Gold Price Forecast: XAU/USD declines towards $1,900 as spotlight shifts to Fed Powell’s speech

- Gold price is declining towards the $1,900.00 support ahead of Fed Powell’s speech.

- Investors are cautious that hawkish remarks from Jerome Powell would propel fears of a recession in the US economy.

- Gold price has tumbled to near the 61.8% Fibonacci retracement at $1,909.00.

Gold price (XAU/USD) has challenged the crucial support of $1,910.00 in the London session. The precious metal is declining towards the psychological support of $1,900.00 as investors are expecting hawkish interest rate guidance from Federal Reserve (Fed) chair Jerome Powell.

S&P500 futures have posted decent losses overnight as investors are cautious that hawkish remarks from Jerome Powell would propel fears of a recession in the United States economy. According to HSBC Asset Management the US will enter a downturn in the fourth quarter, followed by a “year of contraction and a European recession in 2024.

The US Dollar Index (DXY) is struggling to sustain above the critical resistance of 102.60 despite the market mood has turned cautious. It is highly likely that Fed Powell would stick to the guidance delivered earlier that the central bank will hike interest rates at a ‘careful pace’. San Francisco Fed Bank President Mary Daly suggested that two more rate hikes this year is a “very reasonable” projection.

Meanwhile, the US Durable Goods Orders data (May) also remained resilient despite tight monetary policy by the Fed. The economic data expanded by 1.7% while the street was anticipating a contraction of 1%. May’s Durables data has outperformed April’s figure of 1.2%.

Gold technical analysis

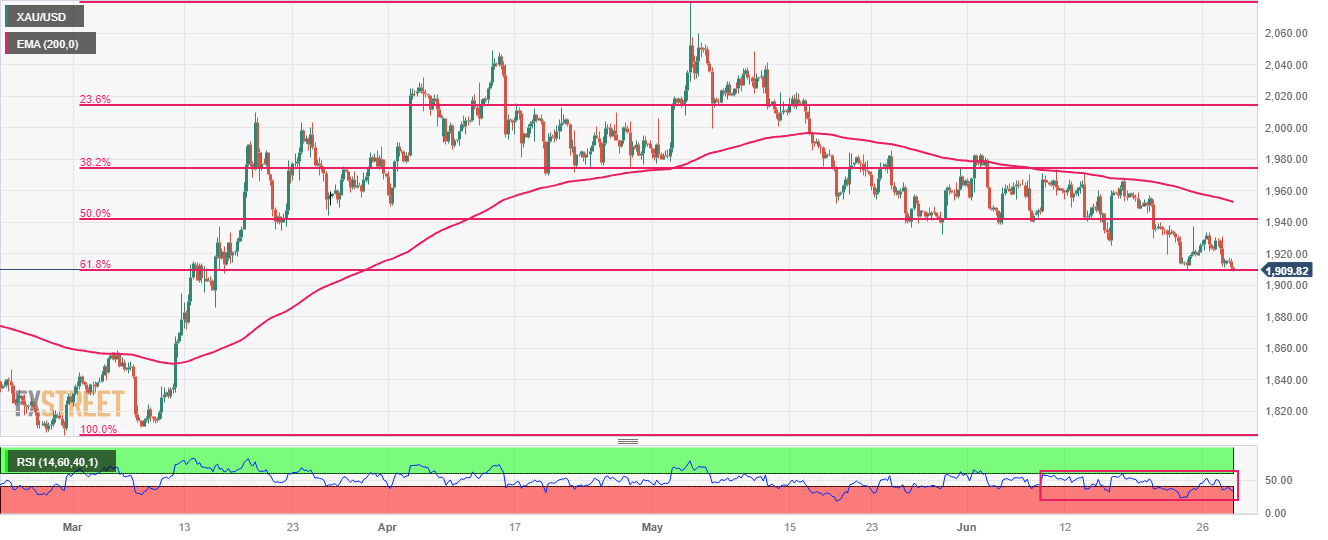

Gold price has tumbled to near the 61.8% Fibonacci retracement (plotted from February 28 low at $1,804.76 to May 03 high at $2,079.76) at $1,909.00 on a four-hour scale. Downward-sloping 200-period Exponential Moving Average (EMA) at $1,952.74 indicates that more downside is in the pipeline.

The Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-60.00, which indicates that the downside momentum is active.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.