Gold Price Forecast: XAU/USD clings to 29-month bottom near $1,650, focus on Ukraine, Fed’s Powell

- Gold price remains sidelined after refreshing the multi-year low.

- Fears emanating from central banks, Ukraine weigh on XAU/USD.

- Italy’s elections, downbeat EU data versus firmer US numbers also favor gold sellers.

- Risk catalysts, Fed Chair Powell’s speech will be eyed for corrective bounce.

Gold price (XAU/USD) licks its wounds at a two-year low, around $1,645 during Monday’s Asian session, as bears take a breather after the biggest daily fall in a week ahead of the key catalysts. Also testing the metal prices could be the mixed headlines surrounding Europe and Russia. Even so, the bears remain hopeful amid the broad rush to risk safety.

A corrective pullback in the sentiment could be observed in Germany’s ability to get a gas deal from Abu Dhabi, as well as in the absence of any immediate reaction from Russia to the Group of Seven (G7) chatters to muster courage against Moscow. A holiday in New Zealand and a light calendar in Asia also recently allowed the XAU/USD bears to take a breather.

During the last week, strong US PMIs, the downbeat activity numbers from the bloc and Russia’s fierce warning to the West, as well as the Group of Seven (G7) leaders’ readiness to counter Moscow with sanctions weighed on the gold price. Additionally, hawkish central bankers and fears of recession also weighed on the market sentiment and drowned the XAU/USD.

That said, the first readings of September month S&P Global PMIs suggested that the European economy slipped further into contraction, hurt by soaring energy prices. German Services PMI dropped to the two-year low while its counterpart for Europe tested the lowest levels in 19 months. Further, Manufacturing PMIs slumped to the lowest in 20 months. US S&P Global PMIs, on the other hand, were encouraging as the Manufacturing gauge rose to 51.8 from 51.5, while its services counterpart recovered from 44.6 to 49.3 for September.

Elsewhere, Fed Chairman Jerome Powell said on Friday, “We are committed to using our tools.” Following him, Fed Vice Chair Lael Brainard mentioned that inflation is very high and is hitting low-income families ‘hard’. During the weekend, Atlanta Federal Reserve President Raphael Bostic said that he still believes the central bank can tame inflation without substantial job losses given the economy's continued momentum, reported Reuters while quoting the Fed policymaker’s interview on CBS' "Face the Nation".

Recently, Ukraine President Zelenskiy was last heard saying that maybe ''Putin's nuclear threats were a bluff, but now, it could be a reality'' as per a CBS interview. Meanwhile, the United States warned of "catastrophic consequences" if Moscow were to use nuclear weapons in Ukraine after Russia's Foreign Minister said regions holding widely-criticized referendums would get full protection if annexed by Moscow.

Against this backdrop, Wall Street closed in the red and US Treasury yields climbed while the US Dollar Index (DXY) also refreshed the multi-year top. That said, S&P 500 Futures print mild losses at the latest.

Looking forward, Italy’s election results and a speech from European Central Bank (ECB) President Christine Lagarde will be important to watch for intraday moves. However, major attention will be given to the Ukraine-Russia tussles, speeches from Fed Chair Powell and US Durable Goods Orders for clear directions during the week.

Technical analysis

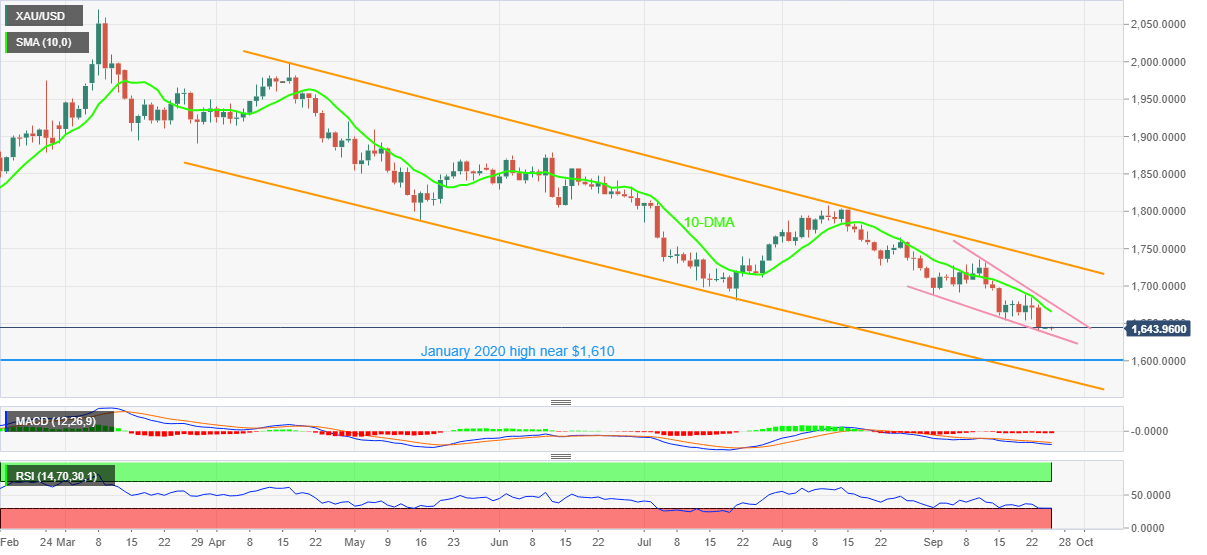

A three-week-old descending support line, currently around $1,635, restricts immediate gold price downside near the multi-month low. The corrective bounce, or at least a pause in further downside, also takes clues from the oversold RSI (14).

However, the 10-DMA and a downward sloping resistance line from September 13, respectively around $1,665 and $1,677, could restrict the immediate recovery of the XAU/USD prices.

Following that, the upper line of the five-month-old bearish channel, around $1,735 by the press time, will be crucial to watch for the metal buyers.

Alternatively, a downside break of $1,635 immediate support could quickly drag gold towards the early 2020 peak surrounding $1,610 before directing the bears to the aforementioned channel’s support line, close to $1,580 at the latest.

Gold: Daily chart

Trend: Corrective bounce expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.