Gold Price Forecast: XAU/USD downtrodden ahead of critical China PMIs

- Gold price extends the downside to test critical daily support.

- US dollar and US yields continue to press higher, weighing on gold.

- $1,680 is eyed in this regard as per the weekly chart.

- Update: Chinese data will be key as the markets scrutinise the nations' economic recovery.

Early Asia Update: Gold ended on Wall Street licking its wounds near the lows of the day of $1,721. There was little reprove for the yellow metal despite the risks associated with the US debt ceiling negotiations, as described below. Instead, the Federal Reserve narrative is propping up the US dollar and yields making for a problematic landscape for precious metals.

Meanwhile, the focus in Asia will be centred around the Chinese economy. China’s PMIs are out and so is China's power. While China’s government is planning to raise power tariffs to ease pressure on power plants, this would increase costs for manufacturing industries going forward, so future data will likely be more interesting. Nevertheless, data below 50, or below expansion territory, will be concerning for risk assets, especially the commodity complex which could further support the US dollar as a safe haven. Ultimately, this would be a risk for gold prices.

''Manufacturing sentiment is likely to continue to suffer from supply constraints, regulatory measures, and environmental policies this month,'' analysts at TD Securities argued. ''Additionally, a number of high-frequency indicators have continued to soften, indicating risks to the outlook. Services are likely to recover after stringent mobility restrictions hit domestic travel and consumer activities in August.''

End of update

The price of gold is in a firm downtrend for the month of September for which it is extending on Wednesday to a fresh low against the US dollar of $1,724.52 while losing some 0.5% on the day by the time of writing. The price fell from a high of $1,745.53 scored in London.

It is a US dollar story this week with the currency scoring a fresh 10-1/2-month peak against rival currencies as measured by the DXY index. Traders are getting set for a reduction in the US Federal Reserve's asset purchases by the end of the year and an interest rate hike that could come as soon as late next year.

However, not only that, the markets are in a state of flux over politics, both home and away with regards to an impasse in Washington over the US debt ceiling, Evergrande and China's economic outlook/(power crunch), as well as the risks to the global recovery from the Delta variant. The world's largest reserve currency, the US dollar, is seen as a safe haven bet at times of such uncertainties.

Moreover, a rise in energy prices and higher US Treasury yields are additional developments that have moved to the fore this week denting risk sentiment even further. Traders are also concerned the Fed will start to withdraw policy support just as global growth slows.

In this environment, global equities are having a hard time trying to stabilise on Wednesday but the benchmarks are up marginally in mid-day trade. The Dow Jones Industrial Average climbed 0.43% with the S&P 500 up by 0.36% and the Nasdaq that was down an hour ago, starting to recover from the lows and rising by 0.14% at the time of writing. Meanwhile, the dollar index DXY rose for the fourth consecutive day, to 94.358, its highest since Sep last year. It was last up 0.68% at 94.362.

US debt ceiling risks remain key focus

The move in the greenback comes despite US Senate Republicans on Tuesday blocking a bid by President Joe Biden's Democrats to head off a potentially catastrophic US credit default. Federal funding is due to expire on Thursday and the borrowing authority deadline is as soon as 18 Oct.

The House Democrat leaders remain far short of votes they need to pass an infrastructure bill. The Senate GOP is still blocking the Dems' ability to raising the debt limit on the floor and say it needs to be done through reconciliation. This leaves a grey cloud over the market's risk sentiment.

Further, a breakout in Treasury yields is weighing on precious metals, analysts at TD Securities have argued. ''In fact, weakening momentum signals are likely to catalyze a CTA selling program which could further weigh on the yellow metal.''

''Yet, price action has remained largely contained relative to that of Treasuries and real yields, reflecting a cleaner discretionary and trend-following positioning slate in gold which should keep any weakness from morphing into a rout.''

Additionally, the analysts at TD Securities explained that the ''evidence is increasingly pointing to 'stagflationary' forces — a narrative that continues to capture share of mind, as participants look to a period of high inflation and slowing growth, but this has yet to translate into additional interest for gold.''

