Gold price slides below $2,600 for the first time since September 20 on stronger USD

- Gold price drifts lower for the third successive day on Tuesday amid sustained USD buying.

- Elevated US bond yields contribute to driving flows away from the non-yielding XAU/USD.

- Traders look forward to Fed speaks and the US consumer inflation figures for a fresh impetus.

Gold price (XAU/USD) continues losing ground through the first half of the European session on Tuesday and slips below the $2,600 mark for the first time since September 20. Investors continue to pile into the so-called Trump trade, which lifts the US Dollar (USD) to over a four-month peak and turns out to be a key factor exerting downward pressure on the commodity for the third successive day.

Meanwhile, US President-elect Donald Trump's anticipated expansionary policies could spur economic growth and boost inflation, which, in turn, is expected to limit the Federal Reserve's (Fed) scope to ease policy. This keeps the US Treasury bond yields elevated and contributes to driving flows away from the non-yielding yellow metal ahead of speeches from a slew of influential FOMC members.

Gold price continues to be pressured by relentless USD buying, elevated US bond yields

- The US Dollar prolonged its positive trend that followed Donald Trump's victory in the US presidential election and shot to its highest level since early July, which prompted heavy selling around the Gold price on Monday.

- Trump's expansionary policies and corporate tax cuts could put upward pressure on inflation, and limit the Federal Reserve's scope to ease its monetary policy more aggressively. This continues to underpin the Greenback.

- Minneapolis Fed President Neel Kashkari said on Sunday that the central bank wants to have confidence and needs to see more evidence that inflation will go back to the 2% target before deciding on further interest rate cuts.

- The US Treasury bond yields hold steady below the post-US election swing high as investors assess broader implications of Trump's victory in the US presidential election on fiscal policy and interest rate cut expectations.

- Before the election, Trump had pledged to impose a universal 10% tariff on imports from all countries. This fuels concerns about an escalation of the global trade war and offers some support to the safe-haven XAU/USD.

- Traders now await speeches from influential FOMC members, including Fed Chair Jerome Powell, for cues about the future of interest rates in the US amid speculations that the US central bank might delay its easing cycle.

- According to the CME Group's Fedwatch tool, traders are now pricing in a 65% chance of another 25-basis-point rate cut by the Fed and a 35% probability of a ‘no change’ at the next FOMC monetary policy meeting in December.

- Investors this week will also confront the release of the US consumer inflation figures and the US Producer Price Index (PPI), which might contribute to determining the next leg of a directional move for the commodity.

Gold price seems vulnerable to prolong its retracement slide from the all-time peak

