Gold Price Forecast: XAU/USD bulls stay the course but bears are lurking

- Gold price is attempting a move higher but faces headwinds, both technically and fundamentally.

- The US CPI data on Wednesday could be pivotal for the gold price.

At $1,787.86, the gold price is firm at the start of the week, trading 0.7% higher having climbed from a low of $1,771.22 to a high of $1,790.04. However, the $1,800 psychological level remains elusive ahead of a critical inflation report due on Wednesday from the US calendar which could be pivotal for the yellow metal, US dollar and US yields.

Meanwhile, the US dollar has given back some of the gains made after last week's blockbuster Nonfarm Payrolls data that has soothed some of the fears about an economic slowdown.

Nevertheless, investors remained cautious as the payrolls data added to expectations of a hawkish US Federal Reserve. US rate futures have priced in a 67.5% chance of a 75-basis-point hike at the Fed's September meeting, up from about 41% before payrolls data on Friday beat market expectations.

However, US 10-year yields remain below the recent highs of 2.869% so far. There is daily support in Monday's lows near 2.7610% at this juncture which could mean the relief is temporary with the focus now on consumer prices data on Wednesday. The inflation data will help to confirm if the Fed's tightening efforts have been successful in starting to tame inflation or if continued Fed tightening is needed and could be a critical milestone for forex markets and indeed the euro.

''While market pricing has shifted more toward another 75bp hike in September, it is far from locked in and with CPI data set for release midweek, the yellow metal has been able to hold firm,'' analysts at TD Securities noted.

However, ''alternatively,'' the analysts warned, ''prop traders in particular still hold a significant amount of long positions, and a continuation of strong economic data could be the catalyst needed to see an unwind. In this sense, we have yet to see capitulation in gold, suggesting the pain trade is still to the downside, and we expect the recent rally will ultimately fade.''

Gold technical analysis

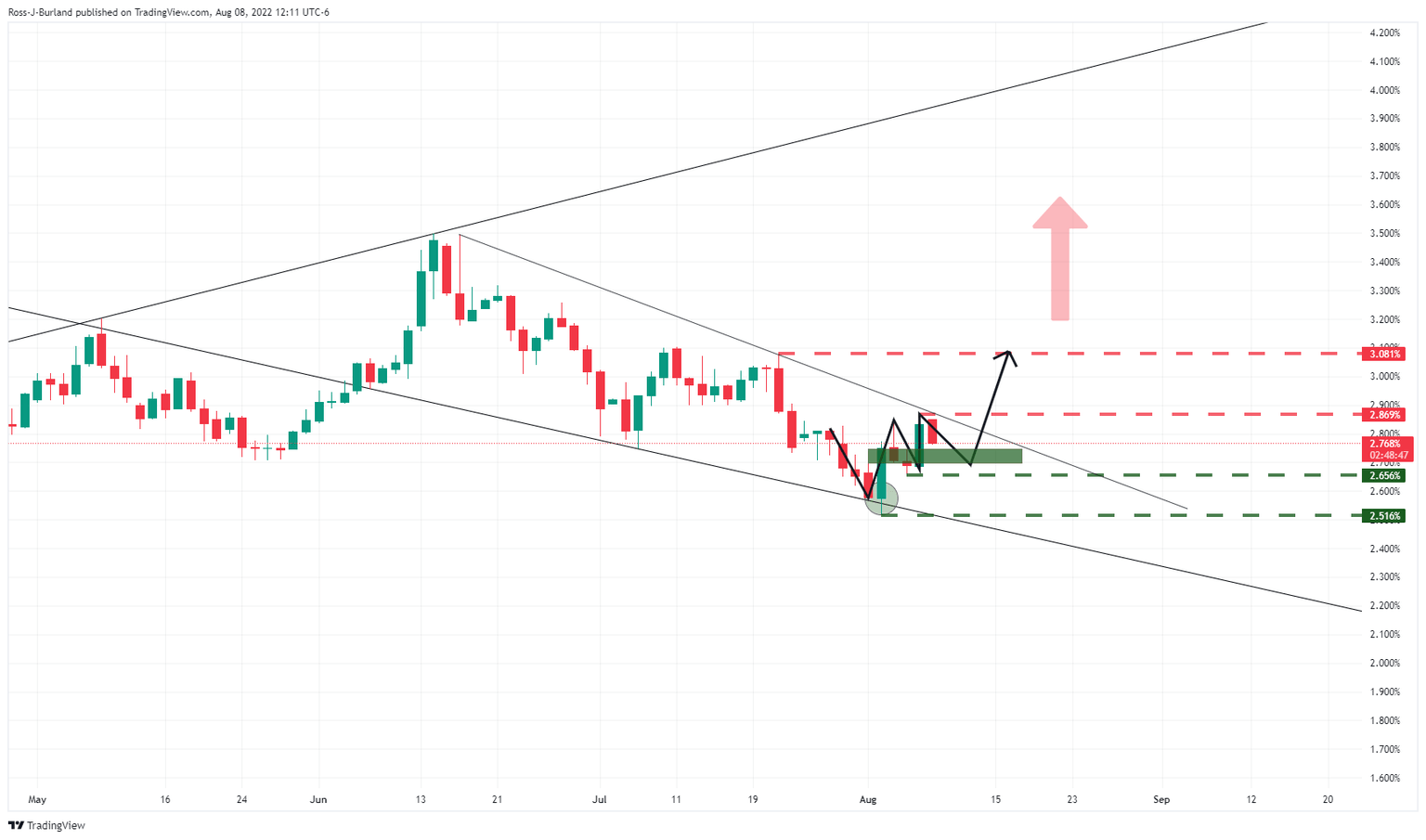

It is worth noting the broadening formation in the US 10-year yield as follows:

The yield has corrected towards the neckline of the W-formation on the daily chart within the lower boundary of the broadening formation.

In turn, should the price hold above the flagged levels on the chart above, then a break of the trendline resistance could result in a rally in yields, a weight for gold prices.

On the other hand, the weekly chart's correction is yet to reach a 61.8% golden ratio as follows:

With that being said, should the bears move in this week, a close below $1,754.35 could be pivotal in opening the prospects of a significant downside continuation beyond $1,720.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.