Gold technical analysis

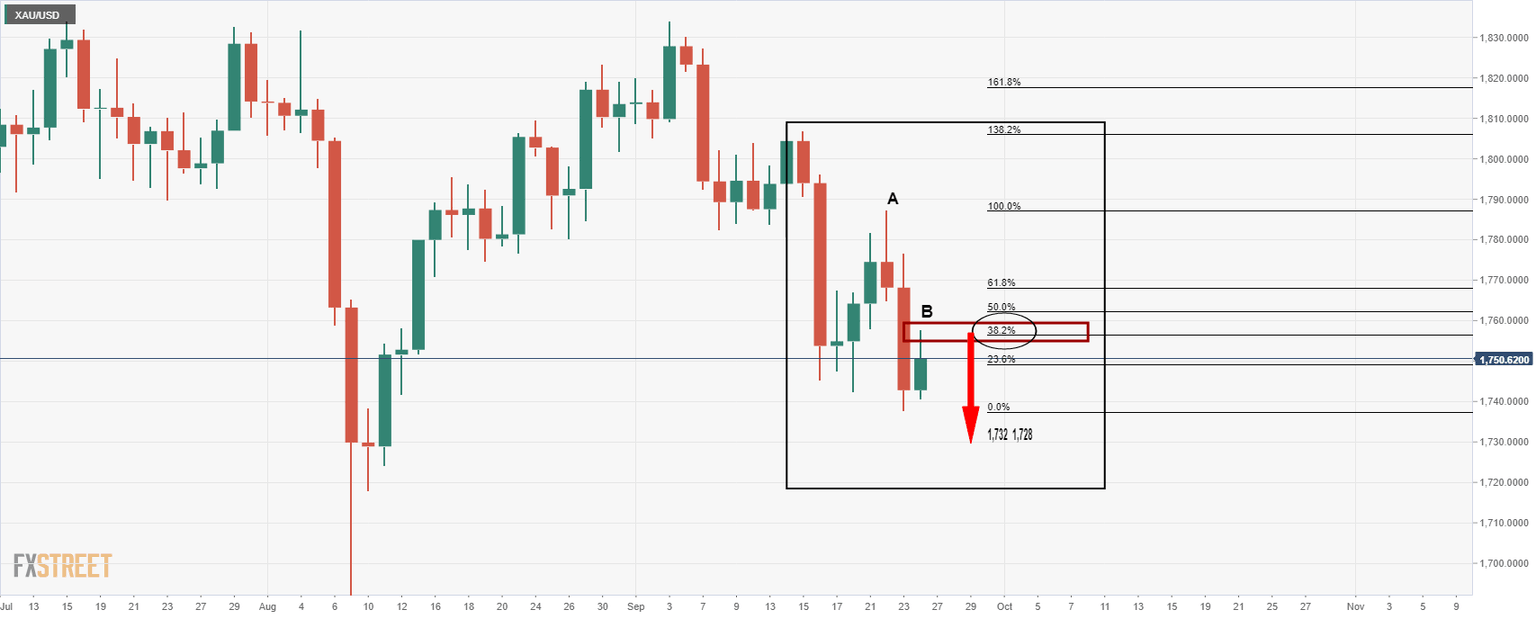

As per the start of the week's analysis, Gold, Chart of the Week: XAU/USD bearish bias forecast below $1,760, whereby targets that were based on Fibonacci retracements at $1,732 and $1,728 were illustrated, the price has indeed followed suit and even surpassing these on Wednesday by a handful of bucks:

Gold, daily chart, prior analysis

Gold, daily chart, live market

At this juncture, a daily bullish correction would be anticipated and based on current levels, the 38.2% Fibo retracement of the latest bearish impulse has a direct confluence of where the price might be expected to test. This comes in at an old support and 10 Aug highs, as illustrated in the chart below:

With that being said, the trend is strong and there are few signs of exhaustion, yet, which leaves further downside targets in play. $1,680 is eyed in this regard as per the following weekly chart.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.