Gold, Chart of the Week: XAU/USD bearish bias forecast below $1,760

- Gold is on a bearish path while below the 200 four-hour EMA.

- The monthly 61.8% Golden Ratio is eyed for the weeks ahead.

Gold has a compelling chart, especially from a top-down analysis that is presented below, offering a bearish bias in the main. We are in the last week of the month, and the markets are bracing for plenty of outcomes to critical market themes and events, which are sure to bring about volatility.

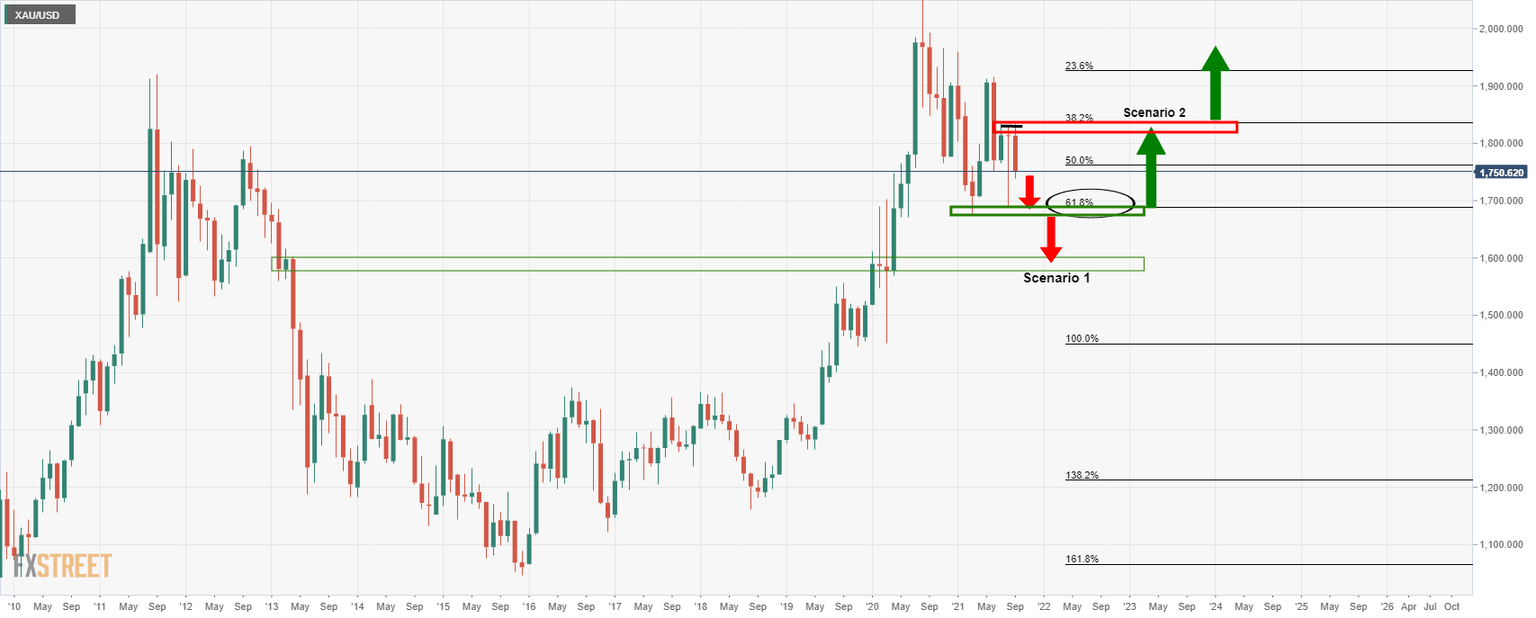

Gold monthly chart

From a monthly perspective, the price is en route to the 61.8% Fibonacci level at $1,690 in the last week of the month. A bearish close for September makes for a bearish continuation bias for October. In scenario 1, as illustrated on the chart above, the $1,600 level will be under pressure. In scenario 2, where the price is supported above the 61.8% ratio, the bulls will be seeking a break above $1,836 to put them back in control with $2,000 eyed once again.

