Gold Price Forecast: XAU/EUR pokes €1,600 during four-day uptrend

- Gold remains mildly bid amid firmer US dollar, steady German yields.

- Holiday mood, light calendar restrict immediate moves but covid woes may weigh on the quote.

- French PM Macro’s speech, US second-tier data to watch for fresh impulse.

Gold (XAU/EUR) rises 0.18% intraday around €1,600 round figure heading into Monday’s European session. In doing so, the yellow metal prices rise for the fourth consecutive day while trading around the monthly peak.

Behind the moves could be the latest pullback in the EUR/USD prices amid Omicron fears and firmer US retail sales data. Adding to the XAU/EUR strength could be the pause in the German 10-year Treasury yields around the monthly top. On the same line are the escalating inflation chatters and optimism surrounding President Joe Biden’s Build Back Better (BBB) stimulus plan.

However, a record jump in the French daily covid infections, as well as a 45% hike in the virus-led hospitalizations on the monthly basis, challenges XAU/EUR buyers. Though, an 8.5% jump in US retail sales and US Vice President Kamala Harris’ readiness to tame inflation keeps the gold buyers hopeful.

Amid these plays, the US 10-year Treasury yields dropped 1.1 basis points (bps) to 1.482%, stepping back from a two-week high flashed the previous day, whereas the stock futures print mild gains by the press time.

Given the holiday mood in the markets, coupled with a lack of major data/events, XAU/EUR may extend the upward grind at a slower pace. Though, comments from French President Emmanuel Macron and risk catalysts mentioned above can offer intermediate direction.

Technical analysis

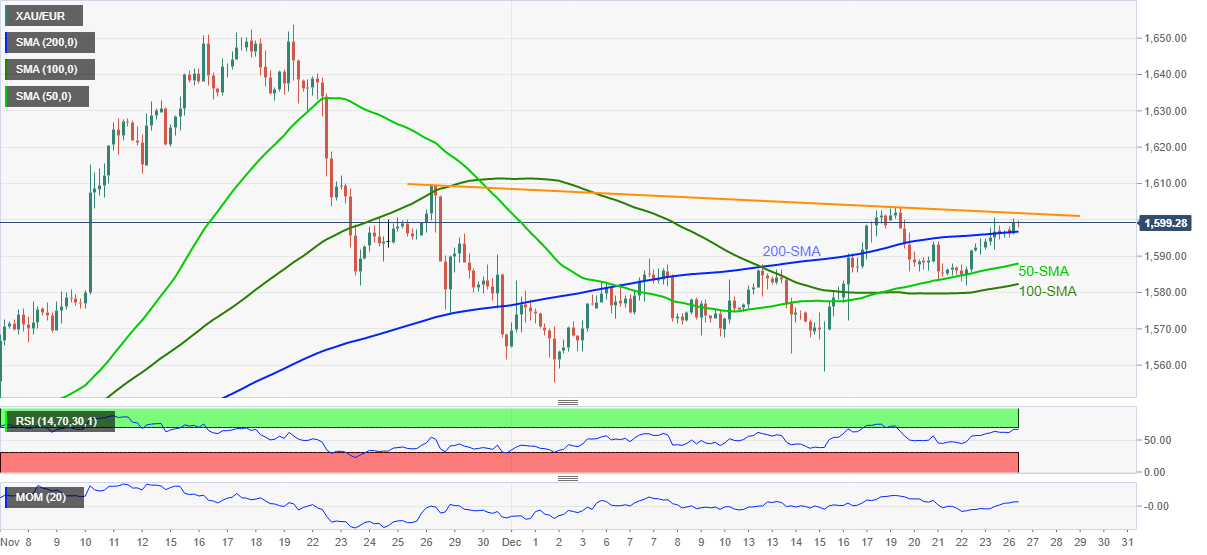

Gold (XAU/EUR) floats above the key SMAs amid the firmer Momentum line, suggesting another battle with the monthly resistance line near €1,602.

It’s worth noting that the monthly peak surrounding €1,603 and the late November’s swing high around €1,610 will act as extra hurdles to the north before the XAU/EUR bulls can eye €1,633 resistance level.

During the quote’s successful trading above €1,633, November’s peak of €1,6554 should return to the chart.

Meanwhile, pullback moves remain elusive until staying beyond the 100-SMA level of €1,582.

Should gold sellers manage to conquer €1,582 support, the monthly low near €1,555 will be in focus.

Overall, XAU/EUR remains in a recovery mode but the year-end inaction challenges the upside momentum.

XAU/EUR: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.