Gold Price Forecast: XAU/USD attempts another run above $1,825 despite USD bounce

- Gold price challenges six-month highs in a cautious start to 2023.

- US Dollar rebounds amid tepid sentiment as S&P 500 futures drop.

- Gold price awaits acceptance above $1,825 to validate an ascending triangle.

Gold price is challenging six-month highs while holding gains above the $1,825 key resistance level so far this Tuesday. Gold price is seeing a continuation of the recent uptrend at the start of 2023, despite the bounce in the US Dollar across the board.

Concerns over a potential global economic recession, China’s covid resurgence and higher inflation are weighing on the market sentiment, driving demand for the traditional safe-haven Gold price. Expectations that the US Federal Reserve (Fed) will continue its fight against raging inflation this year, by continuing its tightening cycle, keep investors’ sentiment broadly undermined.

The risk-off flows are also helping the US Dollar find a floor, capping the upside in the bright metal. Further, the US Treasury bond yields finished the final week of 2022 on an upbeat note, limiting the upside attempts in the non-yielding Gold price.

Attention now turns toward the first relevant US economic data due to be released this year, the S&P Global Manufacturing PMI for December, for fresh trading impetus. Markets will also closely await the Wall Street open for further cues on risk sentiment.

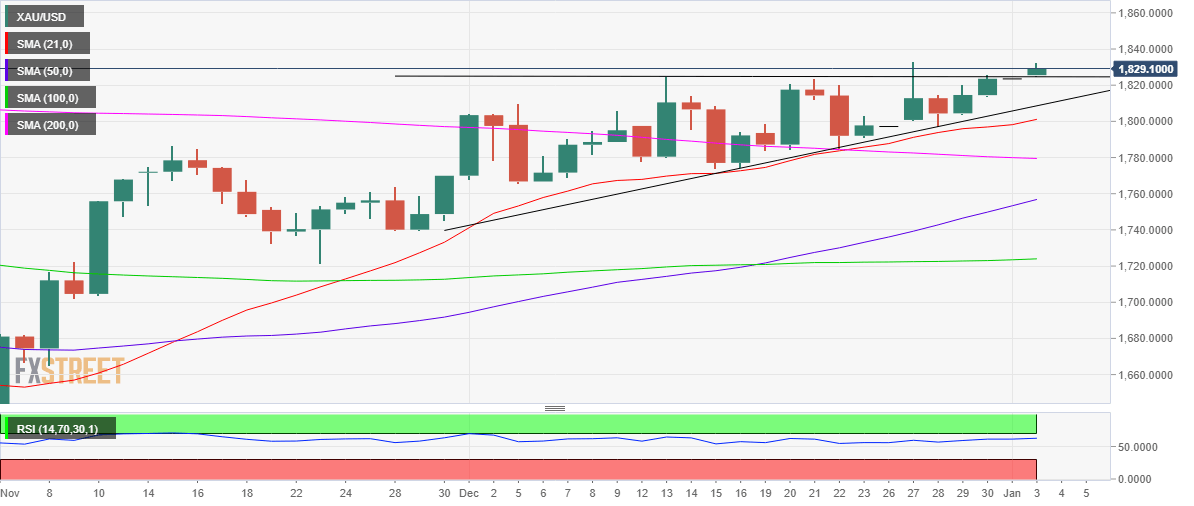

Gold price technical analysis: Daily chart

From a short-term technical perspective, Gold price is once again testing bearish commitments above the critical horizontal trendline (triangle) resistance at $1,825 this Tuesday.

Gold bulls need a daily closing above the horizontal trendline (triangle) resistance to confirm the ascending triangle breakout. Buyers will then aim for a fresh upswing toward the psychological $1,850 level. Ahead of that the $1,840 round figure could come into play.

The 14-day Relative Strength Index (RSI) is inching higher above the midline, backing the ongoing uptrend while the bullish crossovers continue to lend support to Gold bulls.

Alternatively, immediate support is seen at Friday’s low of $1,814. The next critical support awaits at the rising trendline (triangle support line) of $1,808. A breach of the latter could put the $1,800 threshold at risk, where the bullish 21-Daily Moving Average (DMA) hangs around.

Gold Price: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.