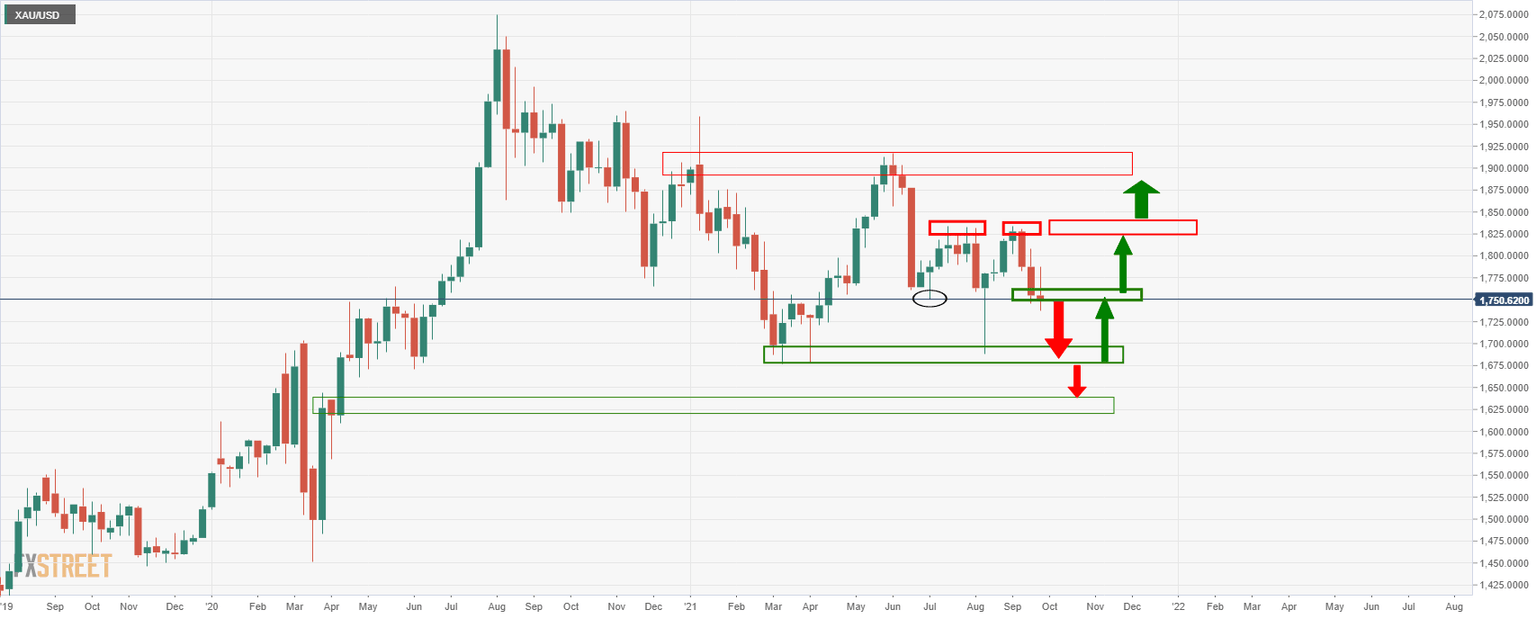

Gold weekly chart

From a weekly outlook, the price is being supported near July lows in the $1,750s. Looking to the left, the price has made a series of lower lows until the summer and autumn's double top highs near $1,830. A break below $1,750 opens risk to the $1,680s initially.

