Gold Price Forecast: XAU/USD holds steady, eyes recovery toward the 20/50-day EMA around $1930

- Gold price remains firm around $1920s, supported by falling US Treasury bond yields.

- Resilient US economic data justifies Fed’s tightening stance, but lower inflation numbers weigh on the greenback.

- Market awaits upcoming US economic data and FOMC meeting minutes for further direction on gold prices.

Gold price stays firm at around $1920s, after hitting a daily low of $1919.89 in a subdued trading session, as the European markets closed, while Wall Street stays shut off in the observance of US Independence Day. Falling US Treasury bond yields lent a lifeline to XAU/USD traders, eyeing to recover the $1950 area, though data from the United States (US) could increase demand for the greenback, a headwind for XAU’s prices.

Subdued trading and US economic data to determine XAU/USD’s path

Risk appetite improved throughout the overnight session amidst the lack of economic data, with the Reserve Bank of Australia’s (RBA) monetary policy decision being the highlight. The RBA’s kept rates unchanged, though opened the door for further tightening if needed. Aside from this, US economic data revealed during the last couple of weeks have shown the US economy’s resilience amidst 500 basis points of tightening by the Federal Reserve (Fed). June’s Durable Good Orders, Consumer Confidence, and Q1’s Gross Domestic Product (GDP) figure, improving with the latter almost doubling GDP preliminary reading of 1.1%, justified the Fed’s stance to lift rates.

However, inflation data, notably the Fed’s preferred gauge for inflation, the PCE and Core PCE numbers in June, edged lower. That weighed on the greenback, as the US Dollar Index (DXY), which tracks the buck’s performance vs. a basket of peers, dropped 0.42% on the data release but so far trimmed some of those losses, exchanging hands at 103.010, gains 0.03% on Tuesday.

US Treasury bond yields lacked the strength to rise further as investors brace for a Fed 25 basis point (bps) interest rate hike in July, as shown by the CME FedWatch Tool. Nonetheless, market participants remain reluctant to believe that Fed Chair Jerome Powell and his colleagues would increase the Federal Funds Rate (FFR) toward the 5.50%-5.75% range.

XAU/USD traders would get more cues about the non-yielding metal direction as the US economic agenda will remain busy. On Wednesday, Factory Orders and the latest FOMC meeting minutes would shed some light on the US central bank path. For Thursday and Friday, the ISM Services PMI and labor market data could increase volatility in the yellow metal. Upbeat figures will increase speculations for not just one but the two rate hikes mentioned by Powell at his latest public appearance.

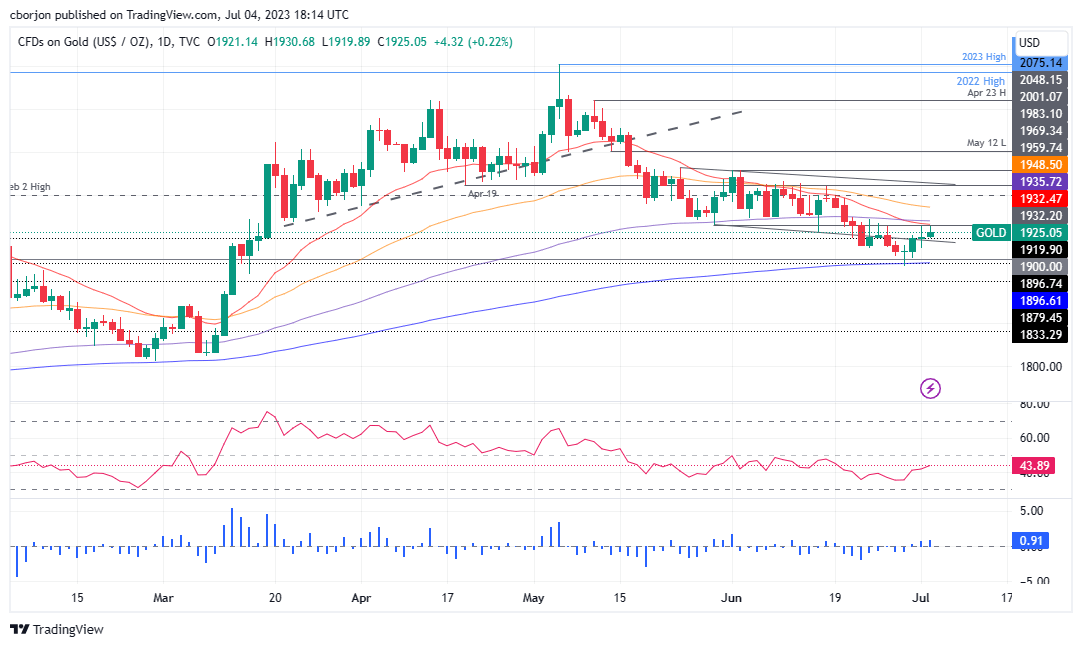

XAU/USD Price Analysis: Technical outlook

XAU/USD is neutral to downward biased, capped on the upside by the 20-day Exponential Moving Average (EMA) at $1932.48, which also intersects with the May 30 daily low of $1932.20. If XAU/USD would resume upwards, buyers must reclaim the previously-mentioned area in order to challenge the 50-day EMA at $1948.51, ahead of testing $1950. Conversely, if XAU/USD stays below the strong supply area around the $1932 region, sellers could drag prices toward the 200-day EMA at $1896.61, as the Relative Strength Index (RSI) remains at bearish territory.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.