Gold Price Forecast: XAU/USD bulls flirt with 100/200-DMA confluence hurdle, around $1,790

- Gold gained traction for the second successive day and shot to a one-week high on Wednesday.

- Retreating US bond yields weighed on the USD and drove flows towards the non-yielding metal.

- Rising geopolitical tensions further benefitted the safe-haven metal and contributed to the uptick.

- The market focus now shifts to the release of the latest US consumer inflation figures on Friday.

Gold edged higher for the second successive day and climbed to a one-week high, around the $1,790 region during the early part of the trading action on Tuesday. Retreating US Treasury bond yields undermined the US dollar and turned out to be a key factor that benefitted the dollar-denominated commodity. Apart from this, rising geopolitical tensions further underpinned the safe-haven precious metal and contributed to the uptick.

The US recently announced that it would boycott the Winter Olympics in Beijing in protest of China's alleged violations of human rights and actions against Muslims in Uyghur. Similarly, relations between the US and Russia took a turn for the worse after US President Joe Biden threatened to impose strong economic and other measures on Russia if it invades Ukraine. This kept a lid on the recent optimistic moves in the financial markets.

Investors abandoned all concerns about the impact of the new coronavirus variant on economic recovery after reports indicated that Omicron patients had only shown mild symptoms. This was evident from a strong two-day rally in the equity markets, which tends to drive flows away from traditional safe-haven assets. Nevertheless, gold, so far, has managed to hold in the positive territory, with bulls awaiting a sustained move beyond the 200-day SMA.

The focus now shifts to the latest US consumer inflation figures, due for release on Friday. The data would influence the Fed's decision to taper its stimulus at a faster pace and set the stage for an eventual interest rate hike in 2022. It is worth mentioning that the money markets have been pricing in the possibility of liftoff in May. Hence, the US CPI report will play a key role in influencing the near-term trajectory for the non-yielding gold.

In the meantime, developments surrounding the coronavirus saga would be looked upon for some impetus. Apart from this, traders will take cues from the US bond yields, which will drive the USD demand and produce short-term opportunities around gold amid absent relevant market-moving economic releases from the US.

Technical outlook

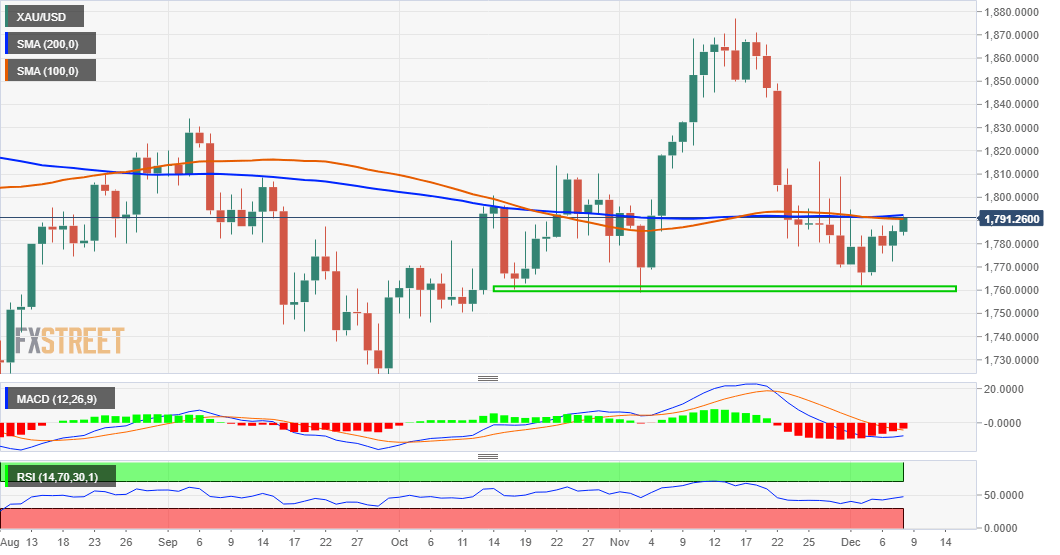

From a technical perspective, bulls might wait for a sustained move beyond a technically significant 200-day SMA before positioning for any further appreciating move. The mentioned barrier coincides with 100-day SMA. A convincing breakthrough the mentioned confluence hurdle should push spot prices beyond the $1,800 mark, towards the next relevant resistance near the $1,810-15 supply zone. The momentum could further get extended towards the $1,832-34 strong horizontal barrier, which should act as a key pivotal point for short-term traders.

On the flip side, the $1,783 area now seems to protect the immediate downside ahead of the overnight swing low, around the $1,772 region. This is followed by support near the $1,762 zone (monthly low), below which the XAU/USD could accelerate the fall towards the $1,752-51 support.

Gold daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.