- Gold price returns to the red, as the US dollar rebounds amid risk-aversion.

- Dwindling Russia-Ukraine peace talks sour mood, in the aftermath of Fed and BOE.

- Gold Price Forecast: XAU/USD bears have the upper hand below $1,960, or 38.2% Fibo.

With the Fed and the BOE policy meetings out of the way, the focus is back on the developments surrounding the Russia-Ukraine conflict. That said, peace talks between both sides are reportedly showing little progress, re-igniting risk-aversion. The US dollar is once again seeing fresh haven demand, which is exerting downward pressure on gold price. Additionally, the renewed upside in oil prices combined with the flattening of the yield curve is alarming markets, benefiting the dollar at gold’s expense.

Also read: AMC Stock Price: AMC Entertainment flat on Friday

Gold Price: Key levels to watch

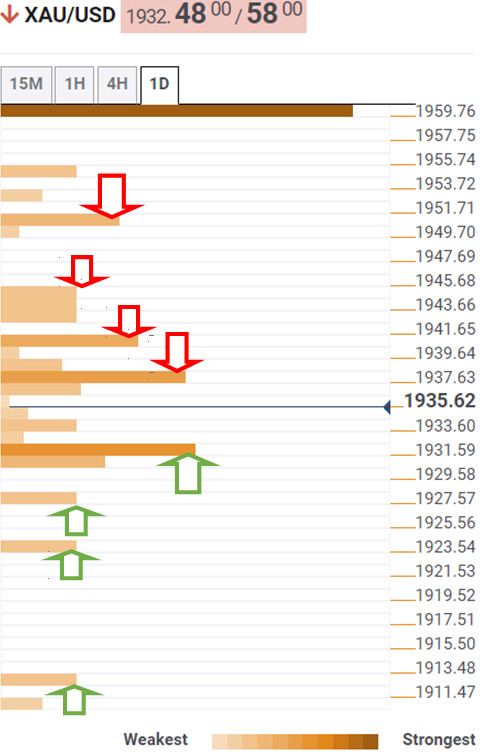

Having tested the $1,950 level, as well predicted here, gold price is now heading south, challenging strong support at $1,929, per the Technical Confluences Detector.

That level is the intersection of the Fibonacci 23.6% one-month and the previous low four-hour.

The next stop for gold bears is seen at $1,926, where the pivot point one-day S1 aligns. Further south, the previous day’s low at $1,923 will be back in focus.

A sustained drop below the latter will fuel a sharp sell-off towards the pivot point one-day S2 at $1,912.

Alternatively, if bulls regain control, then the immediate upside hurdle at $1,937 will be probed. At that level, the pivot point one-week S1 and the previous high four-hour coincide.

The next significant resistance is seen at the Fibonacci 38.2% one-day of $1,940, above which the confluence of the Fibonacci 23.6% one-day and SMA5 one-day at $1,945 will get tested.

Should the renewed upside pick up momentum, gold buyers will then look to threaten the previous day’s high at $1,950.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY trades below two-week top set on Thursday; looks to BoJ for fresh impetus

USD/JPY trades with a positive bias below the 143.00 mark as traders await the BoJ policy update before placing fresh directional bets. In the meantime, data published this Friday showed that Japan's Core CPI rose to a 10-month high in August and reaffirmed bets that the BoJ will hike interest rates again in 2024.

AUD/USD strengthens above 0.6800 on RBA-Fed policy divergence, eyes on PBoC rate decision

The AUD/USD pair trades on a stronger note near 0.6810 during the early Asian session on Friday. The uptick of the pair is bolstered by the softer US Dollar amid the prospects of further rate cuts by the US Federal Reserve this year. Later on Friday, the Fed’s Patrick Harker is set to speak.

Gold price holds steady near record peak amid bets for more Fed rate cuts

Gold price hovers near the all-time peak touched earlier this week amid a bearish USD and rising bets for more upcoming rate cuts by the Fed. Moreover, concerns about an economic downturn in the US and China further underpin the safe-haven XAU/USD.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.