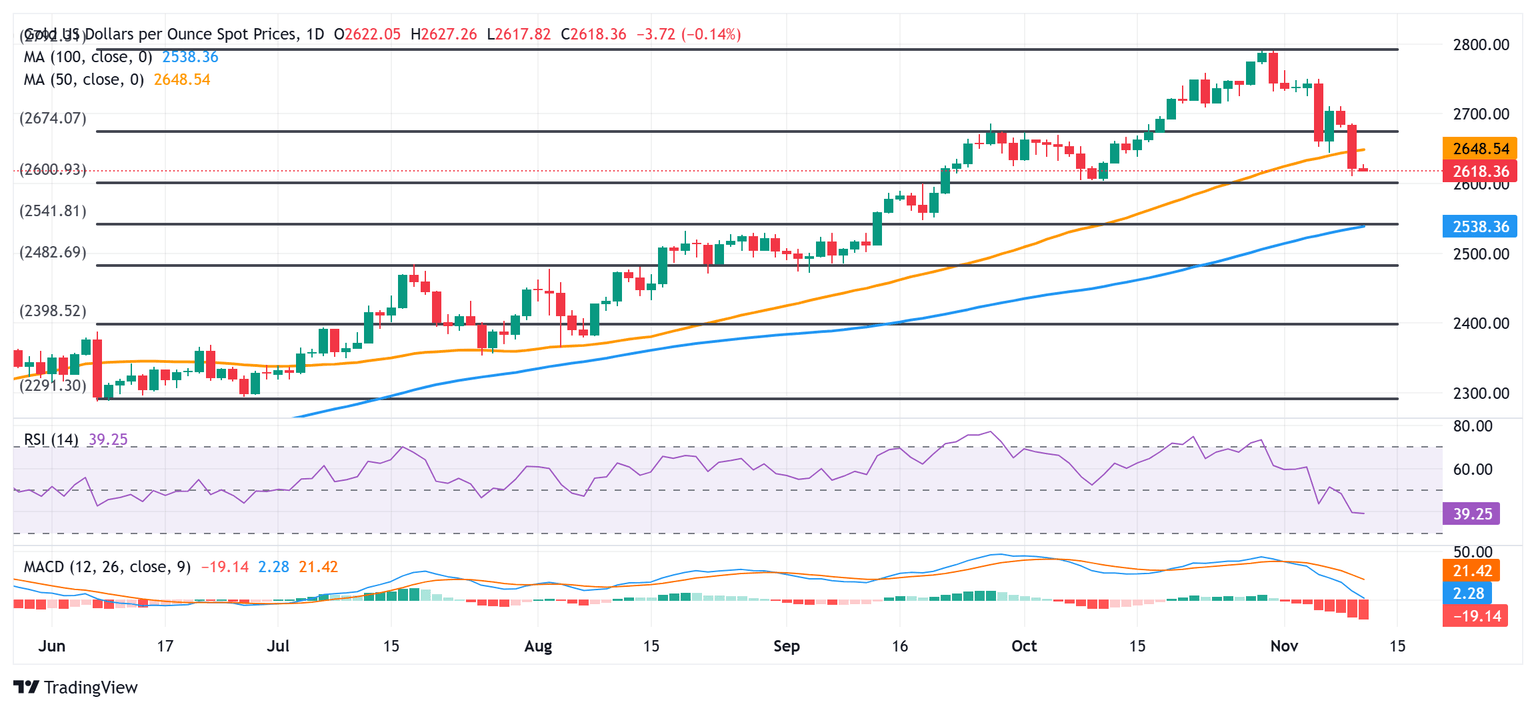

From a technical perspective, the overnight breakdown below the 50-day Simple Moving Average (SMA) was seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart have been gaining negative traction and are still away from being in the oversold zone, suggesting that the path of least resistance for the Gold price is to the downside.

That said, the overnight slump stalled ahead of the $2,600 mark, which represents the 38.2% Fibonacci retracement level of the June-October rally and should act as a key pivotal point. A convincing break below the said handle should pave the way for an extension of the recent pullback from the all-time peak and drag the Gold price to the $2,540-2,539 confluence. This comprises 50% Fibo. level and the 100-day SMA, which if broken decisively will reaffirm that the XAU/USD has topped out in the near term.

On the flip side, the $2,632-2,635 area now seems to act as an immediate hurdle, above which a bout of a short-covering move could lift the Gold price to the $2,659-2.660 static resistance. A sustained strength beyond the latter should pave the way for a move towards the $2,684-2,685 region en route to the $2,700 mark and the $2,710 supply zone. Some follow-through buying will suggest that the recent corrective decline has run its course and shift the bias back in favor of bullish traders.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.26% | 0.46% | 0.09% | 0.21% | 0.34% | 0.15% | 0.06% | |

| EUR | -0.26% | 0.20% | -0.18% | -0.05% | 0.09% | -0.11% | -0.20% | |

| GBP | -0.46% | -0.20% | -0.39% | -0.24% | -0.11% | -0.32% | -0.40% | |

| JPY | -0.09% | 0.18% | 0.39% | 0.13% | 0.26% | 0.06% | -0.02% | |

| CAD | -0.21% | 0.05% | 0.24% | -0.13% | 0.12% | -0.06% | -0.15% | |

| AUD | -0.34% | -0.09% | 0.11% | -0.26% | -0.12% | -0.19% | -0.26% | |

| NZD | -0.15% | 0.11% | 0.32% | -0.06% | 0.06% | 0.19% | -0.09% | |

| CHF | -0.06% | 0.20% | 0.40% | 0.02% | 0.15% | 0.26% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.