Gold Price Forecast: XAU/USD defends key $1,900 support amid central bankers' call for higher rates

- Gold Price remains depressed at three-month low despite recent bounce off $1,900 support confluence.

- Multiple central bankers backed restrictive monetary policies at European Central Bank Forum but ruled out recession woes, favoring XAU/USD sellers.

- US Dollar cheers Federal Reserve Chairman Jerome Powell’s support to “higher for longer” rate expectations, weighing on the Gold Price.

- Fed Chair Powell’s speech, second-tier employment, activity and spending numbers eyed for clear XAU/USD direction.

Gold Price (XAU/USD) portrays a corrective bounce at the lowest level in three months, marked the previous day, as it renews its intraday peak around $1,910 amid early Thursday in Asia. In doing so, the XAU/USD consolidates the latest losses even as the central bankers defend the “higher for longer” rate bias and increasing odds of the tussles between the United States and China.

Gold Price stays bearish on central bankers’ hawkish tones

Gold Price remains on the bear’s radar, despite the latest consolidation, as major central bankers keep defending the restrictive monetary policies in their latest speeches at the European Central Bank (ECB) Forum on central banking in Sintra.

Firstly, Federal Reserve (Fed) Chairman Jerome Powell reiterated support for two rate hikes while ruling out the economic downturn as the most likely case. On the same line, ECB President Lagarde stated that they still have ground to cover and also added, “If the baseline stands, we know we will likely hike again in July.” Further, Bank of England (BoE) Govern Andrew Bailey showed readiness to do what is necessary to get inflation to target.

It’s worth noting, however, that Bank of Japan (BoJ) Governor Kazuo Ueda appeared as an exception at the ECB Forum on central banking as the policymaker defended the dovish bias while saying, “(There is) still some distance to go in sustainably achieving 2% inflation accompanied by sufficient wage growth.”

Apart from the hawkish central bankers, fears of the US-China tension and challenges for the ECB hawks, amid recession woes and mixed bias of the policymakers at home, also facilitate the XAU/USD’s downside.

That said, ECB policymaker Mario Centeno and US Treasury Secretary Janet Yellen recently offered more clues to favor the Gold bears but failed to gain major attention.

ECB’s Centeno said, per Reuters “We are reaching the time when monetary policy may pause”. On the other hand, US Treasury Secretary Yellen recently flagged mixed concerns about the US-China ties by suggesting a visit to Beijing but showed readiness to defend US interests.

Furthermore, the upbeat outcome of the US Banking Stress Test adds strength to the bearish bias surrounding the Gold Price.

The Fed's ‘stress test’ exercise showed lenders, including JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Morgan Stanley and Goldman Sachs, have enough capital to weather a severe economic slump, paving the way for them to issue share buybacks and dividends,” reported Reuters.

Against this backdrop, S&P500 Futures print mild gains even after Wall Street closed mixed and yields remained sidelined after falling the previous day. Further, the US Dollar Index (DXY) snapped two-day downtrend and refreshed the weekly top on Wednesday, which in turn exerts downside pressure on the XAU/USD.

More proofs of higher rates need to convince XAU/USD bears

While the aforementioned catalysts are enough to convince the Gold sellers, fresh short positions may need more proof of the higher rates across the board, as well as of the US-China tussle and economic pessimism ex-US.

With this, today’s speech of Federal Reserve Chairman Jerome Powell in Madrid, as well as the US Weekly Initial Jobless Claims and Germany’s preliminary inflation data for June, will be eyed closely for clear directions.

Also read: Gold Price Forecast: XAU/USD extends its weekly slide and flirts with $1,900

Gold Price Technical Analysis

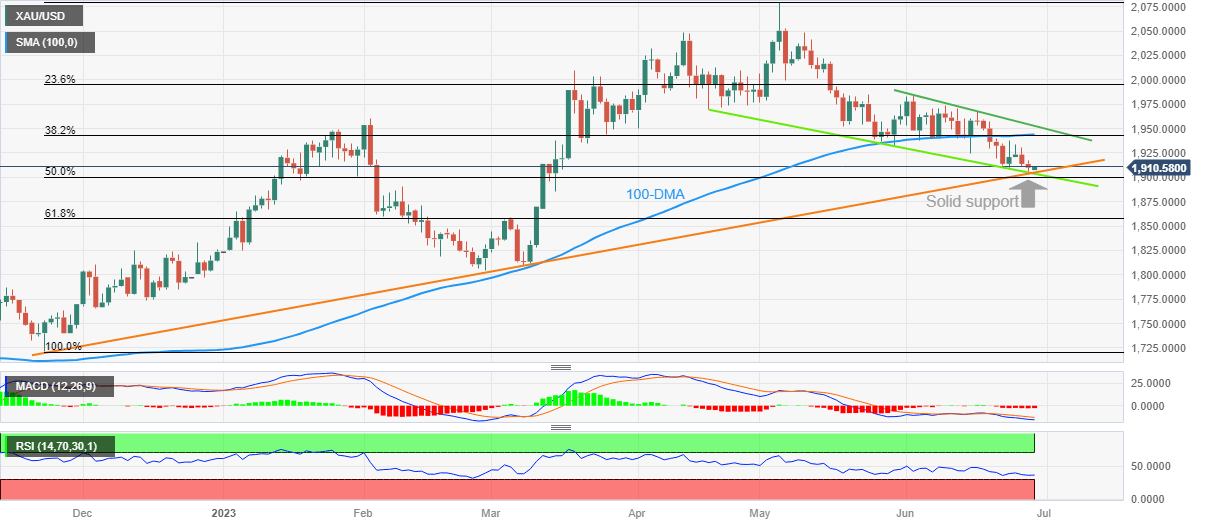

Gold Price languishes at the lowest levels in 3.5 months as bears attack the $1,900 support confluence comprising an upward-sloping trend line from late November, a six-week-old falling support line and the 50% Fibonacci Retracement of November-May upside.

That said, the metal’s sustained downside break of the 100-DMA joins the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator to keep the XAU/USD sellers hopeful.

However, the below 50.0 levels of the Relative Strength Index (RSI) highlights the need for consolidation in the Gold Price during the further south run.

It’s worth noting that an area comprising February 09 swing high and the mid-March bottom, around $1,890-85, acts as an additional downside filter for the XAU/USD.

Following that, the Gold Price fall towards the 61.8% Fibonacci retracement level surrounding $1,857 can’t be ruled out.

Meanwhile, the XAU/USD’s recovery remains elusive below the $1,943-44 resistance comprising the 100-DMA and the 38.2% Fibonacci retracement.

Also likely to challenge the short-term Gold Price upside is a descending resistance line from June 02, near $1,955 at the latest.

Overall, Gold Price is likely to stay bearish but the downside appears long and bumpy.

Gold Price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.