Gold drops on strong US Dollar boosted by ISM improvement

- Gold price drops, pressured by Trump's tariff threats against BRICS nations, rising US bond yields.

- US ISM Manufacturing PMI hits a six-month high, contributing to a stronger Dollar, limiting Gold's gains.

- Mixed signals from Fed officials on rate cuts keep markets cautious; December FOMC meeting closely watched.

Gold prices slump as the last month of the year begins. They edge lower, weighed down by a strong US Dollar strengthened by Trump’s harsh rhetoric on BRICS countries and some easing of geopolitical tensions. The XAU/USD trades at $2,635, down 0.58%.

The golden metal extended its losses after Trump warned BRICS countries that moving away from the Greenback could make them face 100% tariffs “and should expect to say goodbye to selling into the wonderful U.S. Economy,” he added.

Once Monday’s Asian session got underway, XAU/USD plunged to a daily low of $2,621 before recovering some ground, but the jump in US Treasury bond yields and the US Dollar Index (DXY) capped Gold’s advance.

Data-wise, the US economic docket featured the release of the ISM Manufacturing PMI for November, which rose to its highest reading since June. Earlier, S&P Global announced that manufacturing activity in the United States (US) improved, indicating that the economy remains robust.

The Atlanta Fed GDP Now for Q4 2024 rose from 2.69% to 3.16% after the ISM data release.

Atlanta Fed President Raphael Bostic crossed the wires. Bostic stated he’s undecided on whether a cut this month is needed, but he believes that interest rates should continue to be lowered over the following months. He said that rates should be at a reasonable level that “neither stimulates nor restrains economic activity,” adding that he’s keeping his options open.

In the meantime, the CME FedWatch Tool shows that the odds for a 25-basis point rate cut stand at 63%, down from 66% last Friday. This suggests the December 17-18 meeting would be live.

Regarding geopolitics, US officials are concerned the Lebanon ceasefire could unravel, according to Axios. The White House is concerned that the fragile ceasefire in Lebanon could unravel after Israel and Hezbollah exchanged fire in recent days.

This week, the US economic docket will feature Fed speakers, including Chairman Jerome Powell, the JOLTs Job Openings for October, S&P and ISM Services PMI surveys, and Nonfarm Payroll figures.

Daily digest market movers: Gold price undermined by higher US real yields

- Gold prices dive as US real yields climbed one and a half basis points to 1.936%.

- The US 10-year Treasury bond yield rose almost two basis points to 4.196%.

- The US Dollar Index (DXY), which tracks the buck's performance against six currencies, edged up 0.63% at 106.44 on the day.

- The ISM Manufacturing PMI in November rose from 46.5 to 48.4, exceeding forecasts of 47.5. The S&P Global Manufacturing PMI for the same period increased from 48.5 to 49.7, above the 48.8 expected by the consensus.

- Fed officials seemed convinced that further easing is needed and may cut rates at the December meeting. However, they adopted a more cautious stance, opening the door for a pause in the easing cycle.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

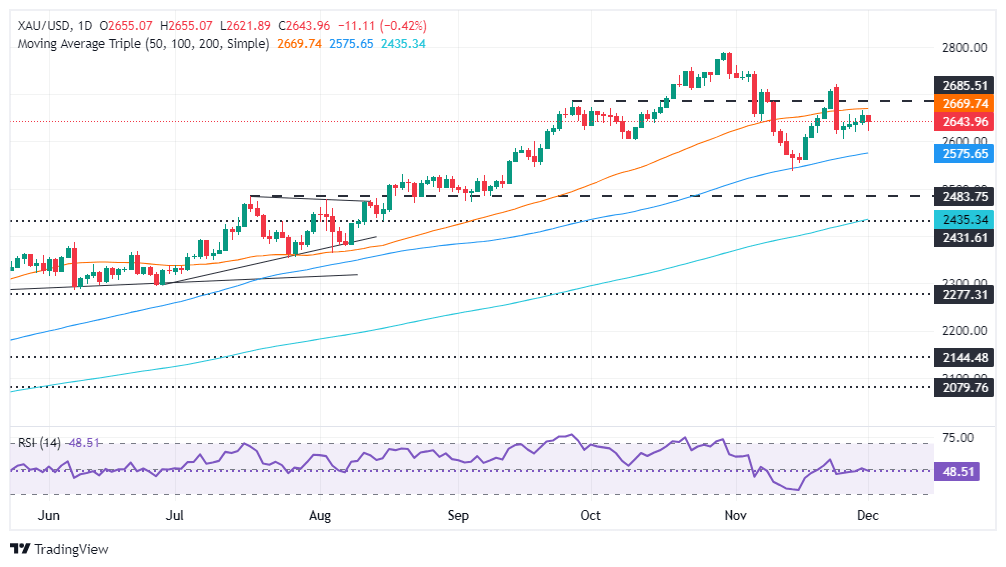

Technical outlook: Gold price retreats deeper below 50-day SMA

Gold’s uptrend remains intact, though buyers could not decisively clear the 50-day Simple Moving Average (SMA) of $2,669. Further consolidation lies ahead, as depicted by the Relative Strength Index (RSI) hovering around the 50 neutral line.

That said, if XAU/USD cleared the 50-day SMA, key resistance levels would be exposed, like $2,700, the $2,750 figure, and the all-time high at $2,790. On the other hand, if sellers drag the non-yielding metal below $2,600, they could target the 100-day SMA ahead of the November 14 swing low of $2,536.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.