Gold Price Forecast: XAU/USD looks set to regain $1,650 ahead of US PMI, Fed’s verdict

- Gold price bounces off five-week-old support line amid pullback in DXY, yields.

- Mixed concerns over Fed, sluggish session allow XAU/USD traders to brace for FOMC.

- Upbeat performance of Chinese equities adds strength to the recovery moves.

- US data, risk catalysts could entertain traders but bears stay hopeful.

Gold price (XAU/USD) grinds higher around $1,640 while snapping a two-day downtrend heading into Tuesday’s European session. In doing so, the yellow metal cheers the US dollar pullback, as well as sluggish Treasury yields, as traders brace for today’s US PMIs for October and Wednesday’s all-important Federal Open Market Committee (FOMC) meeting.

That said, the US Dollar Index (DXY) slides to 111.25 during the first loss-making day in four while the benchmark 10-year Treasury yields fade two-day uptrend by making rounds to 4.05% of late.

Recently softer US data and growing fears of recession recently raised concerns over how the Fed might announce the downshift to smaller hikes. “The safe-haven greenback got some support from overnight losses on Wall Street, but a rise in US stock futures and firmness in Asian stocks, led by China, scuppered that demand on Tuesday. Lower long-term US Treasury yields also removed a crutch for dollar strength,” stated Reuters.

Elsewhere, reports suggesting an increase in gold demand also underpin the XAU/USD run-up. “A report by the World Gold Council (WGC) showed the global gold demand in the third quarter rose 28% from the same period in 2021, bolstered by record buying by central banks, although there was a notable contraction in investment demand,” stated Reuters.

Given the market’s month-start consolidation, the gold price may witness further recovery. However, the moves should take clues from the October month’s ISM Manufacturing PMI and S&P Global Manufacturing PMI for the US ahead of the Fed’s meeting.

Technical analysis

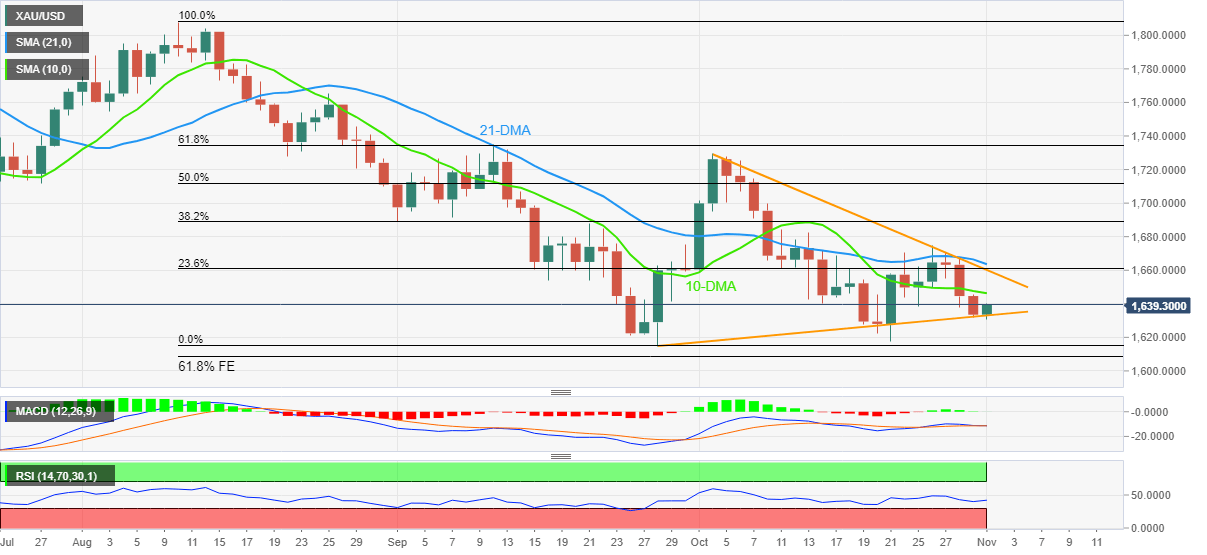

A five-week-old symmetrical triangle restricts short-term XAU/USD moves between $1,632 and $1662.

Given the quote’s latest rebound from the stated triangle’s support, backed by a steady RSI (14), the gold price may witness further advances toward the 10-DMA hurdle near $1,647.

It should be noted that the 21-DMA level surrounding $1,665 acts as an additional upside filter.

Meanwhile, a downside break of $1,632 could direct gold bears toward the yearly low near $1,614 before the 61.8% Fibonacci Expansion (FE) of the metal’s August-October moves, near $1,609, as well as the $1,600 round figure, could challenge the XAU/USD bears.

Gold: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.