Gold Price Forecast: XAU/USD dribbles below $1,820 despite China-linked optimism

- Gold prices struggle to cheer US dollar pullback aid firmer yields, fears of recession.

- US-China trade dialogue, hopes of easing Trump-era tariffs on China favor cautious optimism.

- US data, economic slowdown chatters could exert downside pressure on the metal if Fed Minutes appear hawkish.

Gold Price (XAU/USD) fades early Asian session strength, taking rounds to $1,810 after a downbeat start to the week during the pre-European session trading on Tuesday.

In doing so, the yellow metal prices portray the traders’ indecision even as the China-US dialogue appears to have favored the risk-on mood. That said, comments from Chinese Vice Premier Liu He suggests an improvement in the US-China trade ties, at least for now, which in turn favored the market sentiment previously. “The two agreed to need to strengthen communication & coordination of macroeconomic policies between China and the US,” said the macro update conveying telephonic talks between China’s Liu He and US Treasury Secretary Janet Yellen.

The recession fears recently took clues from Europe as Italy declared a state of emergency amid the worst drought in 70 years. Further, Germany also flashed signals of economic hardships as energy companies struggle to pay gas prices after the Russia-Ukraine crisis.

Elsewhere, strong US Treasury yields also hint at the market’s expectations of tighter monetary policies ahead, which in turn challenge the risk profile.

To sum up, the market’s cautious optimism fails to impress gold buyers, despite positing mild gains. Hence, today’s US Factory Orders for May, expected 0.5% versus 0.3%, as well as Wednesday’s Federal Open Market Committee (FOMC) Minutes and Friday’s US jobs report for June should be watched closely for clear directions.

Technical analysis

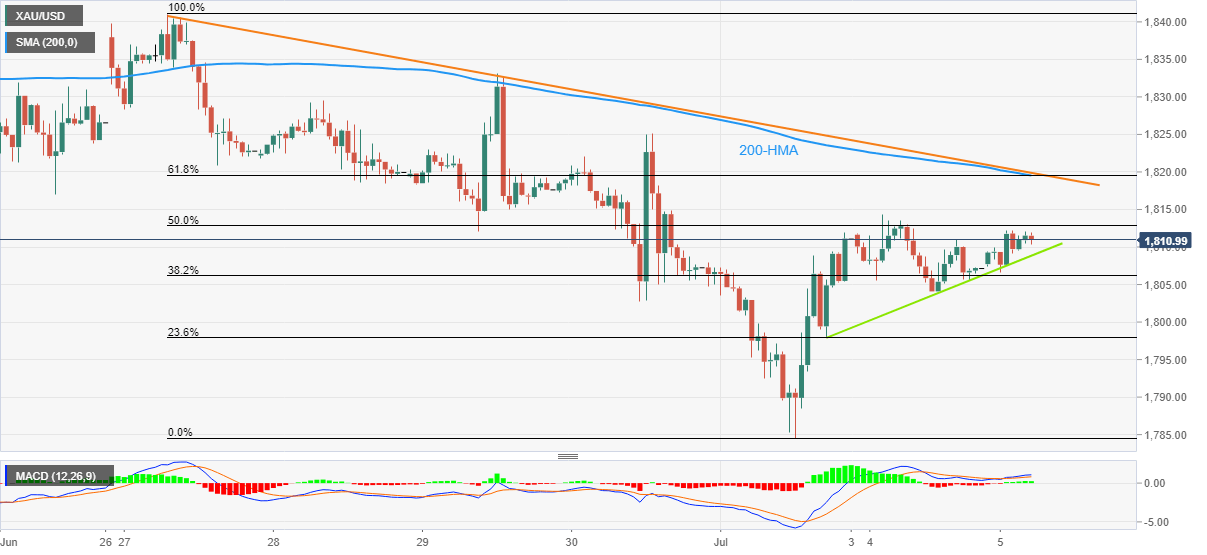

Gold Price grinds higher as the bullish MACD signals and sustained trading beyond the two-day-old support line keep buyers hopeful. However, repeated pullbacks from the 50% Fibonacci retracement of June 27 to July 01 downturn, around $1,813, tests the upside momentum.

Even if the quote manages to cross the $1,813 hurdle, a convergence of the 200-HMA, one-week-old descending trend line and 61.8% Fibonacci retracement level challenge the XAU/USD bulls around $1,820.

In a case where gold rises past $1,820, it can rally to the mid-June swing high near $1,857.

Alternatively, an immediate support line near $1,808 precedes the $1,800 threshold to restrict the short-term downside of the metal, a break of which could quickly drag the XAU/USD towards the recent swing low near $1,785.

Gold: Hourly chart

Trend: Limited recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.