Gold Price Forecast: XAU/USD corrects sharply from multi-month high amid easing Russia-Ukraine tensions

- Gold renews eight-month high on the way to $1,900, prints three-day uptrend.

- Chatters that Russian invasion of Ukraine becomes imminent joins softer yields to keep buyers hopeful.

- Hawkish Fedspeak challenges upside momentum, a daily closing beyond $1,878 become necessary for the bulls.

- Gold Price Forecast: Gold recovers its shine as geopolitical tensions escalate

Update: Gold witnessed an intraday turnaround from the eight-month high touched earlier this Tuesday and dived below the $1,860 level during the early European session. The latest leg of a sharp decline followed reports that several Russian military drills have finished and troops are expected to return to bases. The headlines eased worries about a significant military action/confrontation and provided a much-needed boost to the global risk sentiment. This was evident from a solid rebound in the equity markets, which, in turn, dented demand for traditional safe-haven assets and prompted aggressive long-unwinding around the XAU/USD.

With the latest leg down, gold has now erased the previous day's positive move and remains at the mercy of geopolitical developments. That said, modest US dollar weakness could lend some support to the dollar-denominated commodity and help limit any further losses, at least for the time being. It, however, remains to be seen if the metal is able to attract some buying at lower levels amid the prospects for a faster policy tightening by the Fed. The markets seem convinced that the Fed would adopt a more aggressive policy response to combat stubbornly high inflation and have been pricing in a 50 bps rate hike in March.

Market participants now await the release of the US Producer Price Index (PPI) for January, due later during the North American session this Tuesday. The data might influence the USD price dynamics, which, along with the broader market risk sentiment, should provide a meaningful impetus to gold. The focus, however, remains on the minutes of the FOMC January monetary policy meeting, scheduled for release on Wednesday. Investors will look for fresh cues about the Fed's policy outlook to determine the next leg of a directional move for the non-yielding yellow metal.

Previous update: Gold (XAU/USD) cheers the market’s rush for risk-safety while ticking up to refresh multi-day peak around $1,880 ahead of Tuesday’s European session, near $1,878 by the press time.

Fears of the imminent Russian invasion of Ukraine join chatters surrounding faster rate hikes by the Fed to direct traders towards gold. Also favoring gold buyers is the softer US Dollar Index (DXY), backed by downbeat Treasury yields.

Read: US Dollar Index retreat from fortnight high towards 96.00 as yields ease

The recent push to gold prices towards the north was from the headlines conveying satellite images of multiple pre-war measures near the Russia-Ukraine border.

Further, comments from St. Louis Fed President James Bullard also weigh on the risk appetite. Fed’s Bullard repeated his call for 100 basis points (bps) in interest rate hikes by July 1 by citing the last four inflation reports which show broadening inflationary pressures.

That said, the US Treasury yields consolidate the previous day’s recovery moves with the fresh drop to 1.979%, down 1.7 basis points (bps), whereas the S&P 500 Futures print mild gains by the press time. On Monday, the bond coupons regained upside momentum after stepping back from a 2.5-year high on Friday whereas the Wall Street benchmark closed in the red, despite mildly positive week-start performance.

Moving on, the US Producer Price Index (PPI) for January, expected 9.1% YoY versus 9.7% prior, as well as the Empire State Manufacturing Index for February, bearing the market consensus of 12 versus -0.7% previous readouts, will direct intraday moves of gold. However, major attention will be given to Russia-Ukraine headlines and Fedspeak.

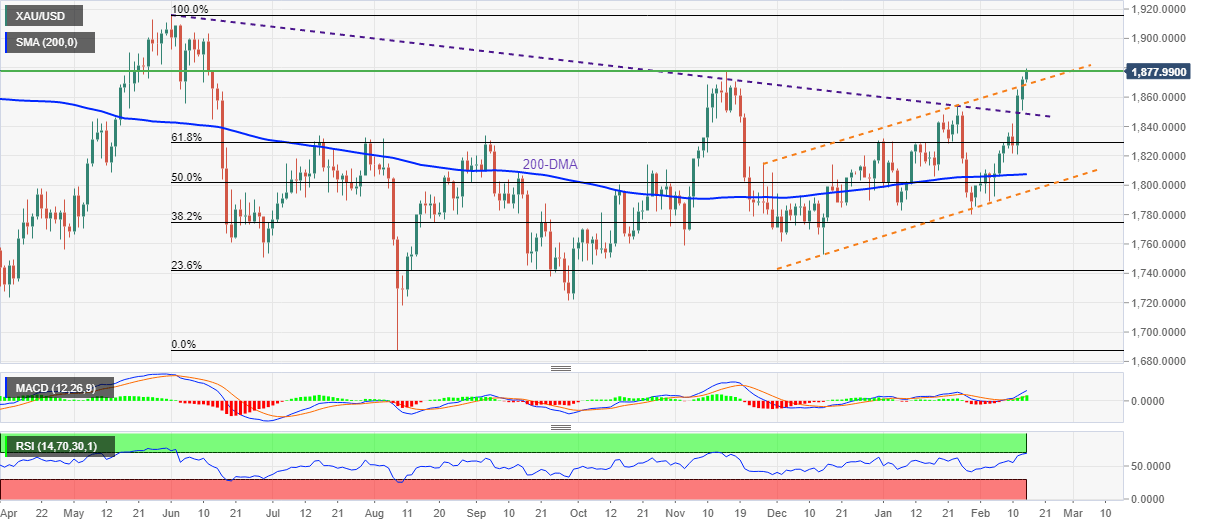

Technical analysis

Gold pokes November 2021 high amid nearly overbought RSI conditions and bullish MACD signals during early Tuesday morning in Europe.

Given the metal’s sustained break of a descending trend line from June 2021 and clearance of the resistance line of an 11-week-old upward sloping channel, gold buyers are likely to keep reins.

However, RSI conditions may test the bulls, which in turn signal a short-term pullback before the buyers recall the $1,900 threshold on the chart.

During the quote’s rise past $1,900, tops marked during June and January 2021, respectively near $1,917 and $1,960 will be in focus.

Meanwhile, pullback moves may initially aim for the stated channel’s upper line, around $1,868, ahead of resting on the resistance-turned-support line from June, close to $1,850 by the press time.

Even if the gold prices drop below $1,850, 61.8% Fibonacci retracement (Fibo.) of June-August downside, near $1,828, will precede the 200-DMA level of $1,807 to act as the last defense for the bulls.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.