Gold Price Forecast: XAU/USD clings to minuscule gains after US inflation report

- Gold price surged from its lows of around $1913.02 after US inflation data.

- The July inflation report revealed a 3.2% YoY rise in CPI, below forecasts and June’s 3%.

- Core CPI, which strips out volatile items, climbed by 4.7% YoY – a tad below expectations and 4.8% from the prior month.

Gold price advances more than 0.20% following an inflation report from the United States (US) showing that prices are getting lower, easing pressure on the US Federal Reserve (Fed), which has been increasing rates to bring inflation towards its 2% target. Hence, XAU/USD jumped from its daily lows of $1,913.02, exchanging hands at $1,920.00 a troy ounce.

XAU/USD reacts positively as US inflation data eases, prompting speculation on the Fed’s forward monetary policy

Gold extended its gains early in the day but is trimming some of those after the greenback recovers some ground as US Treasury bond yields advance. The latest inflation report for July in the US showed the Consumer Price Index (CPI) jumping by 3.2% YoY, below estimates and exceeded June’s 3% dip. Core CPI for the same period rose by 4.7% YoY, less than estimates, and the prior month by 4.8%.

Initially, the data bolstered XAU/USD towards the $1930 area; since then, XAU/USD has extended its losses, as the 10-year benchmark note peaks at 4.047%, gaining one and a half basis points (bps).

Other data revealed by the US Bureau of Labor Statistics (BLS), portrayed the labor market easing after Initial Jobless Claims for the week ending July 29 exceeded forecasts of 230K, advanced 248K.

After the data, traders slashed bets the Fed would raise rates again, as shown by money market futures. The CME FedWatch Tools portrays the chances for a rate hike in September below 10%, while for the November meeting, it dropped to 23.6% from 33.8% a month ago.

The San Francisco Fed President Mary Daly recently stated that CPI data was good news. Still, the July report did not imply Fed’s victory n inflation, while stressing she’s data dependent and supported the last month’s Fed rate hike. She pushed back against easing monetary conditions, saying there’s a “long way from a conversation about rate cuts.”

XAU/USD Price Analysis: Technical outlook

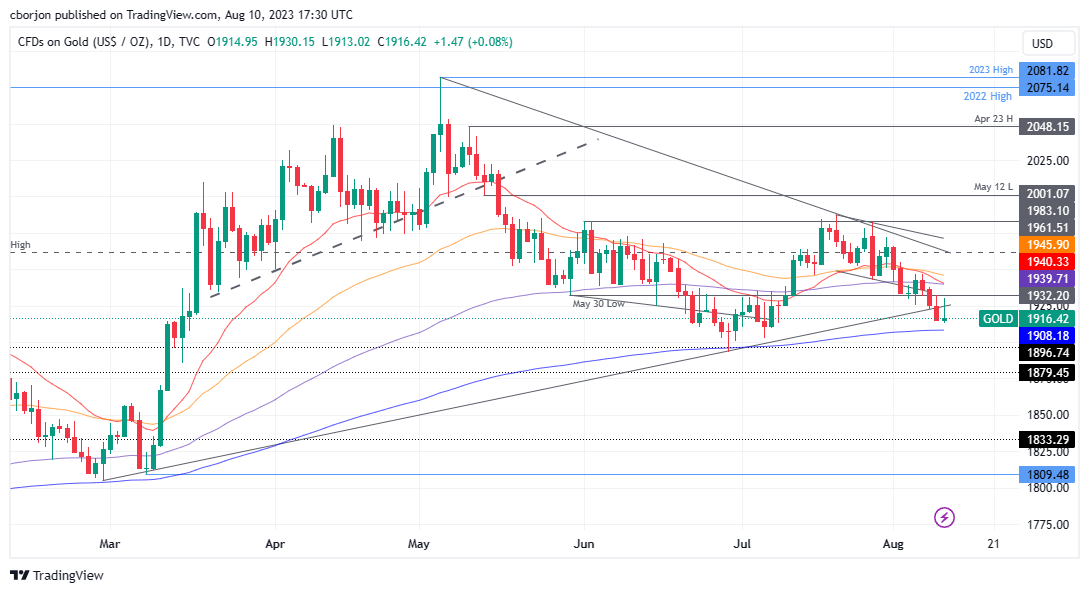

From a technical standpoint, the XAU/USD remains neutrally biased but set to extend its losses toward the $1900 psychological figure. Still, first, it would need to crack the 200-day Exponential Moving Average (EMA) at $1908.19. A breach of the daily low of $1913.02 would expose the latter, followed by the former. At that point, XAU/USD would shift bearish, and it might extend its losses to test June’s low of $1893.12, ahead o diving toward the March 6 high turned support at $1858.33. Conversely, XAU/USD’s reclaiming $1932.36 could open the door to test the confluence of the 100 and 20-day EMAs, each at $1939.75 and $1940.49.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.