Gold Price Forecast: XAU/USD remains vulnerable near $1,750 amid renewed USD strength

- Gold price consolidates the solid rebound from seven-week lows.

- Risk-off mood-led fall in Treasury yields rescue gold buyers.

- Gold’s hourly chart shows that the recovery could likely extend.

Update: Gold prices eases below daily highs above $1,750 after posting a one week high in the US session. The downward pressure builds up on the renewed buying interest in the greenback, which makes the precious metal expensive for holders of the other currencies. The uptrend is supported by the mixed economic data, the US Gross Domestic Product (GDP) rose an annual 6.7% in Q2, moderately higher than market estimates of 6.6%. Earlier the comments from the Chicago Fed Reserve President Charles Evans calls for a patience outlook on the inflation and believes that low interest rates still will be needed to bring US inflation back durably to 2% pulls the greenback lower. Gold is traditionally seen as an inflation hedge. Furthermore, a majority of the US Senate on Thursday voted to keep the government fully operating as the new fiscal year begins.

Gold price is clinging onto the staggering recovery staged from seven-week lows on Thursday, having found support at $1750 amid a minor retreat. The market remains risk-averse amid a delay in the US infrastructure bill vote, looming China Evergrande risks and concerns over the global economic growth. Therefore, the US Treasuries are seeing a revival in the safe-haven flows, weighing heavily on the yields across the curve while the US dollar attempts look to resume the upside.

Despite the rebound in gold price, growing expectations of a sooner than expected Fed rate tapering, followed by a rate hike, are likely to keep the bulls on the edge. Meanwhile, the upward revision to the US final Q2 GDP estimate and hawkish Fedspeak continue to undermine gold’s recovery.

Attention now turns towards the US PCE inflation, ISM Manufacturing PMI index and revised Michigan Consumer Sentiment, as the final quarter of this year kicks in.

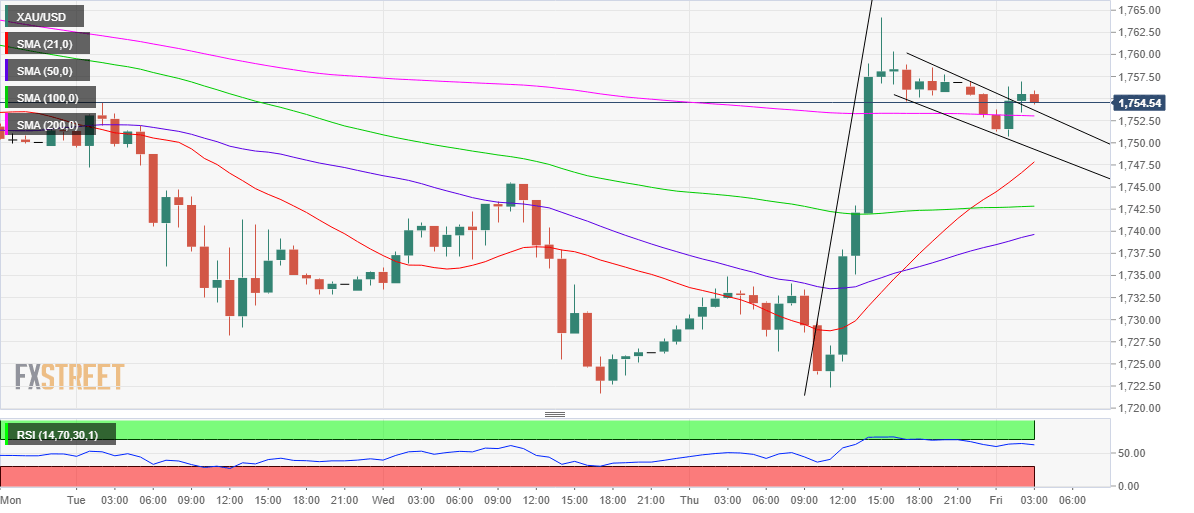

Gold Price: Technical outlook

From a short-term technical perspective, the bull flag breakout confirmed on gold’s hourly chart, suggests that the price remains on track to extend its recovery towards the measured target of $1797.

However, it could be a bumpy ride for gold bulls, as the investors remain cautious ahead of the critical US inflation data due later in the NA session on Friday.

Acceptance above Thursday’s high of $1764 could reinforce the renewed bullish interests.

The Relative Strength Index (RSI) holds firmer above the midline, allowing room for more upside.

Alternatively, immediate support awaits at the 200-Hourly Moving Average (HMA) at $1753, below which the daily lows could be retested.

Further south, the bullish 21-HMA at $1747 could offer strong support, below which the previous week’s low of $1738 will come into play.

Gold Price: Hourly chart

Gold Price: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.