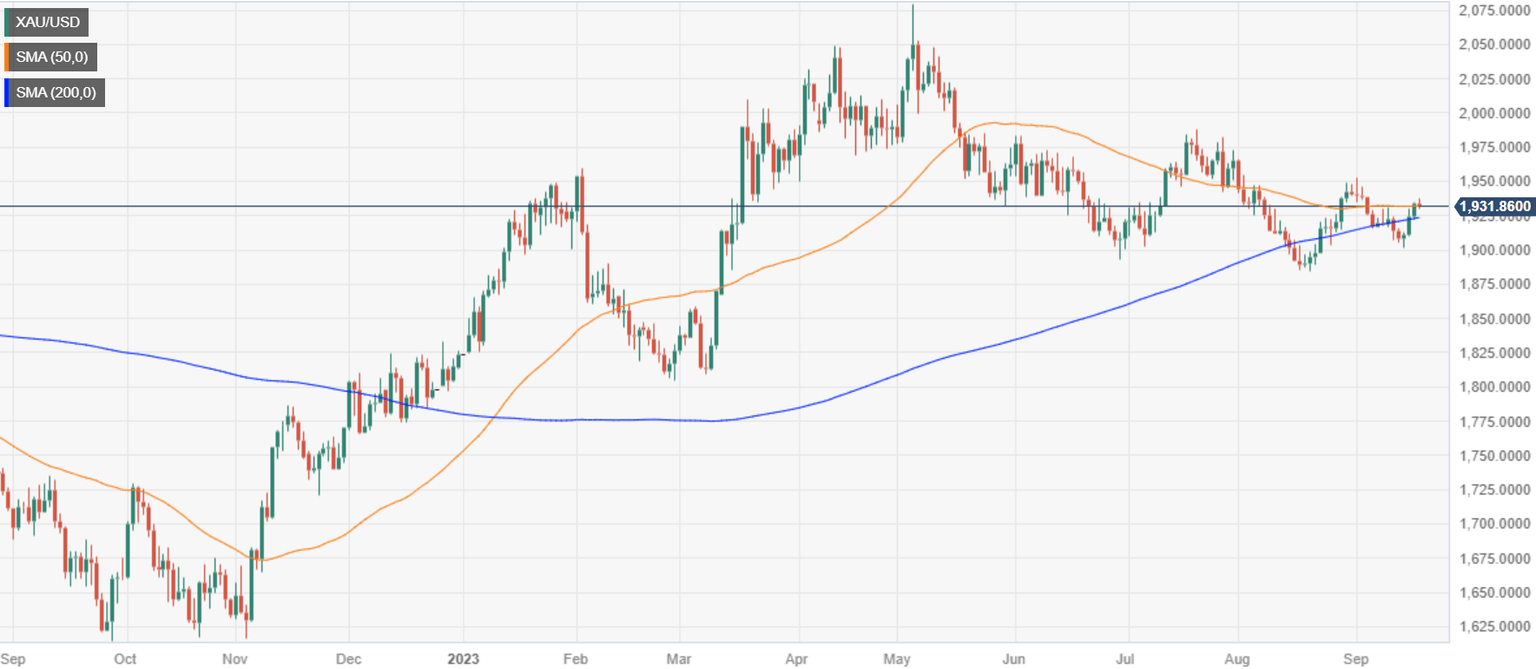

Gold trades sideways inside a descending triangle, cushioned on the downside by a confluence of daily moving averages (DMAs), and the 100-DMA acts as resistance at $1945.20. Although it recorded a higher low on September 14 at $1901.11, it has failed to print a higher peak above the July 20 swing high at $1987.42. If buyers want to shift the bias to neutral, they must reclaim the latter. Otherwise, a break below the confluence of the 20 and 200-DMA around $1924.00 could pave the way to challenge $1900, followed by the August 21 daily low of $1884.89

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.