Gold Price Forecast: XAU/USD bears are in play with eyes on Fed's Powell and NFP

- Gold is under pressure as the US Dollar firms in the open.

- Eyes are on Fed's chair Jerome Powell and NFP this week.

Gold price is slightly offered at the start of the week as markets hold their breath ahead of an update on the US rate outlook from the Federal Reserve's chairman, Jerome Powell. At the end of the week, US labor market data will be also critical. At the time of writing, the Gold price is down 0.15%, sliding from a high of $1,855.43 and reaching a low of $1,851.47 so far.

The US Dollar index, DXY, which measures the greenback's value against six major currencies, fell 0.4% to end Friday at 104.527. The index made a low of 104.485, losing ground from a high of 105.36 at the start of the week, its strongest level since Jan. 6. However, it has picked up a slight bid in the open as there apes to be some disappointment that Beijing chose to lowball its growth outlook with a target of 5%, rather than the 5.5%-plus favored:

Looking at yields on 10-year US Treasuries, they stood at 3.970%, after last week's spike to 4.09%. Meanwhile, all eyes are on the Federal Reserve speakers and especially the chairman Jerome Powell who will testify on Wednesday on monetary policy to the House Financial Services Committee.

San Francisco Fed President Mary Daly on Saturday said rates would have to go up but set a high bar for moving to half-point increases. Meanwhile, futures imply a 72% chance the Fed will go by 25 basis points at its meeting on March 22 and this is where Powell's comments will be important when he is quizzed on whether larger hikes are needed.

Thereafter, we will have the February Nonfarm Payrolls report whereby a more modest increase of 200,000 following January's barnstorming 517,000 jump is expected and that will be followed by the February CPI report on March 14.

However, analysts at ANZ Bank have argued that recent jobs and inflation data do not support the thesis that interest rates are restrictive and they said ''it will be important to scrutinize the next round of hard data, starting with non-farm payrolls this Friday.''

''The early consensus looks for nonfarm jobs to have risen 200k, a lower pace than the 517k in January. That would be the lowest monthly increase since the pandemic, imply January was an outlier and put payrolls back on their decelerating trend evident from August last year,'' the analysts added. ''For what it’s worth, we think initial claims, the employment component of the ISM Services subindex, and seasonal factors are pointing to a stronger-than-forecast outturn. The range of economists’ estimates is 100-325k.''

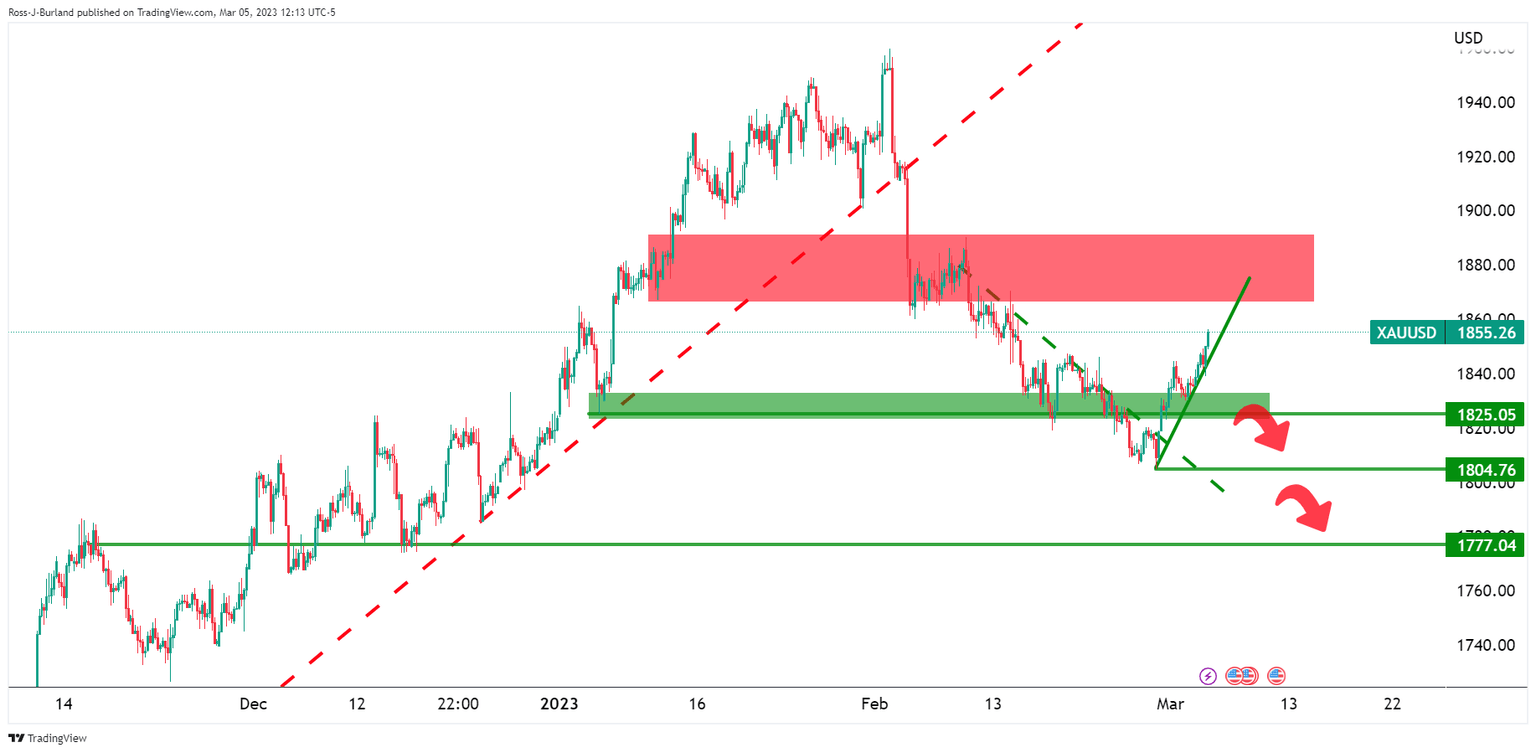

Gold technical analysis

The 4-hour chart shows that the Gold price is riding dynamic support:

Below it, the key $1,825 support structure is what the bears will aim for while a break there will most probably see a flurry of orders triggered and a fast subsequent move lower.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.