Gold Price Analysis: XAU/USD bulls testing critical daily resistance

- Gold has stalled in the decent within its bearish cycle.

- XAU/USD's short term momentum is with the bulls with prospects of a 50% mean reversion of the weekly bearish impulse.

Gold is testing the commitments of the bulls with a focus on the weekly 50% mean reversion confluence with old support.

The following is a top-down analysis that illustrates how bulls now need to get over the daily resistance from within 4-hour bullish conditions.

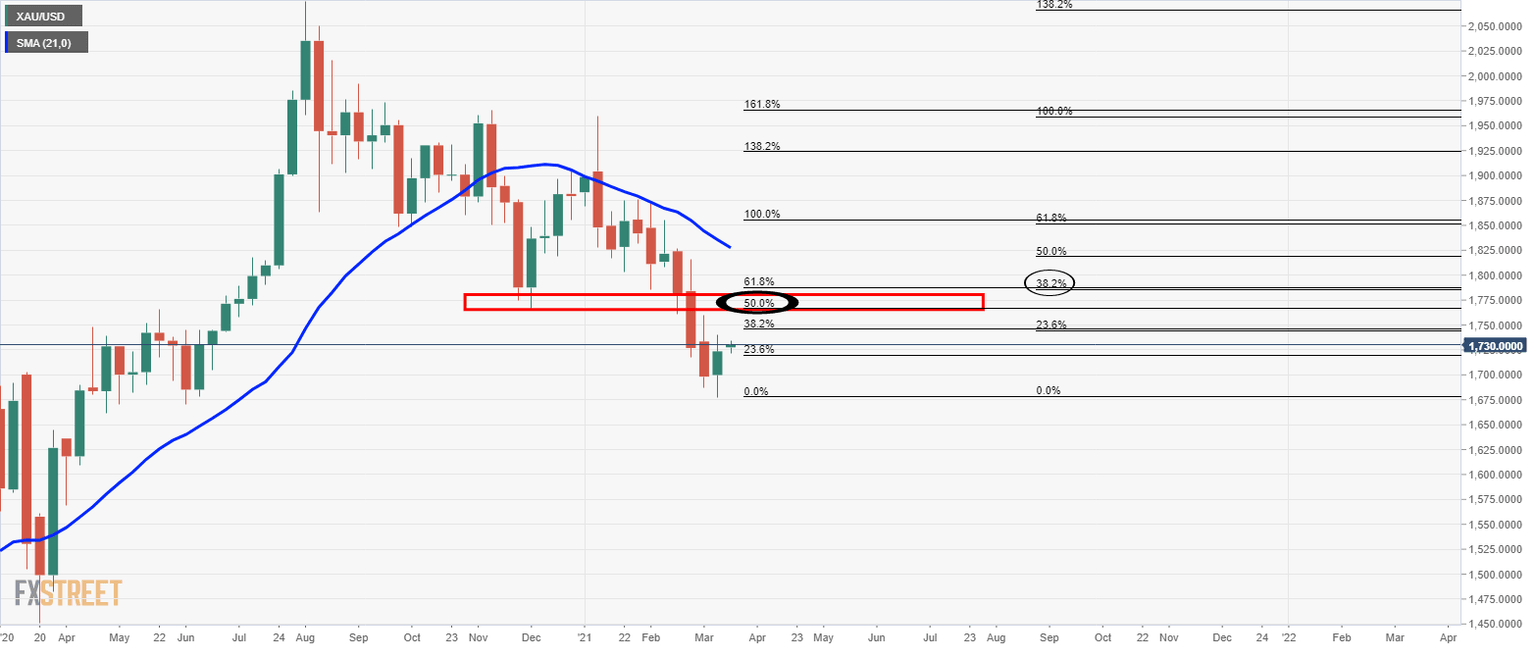

Monthly chart

The monthly chart has shown indecisiveness in the market so far for March, supported by the 21 SMA.

Weekly chart

Bulls have their eyes on a move back to test old support and a 50% mean reversion.

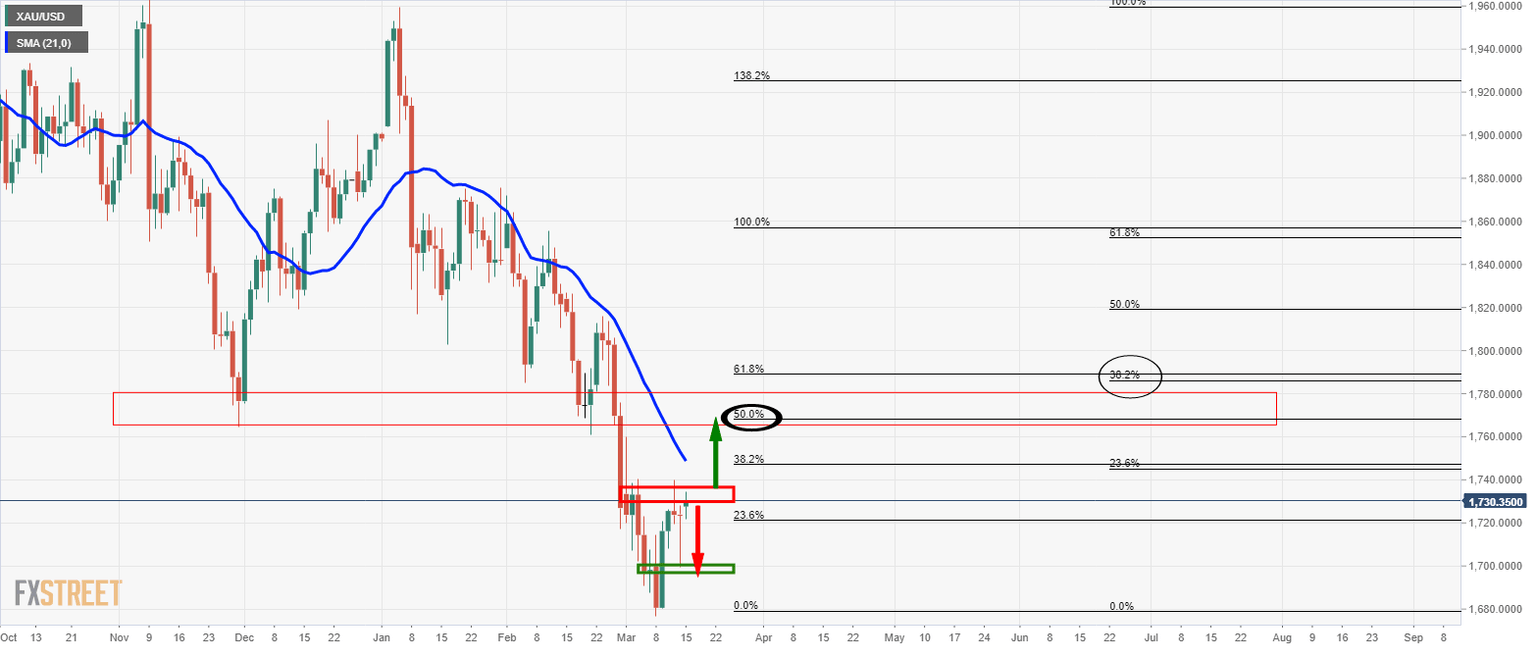

Daily chart

The daily chart shows the price is at a crossroad.

At resistance, there is the possibility of a return back to test the support and would leave the price trapped.

On a break of resistance, there are the prospects of a run back to test the 21-D SMA which would meet a 50% mean reversion of the weekly bearish impulse.

4-hour

The 4-hour momentum is with the bulls as the price chips away at the resistance zone and rides the support of the 21-SMA.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.