Gold Price Forecast: XAU/USD flirts with $1,780 amid lower US Treasury yields

- Gold prices have recovered a significant portion of the daily drop.

- Traders will be watching US data and the FOMC Minutes for the week ahead.

Update: Gold prices lack the strength to make any decisive movement on Monday. The prices opened higher but failed to preserve the momentum, and continued to face pressure near the $1,780 mark. The US Treasury yields trade at 1.25% with more than 3% losses, following the disappointing US consumer sentiment. The University of Michigan’s Consumer Sentiment slumped to 70.2 in August, much lower than the market forecast of a 81.2 rise. US Dollar Index (DXY) recovers from the initial losses on geopolitical tensions and growing concerns of the Delta variant cases in the Asia-Pacific region. The disappointing Chinese economic data exerted pressure on the higher side on the concerns of falling demand. Higher global equity markets and lack of ETF investor buying also weighed on the precious metal.

XAU/USD is trading at $1,779.16 and flat after Friday's price action.

Gold took advantage of a drop in the US dollar on Friday following a plunge in US consumer confidence which boosted demand for the safe-haven metal.

The survey showed US consumer sentiment dropped sharply in early August to its lowest level in a decade.

The fall was one of the six largest drops in the past 50 years of the survey and it underlines a broader concern at economic growth as virus cases rise around the world.

''In a textbook-quality pullback, gold prices are retracing towards the bull-market defining trendline that sparked an epic-but-short-lived capitulation,'' analysts at TD Securities said.

''Speculative pressures have been building in the yellow metal for some time, as taper talk fuels anxiety for gold bugs alongside decisively hawkish fedspeak.''

The analysts also explained that there has nearly never been this few traders short in gold, suggesting that dry powder is also ample to the downside.

''In turn, still lacklustre flows suggest that the retracement higher in gold prices may indeed be pointing to nothing more than a technical pullback.''

Meanwhile, in the lead-up to the Jackson Hole meeting on the 26 August, analysts will be looking to US data for guidance.

Immediately, the market is expecting the August New York Fed Empire State index to pull back from its recent record high of 43.0 to 28.5.

However, bigger calendar events will come in the US Retail Sales on the 17th and the FOMC Minutes on the 18th.

''As for the minutes, the focus will be on expressed views on QE tapering, how, as well as when,'' analysts at TD Securities, said.

''In his press conference, the chairman indicated that most officials favoured tapering of Treasuries and MBS together, rather than starting with just MBS. On when, he suggested that a decision on tapering would require discussions at coming "meetings" (plural), consistent with November at the earliest.''

Gold & DXY technical analysis

Gold prices have been predominately moved along by the performance of the US dollar.