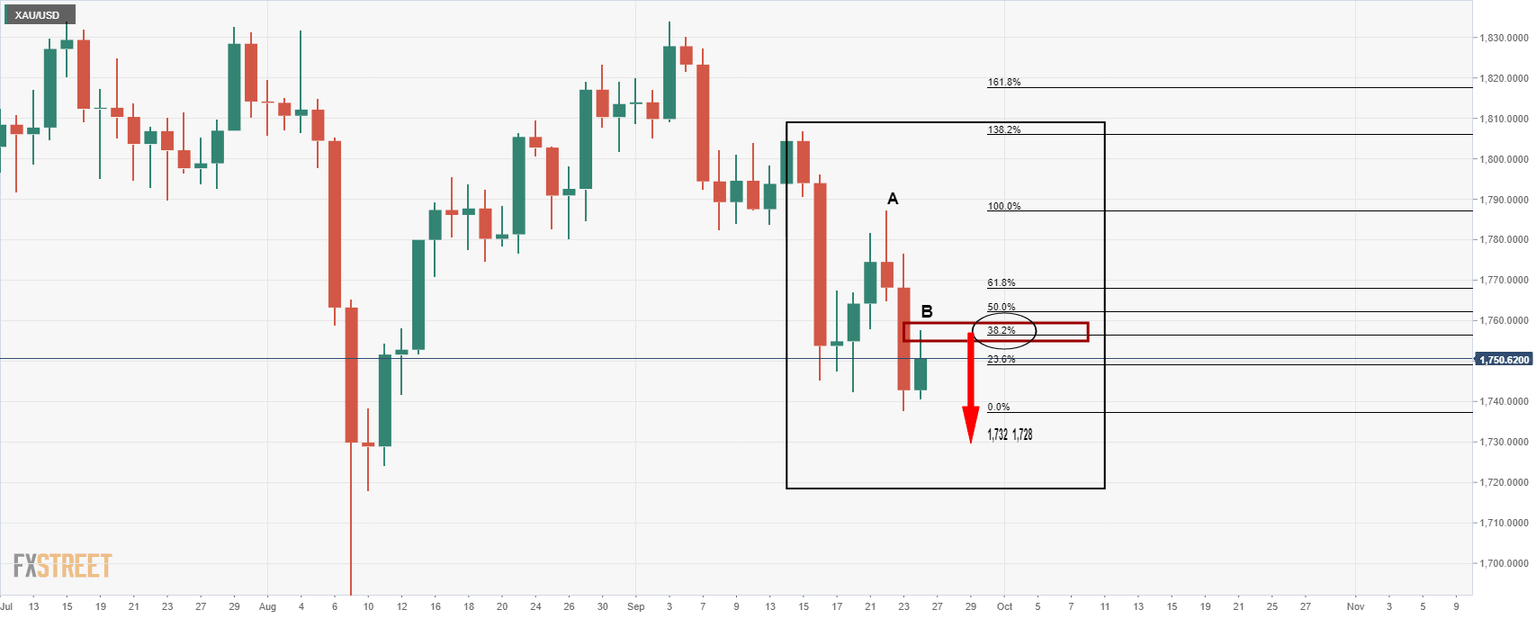

Gold daily chart

Looking at the daily chart, we are in the throes of a downside continuation and a test of the corrections as illustrated as A and B on the chart above. The targets are based on the Fibonacci retracements at $1,732 and $1,728 of the correction's range.

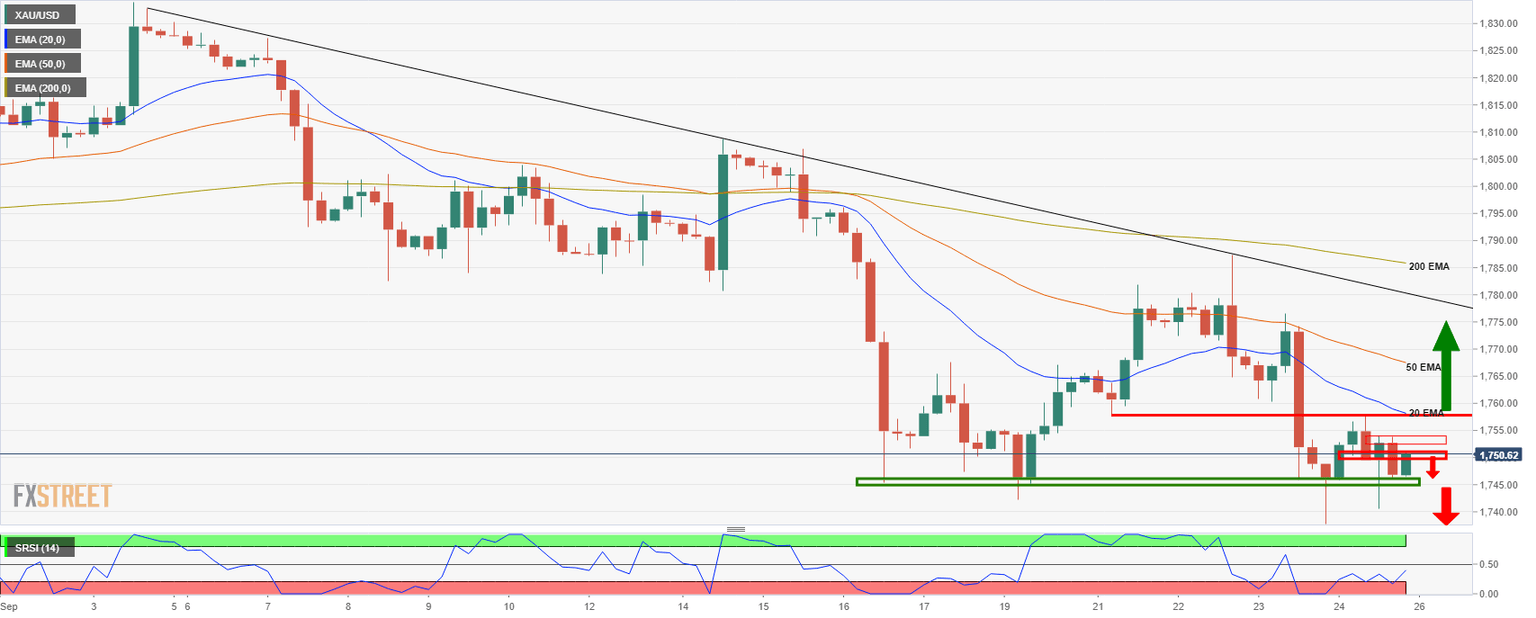

Gold 4-hour chart

From a 4-hour study, the price is in a bearish trend while below the 200 exponential moving average (EMA) and the divergence of the 50 and 20 EMAs. The price is attempting to retest the 20 EMA, which might play out a little longer. However, so long as the price remains below $1,760 and the RSI below 50, then the bias is to the downside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.