Gold Price Forecast: XAU/USD attempts a bounce towards $1,800 ahead of US data, Powell

- Gold prices stay pressured after breaking the two-month-old support line.

- Fed’s Powell, Omicron woes favor bears ahead of the key US data.

- US ADP Employment Change, ISM PMIs will join Fed’s Powell to propel market moves.

- Gold Price Forecast: At the risk of piercing the monthly low at 1,758.81

Update: Gold price is attempting a brief correction after falling to the lowest levels since November 4 at $1,770, as the dust settles in the aftermath of Fed Chair Jerome Powell’s hawkish tilt. Powell said that speeding up of tapering could be discussed at the upcoming Fed meeting, which shot the Treasury yields through the roof along with the US dollar. As a result, the non-yielding gold price as much as $30 before finishing the day at $1,771. Fears over the Omicron covid variant also bolstered the dollar’s haven demand, exacerbating the pain in gold.

Attention now shifts towards the US ADP Jobs data and Day 2 of Powell’s testimony for fresh trading cues. In the meantime, the covid updates and Fed sentiment will continue to play out.

Gold (XAU/USD) remains on the back foot around the monthly low, taking rounds to $1,771-73 during Wednesday’s initial Asian session.

The yellow metal dropped the most in a week to conquer two-month-old support the previous day while poking the lowest levels since November 04 amid sour sentiment. While tracing the clues, the varied opinion of the current vaccines’ ability to tame the South African strain for the coronavirus, dubbed as Omicron, joined comments from Federal Reserve (Fed) Chairman Jerome Powell could be termed as the key catalysts.

In his testimony on the CARES act before the Senate Banking Committee, Fed’s Powell said, “It is time to retire the term ‘transitory’ for inflation." The Fed boss also suggested the risk of more persistent inflation and signaled favor for discussing faster taper in the December meeting.

Elsewhere, Moderna’s Chief Stéphane Bancel weighed on the risk appetite earlier in Tuesday by saying, per the Financial Times (FT), “that existing vaccines will be much less effective at tackling Omicron than earlier strains of Covid-19 and warned it would take months before pharmaceutical companies can manufacture new variant-specific jabs at scale.” It should be noted, however, that representatives of Pfizer and Oxford tried placating market fears citing no such evidence supporting the fact that the current jab will not be able to contain the virus strain.

Talking about data, the US CB Consumer Confidence dropped to a nine-month low and housing numbers also came in softer, offering an intermediate relief to the gold prices. On the same line were comments from China’s Vice Premier Liu He who expects strong 2021 GDP for the dragon nation.

Against this backdrop, Wall Street benchmarks posted losses but the S&P 500 Futures print 0.40% intraday gains by the press time. Further, the US 10-year Treasury yields refreshed a two-month low before recently adding four basis points (bps) to 1.48%. Additionally, the DXY printed a four-day downtrend from the monthly high ahead of consolidating losses around 95.90.

With the early signals of Friday’s US Nonfarm Payrolls in the card, namely the US ADP Employment Change for November, market players may remain cautious ahead of the data given the latest hawkish comments from Fed’s Powell. Also important are the ISM PMI details for November and the second round of Powell’s testimony.

Overall, gold prices are likely to remain pressured as bears have already conquered the key support line and the risk appetite is weak of late.

Technical analysis

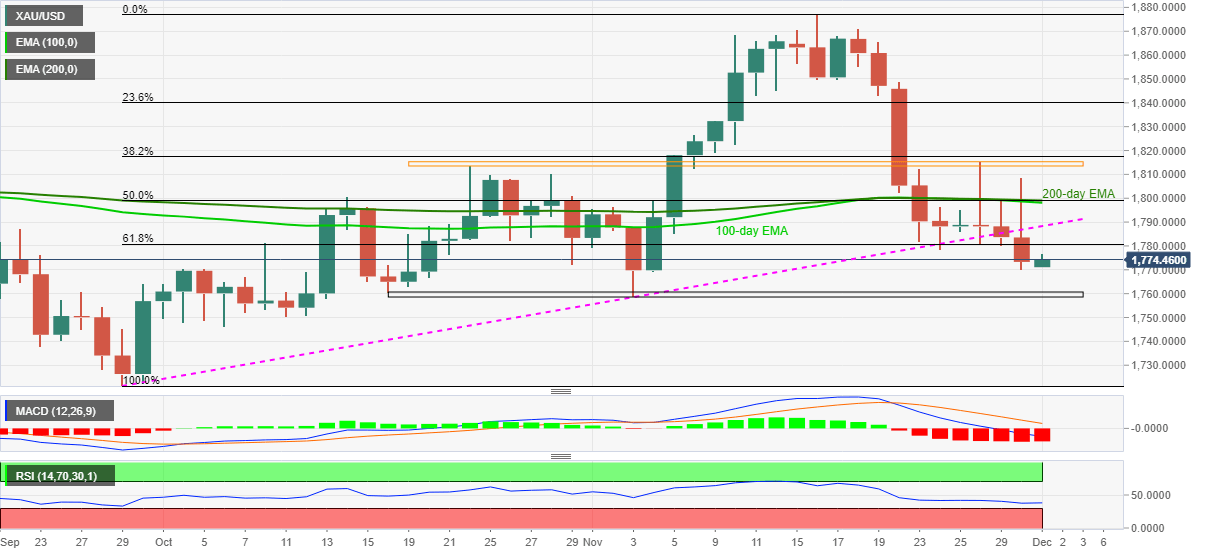

Gold sellers finally conquered two-month-old support following multiple days of breaking the key trend line, now resistance around $1,790.

The trend line breakdown joins bearish MACD signals and descending RSI line, not oversold, to hint at the metal’s further weakness towards a horizontal area comprising lows marked since October 18, around $1,760-59.

However, $1,747-46 may challenge the gold bears past $1,759, a break of which will make the quote vulnerable to test September’s swing low near $1,721.

Meanwhile, the confluence of 100-day and 200-day EMA, as well as 50% Fibonacci retracement (Fibo.) of September-November upside, around $1,800, becomes the key hurdle for the gold buyers to confront even if they manage to cross the previous support line figure of $1,790.

Should the gold prices rally beyond $1,800, buyers can target a five-week-long horizontal region around $1,815-17 and the mid-November lows near $1,850 before eyeing the last month’s peak of $1,877.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.