Gold Price Forecast: XAU/USD extends gains above $1,980 despite solid US activity backs hawkish Fed bets

- Gold price has stretched its recovery above $1,980.00 despite bets supportive of more rate hikes from the Fed.

- The US Preliminary Manufacturing PMI figure landed above 50.0 for the first time in the past six months.

- Gold price is struggling to defend the cushion from the lower portion of a Rising Channel chart pattern.

Gold price (XAU/USD) showed a recovery move from near the crucial support of $1,970.00 and has stretched its recovery above $1,980.00 in the early Asian session. The precious metal has rebounded after a sheer sell-off despite solid preliminary United States S&P PMI data released on Friday.

S&P500 ended mild positive on Friday as significant movements remained stock-specific due to the quarterly result season, portraying a quiet market mood. The US Dollar Index (DXY) has remained topsy-turvy, ranging in a tight boundary of 101.63-102.14 for the past four trading sessions. Meanwhile, the demand for US government bonds trimmed further as bets for one more rate hike remain solid. This has led to a further jump in US Treasury yields. The yields offered on 10-year US bonds jumped to near 3.57%.

On Friday, the preliminary S&P Manufacturing data jumped to 50.4 from the consensus of 49.0 and the former release of 49.2. The figure landed above 50.0 for the first time in the past six months. A recovery in manufacturing activities in spite of higher interest rates from the Federal Reserve (Fed) and tight credit conditions from US commercial banks supports further policy tightening. This also hints that demand for labor will remain extremely tight.

In addition, preliminary Services PMI jumped to 53.7 from the estimates of 51.5 and the former release of 52.6. An all-around strength in the US economic activities is backing the need for more rate hikes from the Fed.

Gold technical analysis

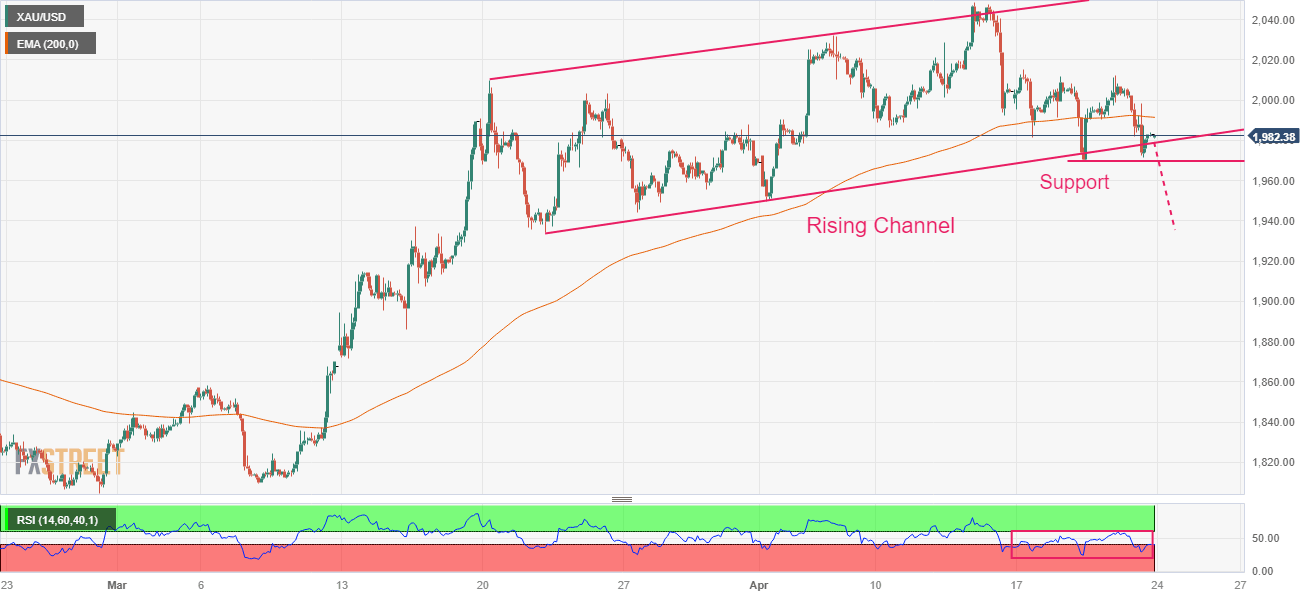

Gold price is struggling to defend the cushion from the lower portion of a Rising Channel chart pattern formed on a two-hour scale. The precious metal has shifted below the 200-period Exponential Moving Average (EMA) at $1,991.20, which indicates that the long-term trend has turned bearish. A slippage below the immediate support plotted from April 19 low at $1,969.26 will expose the asset to a fresh downside.

The Relative Strength Index (RSI) (14) has shifted its oscillation range into the 20.00-60.00 range indicating a bearish range shift.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.