Gold Price Forecast: XAU/USD buyers approach $1,750 as markets brace for US NFP

- Gold Price extends the previous day’s corrective pullback from yearly low.

- Softer yields offer extra strength to buyers, by exerting more downside pressure on USD.

- Sentiment improves as recession fears ebb on absence of major fresh catalysts, China news.

- Technical details also add strength to the recovery moves ahead of the key US data, Biden’s meeting on China tariff.

Gold Price (XAU/USD) cheers the US dollar pullback from a nearly two-decade high to extend the recovery moves towards $1,750 during Friday’s Asian session. That said, the metal renews its intraday high near $1,745 by the press time.

US Dollar Index (DXY) drops 0.20% while portraying the market’s preparations for today’s US jobs report. Also weighing on the greenback’s gauge versus the six major currencies is the improvement in the risk profile amid repeated comments from the major central bankers and efforts to tame recession fears, not to forget headlines concerning China. It’s worth mentioning that Thursday’s Doji candlestick at the multi-year high joins the overbought RSI to also weigh on the DXY.

That said, CEO of the Federal Reserve Bank of St. Louis, James Bullard stated, per Reuters, “We've got a good chance at a soft landing.” Additionally, Federal Reserve Governor Christopher Waller said inflation is way too high and does not seem to be easing and the Fed has to apply a more restrictive policy.

On other hand, US President Joe Biden is up for a meeting with his senior advisors on Friday to determine the tariff policy on China. Previously, diplomats from the US and China signaled a personal meeting after the latest virtual trade talks witnessed progress. With this, Beijing is optimistic that it can help ease the US its inflation problem by solving the supply-chain riddle, the same gained fewer accolades from the experts though. Also relating to China is the dragon nation’s readiness for $220 billion of stimulus with unprecedented bond sales, per Bloomberg.

Mixed data from the US also weighed on the DXY as US Initial Jobless Claims rose by 4,000 to 235,000 in the week ending July 2, versus 230,000 expected. With this, the 4-week moving average number was 232,500, up 750 from the previous week's average. Further, the US goods and services deficit narrowed by $1.1 billion to $85.5 billion in May, marking the smallest monthly deficit in 2022.

Amid these plays, the US 10-year Treasury yields fade the two-day rebound while the S&P 500 Futures remain directionless at the latest.

Moving on, updates from Biden’s meeting on China tariffs will join the US employment data for June to direction short-term Gold Price moves.

Also read: US June Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

Technical analysis

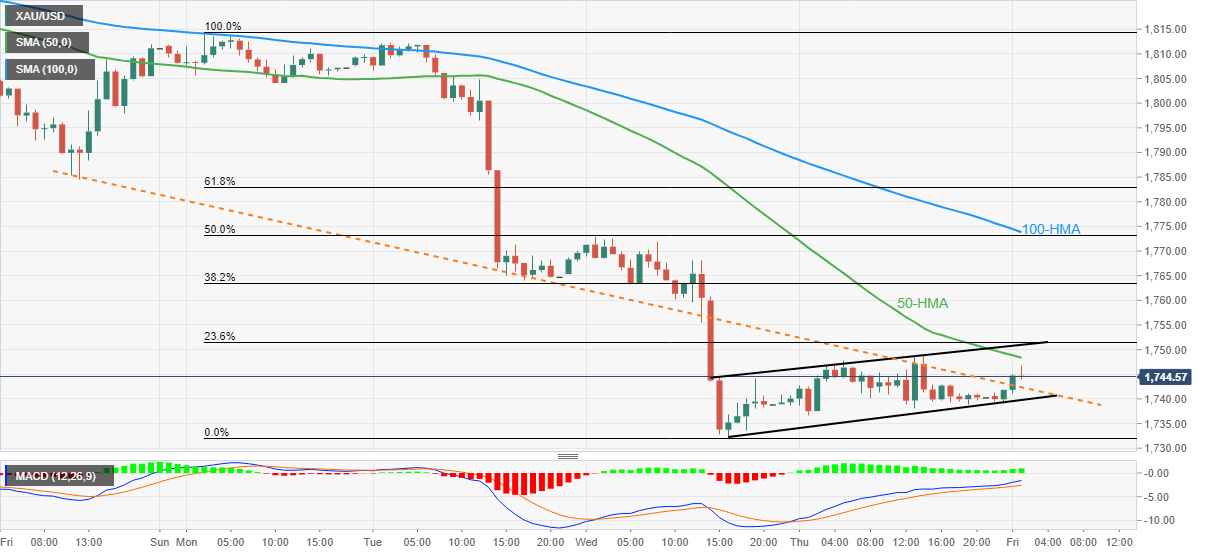

A clear upside break of the previous support line from the last Friday joins bullish MACD signals to keep gold buyers hopeful inside a three-day-old ascending trend channel.

That said, the 50-HMA level near $1,749 guards immediate recovery moves ahead of the stated channel’s upper line, near $1,751.

It should be noted, however, that the 100-HMA and 50% Fibonacci retracement of the last week’s downturn, around $1,774, appears a tough nut to crack for the XAU/USD bulls.

Alternatively, pullback moves need to break the channel’s support line, at $1,739 by the press time, to tease sellers. Also challenging the downside move is the latest low of $1,732.

If the Gold Price drops below $1,732, the odds of witnessing a south-run towards September 2021 low near $1,721 can’t be ruled out.

Gold: Hourly chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.