Gold Price Forecast: XAU/USD bears taking on the bulls towards critical hourly support

- Gold is correcting back towards the W-formation's neckline which would be expected to hold the initial tests.

- Bulls could be encouraged to move in to target the prior resistance near $1,870.

The price of gold is under a little bit of pressure in Asia as the US dollar attempts to stabilise. At $1,851.94, the gold price is down 0.07% and is sticking to a range of between 41,851.63/$1,854.43 so far. The US dollar, as measured by the DXY index, edged lower following the Federal Reserve minutes that failed to send a message that large rate hikes were being considered. Therefore, the move lower in the greenback was making bullion less expensive for buyers holding other currencies and limiting losses.

''Gold struggled to find a bid amid the weak economic backdrop,'' analysts at ANZ Bank said in a note on Thursday. ''Gold was under pressure from the opening of the session as the USD gained but pared some of those losses after Federal Reserve minutes showed little appetite for more aggressive rate hikes. Fed officials agreed the bank needed to tighten in half-point steps over the next couple of meetings.''

Gold technical analysis

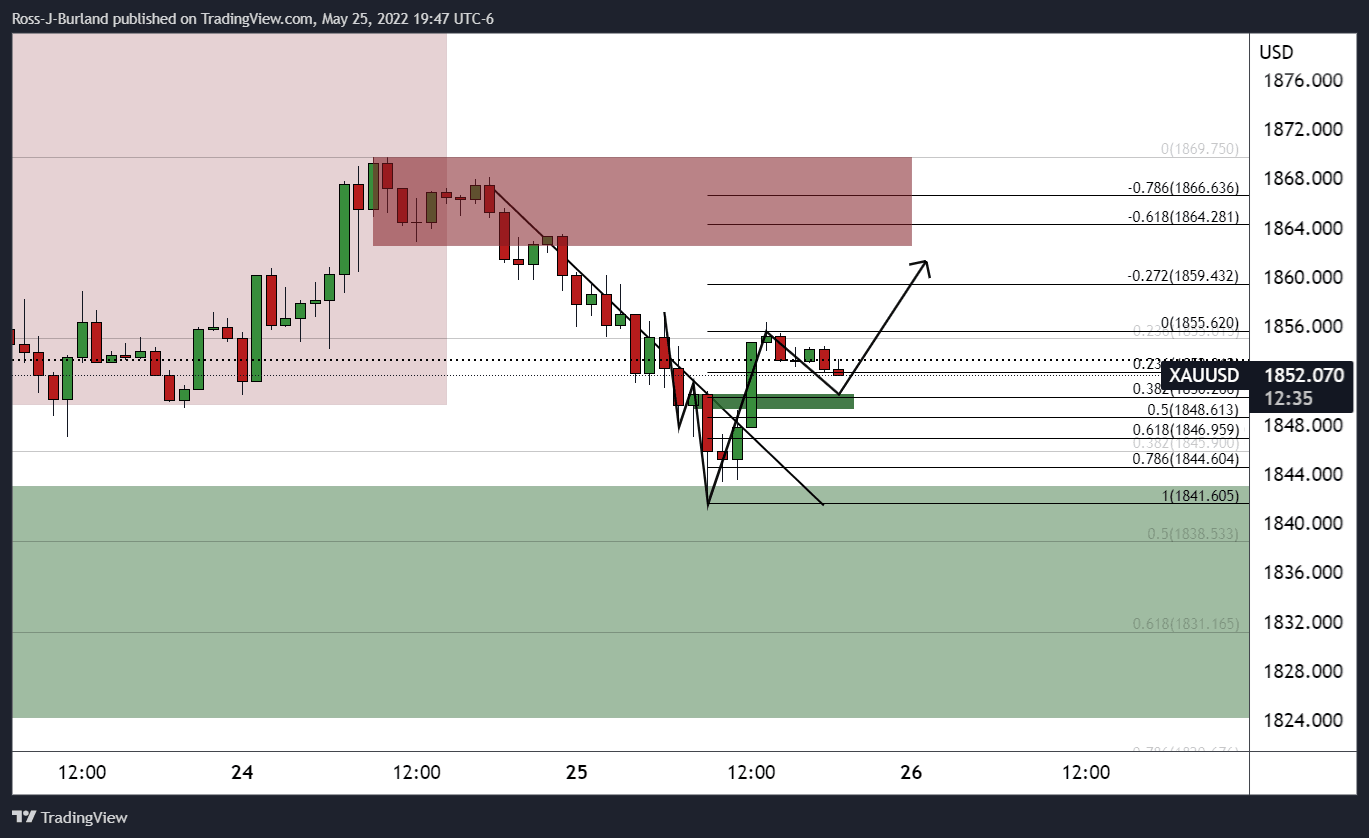

In the New York session analysis, below, it is seen that the price had moved in on the support in a 38.2% Fibonacci retracement:

It was stated that ''the lower time frames can be monitored for signs of a deceleration of the bearish correction.''

Gold, H1 charts

This chart, from the New York session, shows the bulls were moving in to slow down the correction on the daily chart.

Gold live market

As we can see here, the bulls had been moving in but the price is correcting back towards the W-formation's neckline, as forecasted in the previous analysis above. The neckline would be expected to hold the initial tests and on repeated failures to break below, then bulls will more than likely be encouraged to move in to target the prior resistance near $1,870.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.