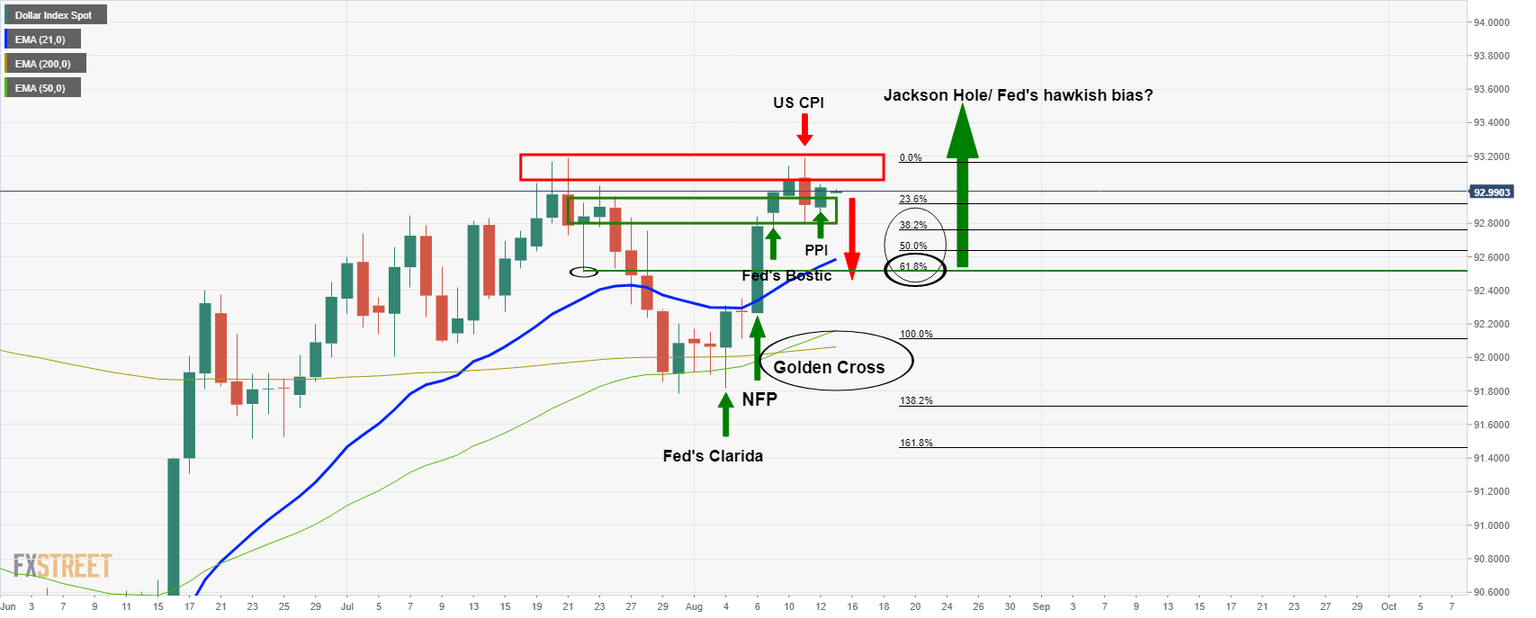

In the prior analysis, US dollar teases reversal traders, Golden Cross underpins, it was anticipated that there would be some let-up in the greenback's strength ahead of the Jackson Hole:

However, the deterioration has been immediate:

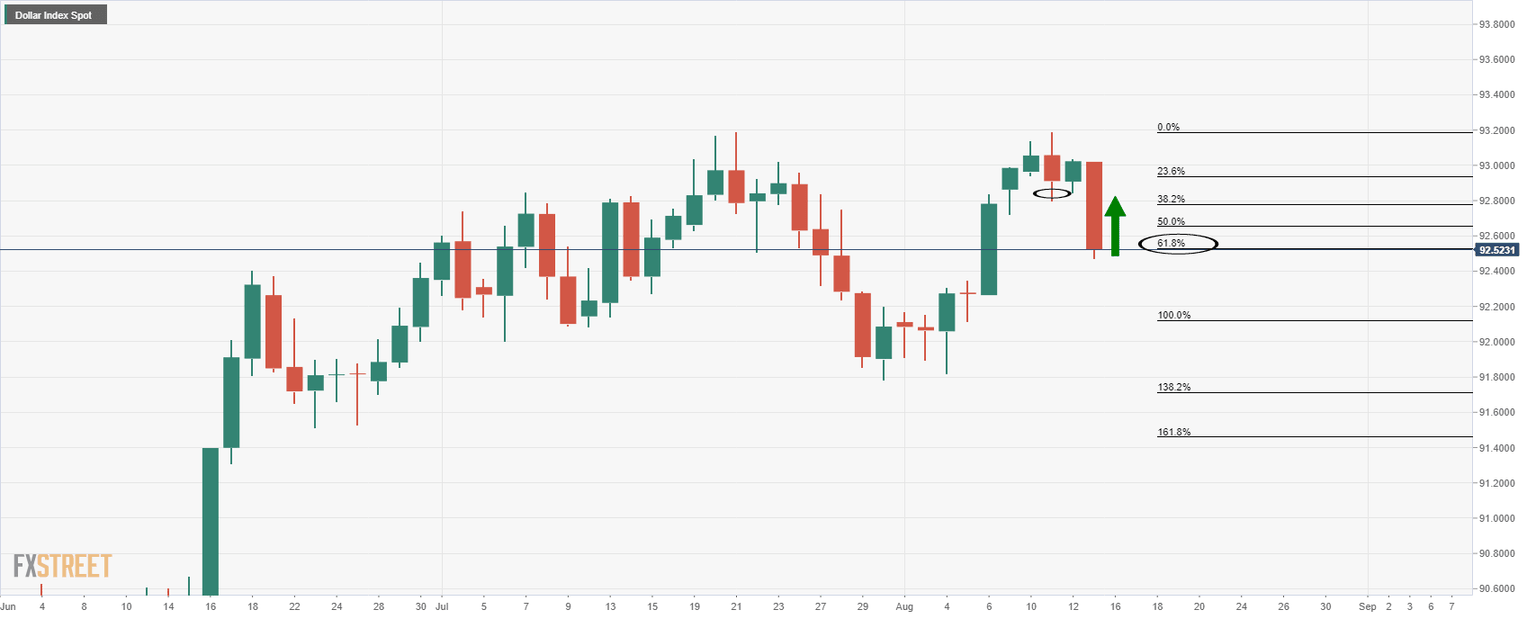

There is now a bias to the upside while above 92.351 which will be a headwind for the gold price going forward.

Gold has rallied through a 50% mean reversion level. The 61.8% Fibo of the drop has also been breached and bulls now eye the 78.6% Fibo at 1,798.

Before then, 1,790 comes as the next presumed resistance as being a prior low on 23 July.

On the flip side, the 4-hour 10 EMA has a confluence with the 6 Aug structure near 1,758/60 which would be expected to act as support on initial attempts.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.